|

Investment Subcommittee Tuesday 26 June 2018 at 9.00am

|

|

|

|

|

|

Investment Subcommittee Tuesday 26 June 2018 at 9.00am

|

|

|

|

|

Investment Subcommittee

26 June 2018

Investment Subcommittee Agenda

Meeting to be held in the Whale Bay Room

36 Water Street, Whangārei

on Tuesday 26 June 2018, commencing at 9.00am

Recommendations contained in the agenda are NOT

decisions of the meeting.

Please refer to minutes for resolutions.

MEMBERSHIP OF THE Investment Subcommittee

Cr John Bain (Chair) Cr Bill Shepherd

Cr Penny Smart Mr Geoff Copstick

Item Page

1.0 apologies

2.0 declarations of conflicts of interest

3.1 Performance

of council's externally manged funds to May 2018

and transfer of IIF funds 3

3.2 Transfer of managed fund gains to councils general funds 31

4.0 UPDATE ON REVIEW OF MANAGED FUNDS

Investment Subcommittee item: 4.1

26 June 2018

|

TITLE: |

Performance of council's externally manged funds to May 2018 and transfer of IIF funds |

|

ID: |

A1076599 |

|

From: |

Simon Crabb, Finance Manager |

Executive Summary

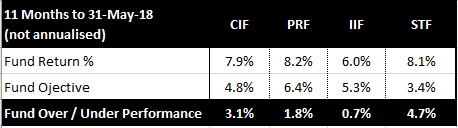

A summary of the returns and target objectives for the year to date period ending 31 May 2018 for each externally managed fund is presented below, with the supporting detail and fund performance for longer periods contained in Attachment 1.

It is recommended that $399,991 is transferred from the IIF Mint Diversified Income Fund into the IIF Schroders +5% Fund when the NZD/AUD cross rate exceeds 0.94. This transfer will action a recommendation that has been on-hold while we have been experiencing near-term lows in the NZD/AUD cross rate.

1. That the report ‘Performance of council's externally manged funds to May 2018 and transfer of IIF funds’ by Simon Crabb, Finance Manager and dated 19 June 2018, be received.

2. That $399,991 is transferred from the IIF Mint Diversified Income Fund into the IIF Schroders CPI +5% fund when the NZD/AUD cross rate exceeds 0.94.

3.

Background

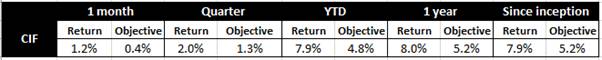

Community Investment Fund (CIF)

At 31 May 2018, the CIF had a market value of $14M and had performed as follows:

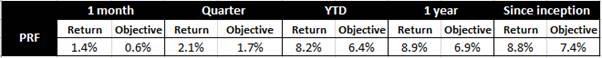

Property Reinvestment Fund (PRF)

At 31 May 2018, the PRF had a market value of $18.8M and performed as follows:

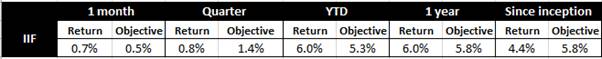

Infrastructure Investment Fund (IIF)

At 31 May 2018, the IIF had a market value of $10.8M and performed as follows:

· On 8 June 2018, $399,991 was invested into the IIF Mint Diversified Income Fund.

· Originally these funds were recommended for investment into the Schroders CPI +5% fund which Is denominated in AUD. This recommendation was not actioned as the NZD/AUD cross rate at such time was 0.92. It was considered that investing at 0.92 would result in a foreign exchange loss on the back of a rising cross rate.

· At the time of writing this paper, the NZD/AUD cross rate had increased to 0.934.

· It is recommended that original investment of $399,991 into Schroders is reinstated when the NZD/AUD cross rate exceeds 0.94, and is funded by transferring $400K from the IIF Mint Diversified Income Fund.

· The IIF asset mix will move slightly from 61% growth: 39% income to 62%:38% while the overall expected return of the fund will increase marginally.

· This recommendation will reduce Councils overall exposure to the Mint Fund Manager and is endorsed by EriksensGlobal.

· There are no entry or exit fees associated with either fund.

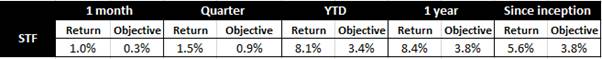

Short Term Investment Fund (STF, formerly known as the WCF)

At 31 May 2018, the STF had a market value of $1.0M and performed as follows:

Considerations

1. Options

|

No. |

Option |

Advantages |

Disadvantages |

|

1 |

Transfer $399,991 from the IIF Mint Diversified Fund into the IIF Schroders CPI + 5% Fund |

The Schroders CPI +5% fund is a defensively managed growth asset that targets a return of CPI plus 5%, whereas the Mint Diversified income targets CPI plus 3%, thus the Schroder fund ought to return greater gains in the current market. In addition, a $399.991 transfer out of the Mint Diversified Income fund will reduce councils overall risk exposure to Mint, which at the end of May was 19%. |

The Schroders CPI +5% fund is more aggressive than the Mint Income Fund and may suffer to a greater extent in a market downturn. The Schroders CPI +5% is denominated in AUD and will incur a foreign exchange loss (if not hedged) should the NZD/AUD cross rate exceed the cross rate that was in effect at the date of the transfer. |

|

2 |

Status Quo |

Mint Diversified income fund is more defensive than Schroders CPI +5% and may not suffer to the same in a market downturn. The Mint Diversified Income fund is not exposed to any foreign exchange risk. |

Maintain a level of investment that will have a slightly lower expected rate of return Continue to have a relatively high overall exposure to the Mint fund manager. |

The staff’s recommended option is Option 1

2. Significance and engagement

In relation to section 79 of the Local Government Act 2002, this decision is considered to be of low significance because it is part of council’s day-to-day activities and is in accordance with the approved Treasury Management Policy.

3. Policy, risk management and legislative compliance

The activities detailed in this report are in accordance with council’s Treasury Management Policy, the 2015–25 Long Term Plan both of which were approved in accordance with council’s decision-making requirements of sections 76–82 of the Local Government Act 2002.

Further Considerations

4. Community views

The impact investing in externally managed funds has been consulted on with the community through the 2015–25 Long Term Plan consultative procedure in accordance with s82 of the Local Government Act 2002

5. Māori impact statement

Targeted consultation on the council’s intention to invest in externally managed funds was undertaken with iwi as part of the 2015–25 Long Term Plan consultation process using existing relationship channels.

6. Financial implications

Investment strategies carry different risk profiles and are subject to different return volatilities. The returns from managed funds can fluctuate over a given time and period; and historical returns do not necessarily form the basis for forecasted future returns.

7. Implementation issues

There are no implementation issues that council needs to be aware of.

Attachment 1: Northland Regional

Council Externally Managed Investment Funds - Eriksens Global Monthly Report to

31 May 2018 ⇩ ![]()

Authorised by Group Manager

|

Name: |

Dave Tams |

|

Title: |

Group Manager, Corporate Excellence |

|

Date: |

19 June 2018 |

26 June 2018

|

TITLE: |

Transfer of managed fund gains to councils general funds |

|

ID: |

A1076687 |

|

From: |

Simon Crabb, Finance Manager |

Executive Summary

When Council adopted the 2017-18 Annual Plan they provided for $1,422,029 of Property Reinvestment Fund (PRF) gains and $276,313 of Infrastructure Investment Fund (IIF) gains to be withdrawn and used as operational funding.

For the eleven months to May 2018, the actual performance of these two funds has been good enough to allow a physical withdrawal of these two amounts, while still maintaining a better than budget reinvestment amount.

1. That the report ‘Transfer of managed fund gains to councils general funds ’ by Simon Crabb, Finance Manager and dated 19 June 2018, be received.

2. That $1,422,029 of gains are physically withdrawn from the Property Reinvestment Fund before 30 June 2018, in line with a recommendation from EriksensGlobal.

3. That $276,313 of gains are physically withdrawn from the Infrastructure Investment Fund before 30 June 2018, in line with a recommendation from EriksensGlobal.

Background

Council approved and adopted their 2017-18 Annual Plan on 27 June 2017.

The budgets contained within 2017-18 Annual signalled that a portion of the gains earnt from each externally managed fund would be used as operational funding subject to each fund’s performance.

· The Property Reinvestment Fund (PRF) was budgeted to contribute $1.4M of its gains as operational funding.

· The Infrastructure Investment Fund (IIF) was budgeted to contribute $276K of its gains as operational funding.

· The Community Investment fund (CIF) was budgeted to contribute $221K of its gains as operational funding

The actual gains earnt from each fund for the eleven months to May 2018 is presented in the following tables. A comparison is made to the corresponding Full Year budget amounts.

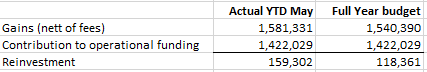

Property Reinvestment Fund

· The PRF has made more gains at the end of May than what was budgeted for the full year.

· This would allow the budgeted operational funding contribution of $1,422,029 to be physically withdraw from the PRF.

· After the above physical withdrawal, a reinvestment amount more than what was budgeted is still available (i.e. $159,302 possible reinvestment compared to a budget reinvestment of $118,361).

· The performance for the month of June 2018 is still to come. Any additional gains in June would add to the $159,302 of possible reinvestment.

· A negative result in June will reduce the level of gains that may be reinvested. In this instance, council may decide to put some of the withdrawn operational funding back into the PRF.

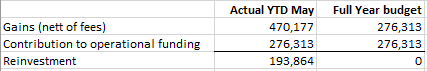

Infrastructure Investment Fund

· The IIF has made more gains at the end of May than what was budgeted for the full year.

· This would allow the budgeted operational funding contribution of $276,313 to be physically withdraw from the IIF.

· After the above physical withdrawal, a reinvestment amount more than the zero budget is still available (i.e. $193,864 possible reinvestment compared to a budget reinvestment of $0).

· The performance for the month of June 2018 is still to come. Any additional gains in June would add to the $193,864 as possible reinvestment.

· A negative result in June will reduce the level of gains that may be reinvested. In this instance, council may decide to put some of the withdrawn operational funding back into the IIF.

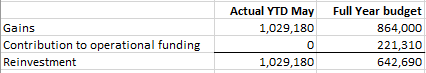

Community Investment Fund

· The CIF has made more gains at the end of May than what was budgeted for the full year.

· As council received a greater than budget dividend from Marsden Maritime Holdings Limited there is no requirement to withdraw any gains from the CIF to fund operations

· A reinvestment amount more than the budget is available (i.e. $1,029,180 possible reinvestment compared to a budget reinvestment of $642,690).

· The performance for the month of June 2018 is still to come. Any additional gains in June would add to the $1,029,180 as possible reinvestment.

· A negative result in June will reduce the level of gains that may be reinvested

The fund managers that the IIF and PRF gains are actually withdrawn from will be based on a recommendation from EriksensGlobal

It is desirable to physically withdraw the operational funding component of the gains in the 2017-18 financial year (i.e. before 30 June 2018). This allows the year-end financial statements to reflect an accurate fund asset balance.

Council will ultimately finalise and confirm the reinvestment component of the gains (or direct elsewhere) at their August 2018 council meeting.

Considerations

1. Options

|

No. |

Option |

Advantages |

Disadvantages |

|

1 |

Physically withdraw the amounts recommended from each fund before the 30 June 2018 |

The 2017-18 budgeted withdrawal can be processed in the 2017-18 financial year. This ensures the Fund Balances presented in the Annual Report are not overstated. (I.E. overstated due to the fund balances containing the amounts that are to be withdrawn in August 2018) |

The performance of a Fund in the month of June may be negative, and the total gains for the full year ends up lower than in May. This may require some withdrawn funds to be placed back into a fund to ensure the correct amount can be recapitalised. |

|

2 |

Present a paper to council in August 2018 to confirm the amounts to withdraw from each fund |

The final level of gains from each fund will be confirmed by the August 2018 council meeting and the withdrawal and reinvestment amounts will be conclusive. |

The Fund asset balances in the Annual Report will be overstated. |

The staff’s recommended option is Option 1

2. Significance and engagement

In relation to section 79 of the Local Government Act 2002, this decision is considered to be of low significance because it is part of council’s day-to-day activities and is in accordance with the approved Treasury Management Policy and 2017-18 Annual Plan.

3. Policy, risk management and legislative compliance

The activities detailed in this report are in accordance with council’s Treasury Management Policy, the 2015–25 Long Term Plan and 2017-18 Annual Plan, all of which were approved in accordance with council’s decision-making requirements of sections 76–82 of the Local Government Act 2002.

Further Considerations

4. Community views

The impact of investing in, and withdrawing funds from, externally managed funds has been consulted on with the community through the 2015–25 Long Term Plan consultative procedure in accordance with s82 of the Local Government Act 2002

5. Māori impact statement

Targeted consultation on the council’s intention to invest in, and withdraw from, externally managed funds was undertaken with iwi as part of the 2015–25 Long Term Plan consultation process using existing relationship channels.

6. Financial implications

Investment strategies carry different risk profiles and are subject to different return volatilities. The returns from managed funds can fluctuate over a given time and period; and the returns over the year will not necessarily form the basis for a precited return for the final month of June.

7. Implementation issues

There are no implementation issues that council needs to be aware of.

Authorised by Group Manager

|

Name: |

Dave Tams |

|

Title: |

Group Manager, Corporate Excellence |

|

Date: |

19 June 2018 |