|

Moved (Stolwerk/Smart)

1. That

the report ‘Rates for the year 1 July 2019 to 30 June 2020’ by Dave

Tams, Group Manager, Corporate Excellence and Casey Mitchell, Assistant

Management Accountant and dated 24 May 2019, be received.

2. That

council notes that it has had regard to section 100T of the Biosecurity Act

1993 and confirms that its analysis of Section 100T of the Biosecurity Act

1993, as included in the Long Term Plan 2018-2028, remains appropriate in

relation to setting the Pest Management Rate for 2019/20.

3. That

the Northland Regional Council resolves to set the following rates under the

Local Government (Rating) Act 2002 (LGRA) for the financial year commencing 1

July 2019 and ending 30 June 2020:

a. Targeted council services rate

A targeted rate as authorised by

the LGRA. The rate is calculated on the total projected capital value, as

determined by the certificate of projected valuation of each constituent

district in the Northland region. An additional $1.73 (including GST)

per each rateable separately used or inhabited part (SUIP) of a rating unit

is to be assessed across the Whangārei constituency

to provide funding for the ongoing maintenance of the Hātea River

Channel. The rate is differentiated by location in the Northland region

and assessed as a fixed amount per each rateable separately used or inhabited

part (SUIP) of a rating unit in the Far North and Whangārei districts, and on each rateable rating

unit (RU) in the Kaipara district. The rate is set as follows:

Including

GST

Far North

District $82.16

per SUIP

Kaipara

District $112.05

per RU

Whangārei

District $104.25

per SUIP

The

Whangārei District targeted council services rate amount of $104.25

(including GST) per SUIP includes funding for the Hātea River Channel amount of $1.73

(including GST).

b. Targeted land management rate

A targeted rate as authorised by

the LGRA. The rate is assessed on the land value of each rateable rating

unit in the region. The rate is set per dollar of land value. The

rate per dollar of land value is different for each constituent district

because the rate is allocated based on projected land value, as provided for

in section 131 of the LGRA. The rate is set as follows:

Including

GST

Far North

District $0.0001168

per dollar of land value

Kaipara

District $0.0001063

per dollar of land value

Whangārei

District $0.000991

per dollar of land value

c. Targeted freshwater management

rate

A targeted rate as authorised by

the LGRA. The rate is assessed on the land value of each rateable

rating unit in the region. The rate is set per dollar of land

value. The rate per dollar of land value is different for each

constituent district because the rate is allocated based on projected land

value, as provided for in section 131 of the LGRA. The rate is set as

follows:

Including

GST

Far North

District $0.0002379

per dollar of land value

Kaipara

District $0.0002166

per dollar of land value

Whangārei

District $0.0002022

per dollar of land value

d. Targeted pest management rate

A targeted rate as authorised by

the LGRA. The rate is calculated on the total projected capital value, as

determined by the certificate of projected valuation of each constituent

district in the Northland region. The rate is a fixed amount, differentiated

by location in the Northland region. The rate will be assessed on each

rateable separately used or inhabited part (SUIP) of a rating unit in the Far

North and Whangārei districts

and each rateable rating unit (RU) in the Kaipara District. The rate is

set as follows:

Including

GST

Far North

District $46.78

per SUIP

Kaipara

District $63.80

per RU

Whangārei District $58.37

per SUIP

e. Targeted flood infrastructure rate

A targeted rate as authorised by

the LGRA. The rate is a fixed amount assessed on each rateable

separately used or inhabited part (SUIP) of a rating unit in the Far North

and Whangārei districts and

each rateable rating unit (RU) in the Kaipara District. The rate is set

as follows:

Including

GST

Far North

District $26.02

per SUIP

Kaipara

District $26.02

per RU

Whangārei District $26.02

per SUIP

f. Targeted civil defence and hazard

management rate

A targeted rate as authorised by

the LGRA. The rate is calculated on the total projected capital value,

as determined by the certificate of projected valuation of each constituent

district in the Northland region. The rate is a fixed amount, differentiated

by location in the Northland region. The rate will be assessed on each

rateable separately used or inhabited part (SUIP) of a rating unit in the Far

North and Whangārei districts

and each rateable rating unit (RU) in the Kaipara District. The rate is

set as follows:

Including

GST

Far North

District $16.58

per SUIP

Kaipara

District $22.61

per RU

Whangārei District $20.68

per SUIP

g. Targeted emergency services rate

A targeted rate as authorised by

the LGRA. The rate is a fixed amount assessed on each rateable

separately used or inhabited part (SUIP) of a rating unit in the Far North

and Whangārei districts and

each rateable rating unit (RU) in the Kaipara District. The rate is set

as follows:

Including

GST

Far North

District $11.69

per SUIP

Kaipara

District $11.69

per RU

Whangārei District $11.69

per SUIP

h. Targeted regional sporting facilities

rate

A targeted rate as authorised by

the LGRA. The rate is a fixed amount assessed on each rateable

separately used or inhabited part (SUIP) of a rating unit in the Far North

and Whangārei districts and

each rateable rating unit (RU) in the Kaipara District. The rate is set as

follows:

Including

GST

Far North

District $16.74

per SUIP

Kaipara

District $16.74

per RU

Whangārei District $16.74

per SUIP

i. Targeted regional

infrastructure rate

A targeted rate as authorised by

the LGRA. This rate is assessed on the land value of each rateable

rating unit in the region. The rate is set per dollar of land

value. The rate per dollar of land value is different for each

constituent district, because the rate is allocated based on projected land

value, as provided for in section 131 of the LGRA. The rate is set as

follows:

Including

GST

Far North

District $0.0000297

per dollar of land value

Kaipara

District $0.0000270

per dollar of land value

Whangārei District $0.0000253

per dollar of land value

j. Targeted Whangārei

transport rate

A targeted rate as authorised by

the LGRA. The rate is a fixed amount assessed on each rateable

separately used or inhabited part of a rating unit (SUIP) in the

Whangārei District.

The rate is set as follows:

Including

GST

Whangārei District $22.83

per SUIP

k. Targeted Far North transport rate

A targeted rate as authorised by

the LGRA. The rate is a fixed amount assessed on each rateable

separately used or inhabited part of a rating unit (SUIP) in the Far North

District. The rate is set as follows:

Including

GST

Far North

District $8.68

per SUIP

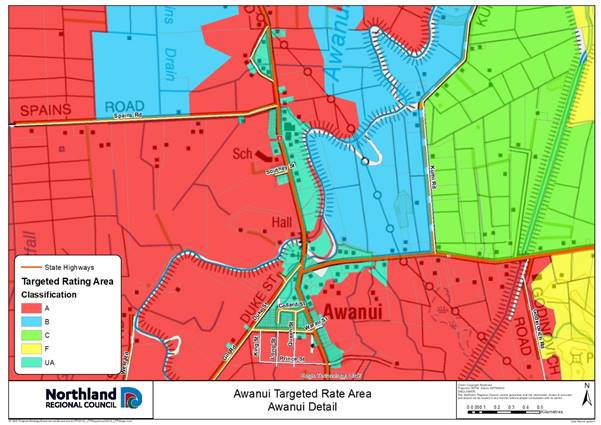

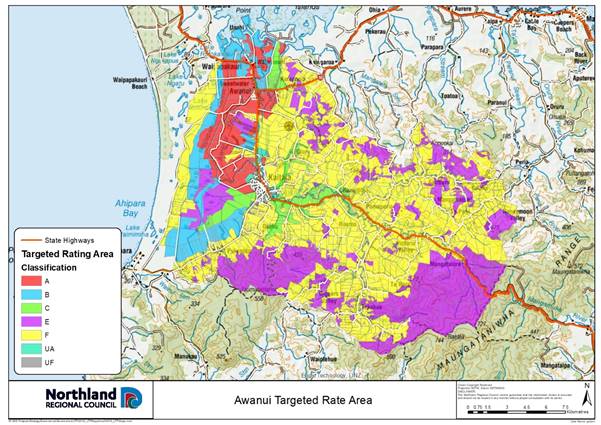

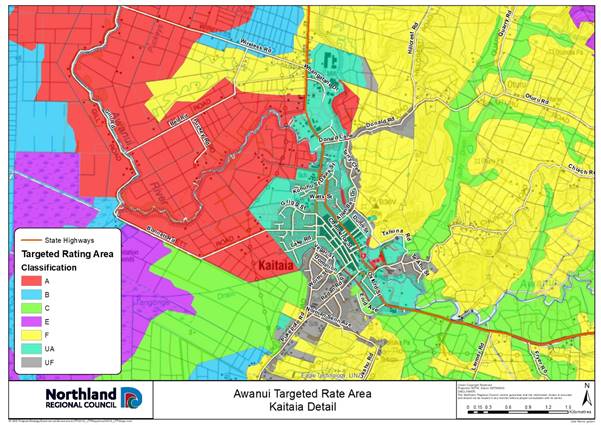

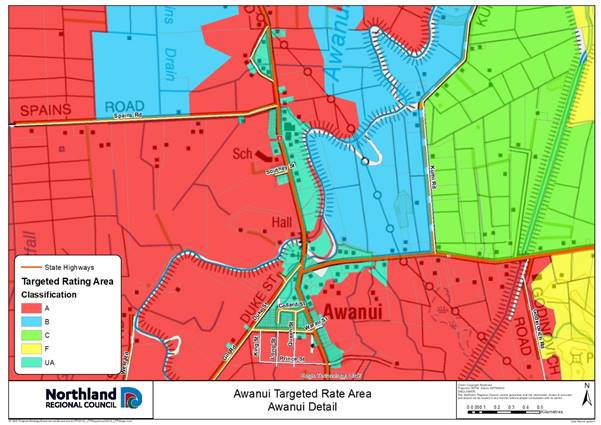

l. Targeted Awanui River

management rate

A targeted rate set under the

LGRA, set differentially by location and area of benefit as defined in the

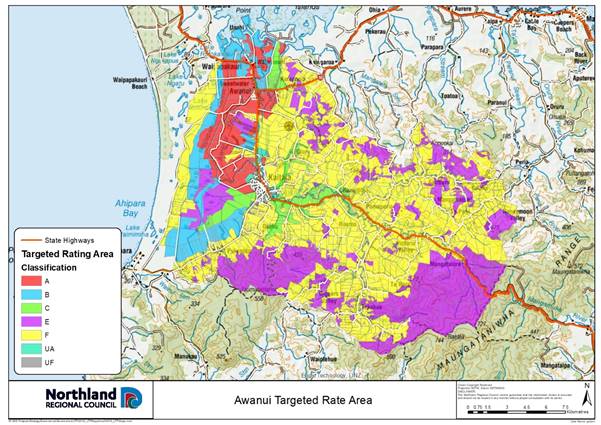

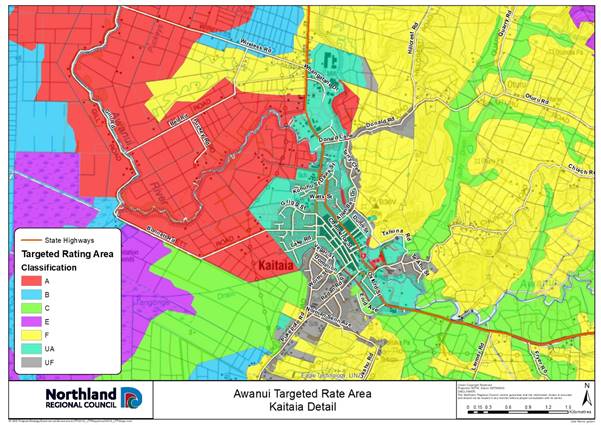

Awanui River Flood Management Plan, and as defined in the following table:

The rate is set differentially

as follows:

|

Category

|

Description

|

Rate including GST

|

|

|

UA

|

Urban rate class UA (floodplain location) $297.95 direct

benefit plus $30.01 indirect benefit per separately used or inhabited part

of a rating unit (SUIP).

|

$327.96 per SUIP

|

|

|

UA

|

Urban rate class UA – commercial differential.

|

$983.87 per SUIP

|

|

|

UF

|

Urban rate classes UF (higher ground) $30.00 direct

benefit plus $30.01 indirect benefit per separately used or inhabited part

of a rating unit.

|

$60.01 per SUIP

|

|

|

UF

|

Urban rate class UF – commercial differential.

|

$180.03 per SUIP

|

|

|

Rural

|

Rural rate differentiated by class,

$13.35 per separately used or inhabited part of a rating unit (SUIP) of

indirect benefit plus a rate per hectare for each of the following classes

of land in the defined Kaitāia flood rating district as illustrated in

the following maps and table.

|

$13.35 per SUIP

|

|

|

Class

|

Description

|

Rate including GST

|

|

|

A & B

|

High benefit; rural land which receives high benefit

from the Awanui scheme works due to reduced river flooding risk and/or

reduced duration of flooding and/or coastal flooding – all rateable

land other that in the commercial differential.

|

$24.47 per hectare

|

|

|

A & B commercial differential

|

$73.40 per hectare

|

|

C

|

Moderate benefit; land floods less

frequently and water clears quickly – all rateable land other

that in the commercial differential.

|

$11.07 per hectare

|

|

|

C commercial differential

|

$33.21 per hectare

|

|

F

|

Contributes runoff waters, and

increases the need for flood protection - all rateable land other

that in the commercial differential.

|

$1.09 per hectare

|

|

|

F commercial differential

|

$3.27 per hectare

|

|

|

|

|

|

The rating classifications are

illustrated in the following maps:

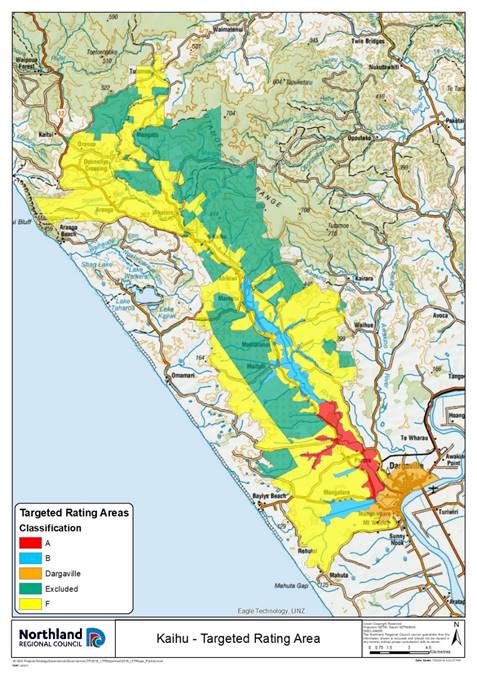

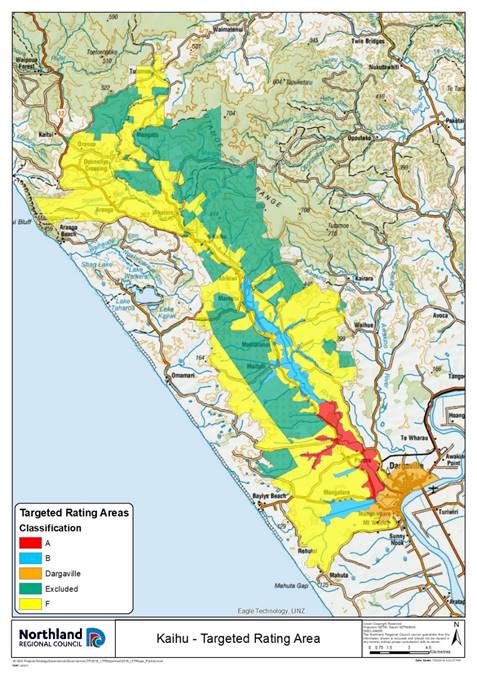

m. Targeted Kaihū River management rate

A targeted rate set under the

LGRA, and set differentially by location and area of benefit as defined in

the following table:

|

Class

|

Description

|

Rate Including GST

|

|

|

A

|

Land on the floodplain and side

valleys downstream of Rotu Bottleneck.

|

$23.72 per hectare

|

|

B

|

Land on the floodplain and

tributary side valleys between Ahikiwi and the Rotu Bottleneck and in the

Mangatara Drain catchment upstream of SH12.

|

$11.68 per hectare

|

|

F

|

Land within the Kaihū

River rating area not falling within Class A and Class B.

|

$1.64 per hectare

|

|

Urban Contribution

– A contribution from the Kaipara District Council instead of a

separate rate per property:

|

$5,015 per annum

|

The rating classifications are illustrated in the

following map:

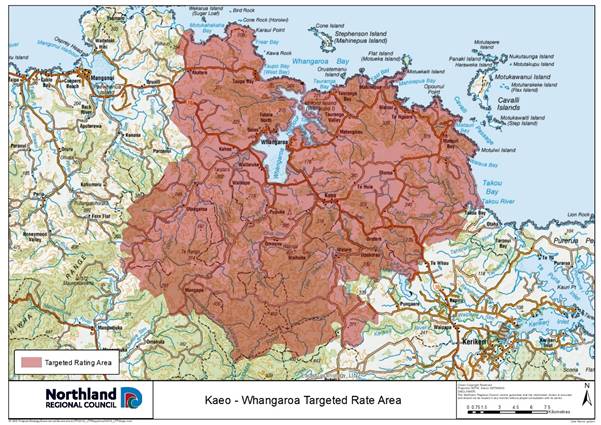

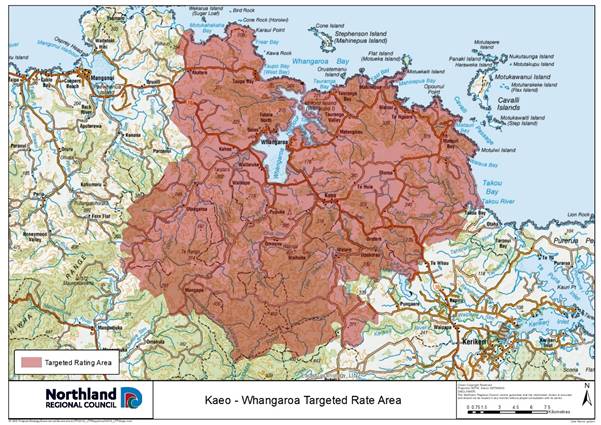

n. Targeted Kaeo-Whangaroa rivers

management rate

A targeted rate set under the

LGRA, set on a uniform basis in respect of each rateable separately used or

inhabited part of a rating unit falling within the former Whangaroa Ward

rating rolls of 100-199, as illustrated in the map below:

Including

GST

Former

Whangaroa Ward $52.06

per SUIP

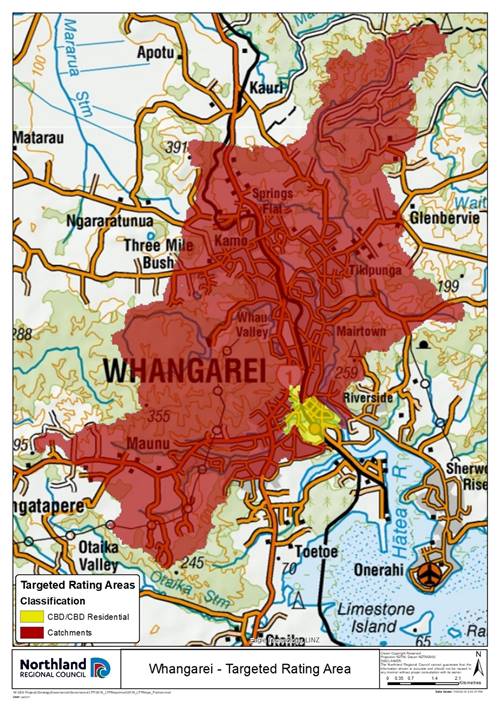

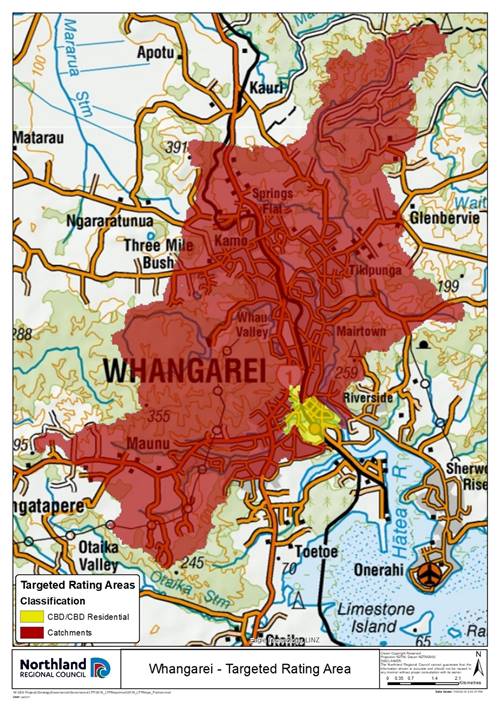

o. Targeted Whangārei urban rivers

management rate

A targeted rate set under the LGRA, and assessed on all rateable

properties defined by reference to the differential categories, and

differentiated by location (illustrated in the map below) and, for some

categories, land use. It is set as a fixed amount per each rateable

separately used or inhabited part (SUIP) of a rating unit, as follows:

|

Category

|

|

Including GST

|

|

1

|

Commercial properties located in the Whangārei Central Business District flood area:

|

$352.25 per SUIP

|

|

2

|

Residential properties located in the Whangārei Central Business District flood area:

|

$174.16 per SUIP

|

|

3

|

Properties located in the contributing

water catchment area (including properties falling in the Waiarohia,

Raumanga, Kirikiri and Hātea River Catchments):

|

$43.34 per SUIP

|

Differential categories for the Whangārei urban

rivers management rate:

|

Residential properties in the

Whangārei central business district

|

Residential properties in the

Whangārei central business district (CBD) flood area are defined as

all rating units which are used principally for residential or lifestyle

residential purposes, including retirement villages, flats etc.

Residential properties also includes

multi-unit properties, these being all separate rating units used

principally for residential purposes, and on which is situated multi-unit

type residential accommodation that is used principally for temporary or

permanent residential accommodation and for financial reward, including,

but not limited to, hotels, boarding houses, motels, tourist accommodation,

residential clubs and hostels but excluding any properties that are

licensed under the Sale and Supply of Alcohol Act 2012.

|

|

Commercial properties in the

Whangārei central business district

|

Commercial properties in the

Whangārei CBD flood area are all separate rating units used

principally for commercial, industrial or related purposes or zoned for

commercial, industrial or related purposes in accordance with the

Whangārei district plan. For the avoidance of doubt, this

category includes properties licensed under the Sale and Supply of Alcohol

2012; and private hospitals and private medical centres.

|

4. Payment

dates for rates, discounts, and penalty regime

That the Northland Regional

Council resolves the following:

Far North

District constituency:

All rates

within the Far North District constituency are payable in four equal

instalments, on the following dates:

|

Instalment

|

Due

date for payment

|

|

Instalment 1

|

20 August 2019

|

|

Instalment 2

|

20 November 2019

|

|

Instalment 3

|

20 February 2020

|

|

Instalment 4

|

20 May 2020

|

The Northland

Regional Council resolves to add the following penalties to unpaid Far North

District constituency rates:

· In accordance with section 58(1)(a) of the LGRA, a

penalty of ten percent (10%) will be added to any portion of each instalment

of Far North District constituency rates assessed in the 2019/20 financial

year that is unpaid on or by the respective due date for payment as stated

above. These penalties will be added on the following dates:

|

Instalment

|

Date penalty

will be added

|

|

Instalment 1

|

27 August 2019

|

|

Instalment 2

|

27 November 2019

|

|

Instalment 3

|

27 February 2020

|

|

Instalment 4

|

27 May 2020

|

Kaipara

District constituency:

All rates

within the Kaipara District constituency are payable in four equal

instalments, on the following dates:

|

Instalment

|

Due

date for payment

|

|

Instalment 1

|

20 August 2019

|

|

Instalment 2

|

20 November 2019

|

|

Instalment 3

|

20 February 2020

|

|

Instalment 4

|

20 May 2020

|

The Northland Regional Council

resolves to add the following penalties to unpaid Kaipara District

constituency rates:

· In accordance with section 58(1) (a) of the LGRA, a

penalty of ten percent (10%) of so much of each instalment of the Kaipara

District constituency rates assessed in

the 2019/20 financial year that are unpaid after the relevant due date for

each instalment will be added on the relevant penalty date for each

instalment stated below, except where a ratepayer has entered into an

arrangement by way of direct debit authority, or an automatic payment

authority, and honours that arrangement.

These penalties will be added on the following dates:

|

Instalment

|

Date penalty

will be added

|

|

Instalment 1

|

21 August 2019

|

|

Instalment 2

|

21 November 2019

|

|

Instalment 3

|

21 February 2020

|

|

Instalment 4

|

21 May 2020

|

· In accordance with section 58(1)(b) of the LGRA, a

penalty of ten per cent (10%) of the amount of all Kaipara District

constituency rates (including any penalties) from any previous financial

years that are unpaid on 01 July 2019 will be added on 03 July 2019.

· In accordance with section 58(1)(c) of the LGRA, a

penalty of ten per cent (10%) of the amount of all Kaipara District

constituency rates to which a penalty has been added under the point

immediately above and which remain unpaid will be added on 06 January

2020.

Whangārei

District constituency:

All rates

within the Whangārei District constituency are payable in four equal

instalments, on the following dates:

|

Instalment

|

Due date for

payment

|

|

Instalment 1

|

20 August 2019

|

|

Instalment 2

|

20 November 2019

|

|

Instalment 3

|

20 February 2020

|

|

Instalment 4

|

20 May 2020

|

The Northland Regional Council

resolves to add the following penalties to unpaid Whangārei District

constituency rates:

· In accordance with section 58(1)(a) of the LGA, a

penalty of ten percent (10%) will be added to any portion of each instalment

of Whangārei District constituency rates assessed in the 2019/20

financial year that is unpaid on or by the respective due date for payment as

stated above. These penalties will be added on the following dates:

|

Instalment

|

Date penalty

will be added

|

|

Instalment 1

|

23 August

2019

|

|

Instalment 2

|

25 November

2019

|

|

Instalment 3

|

25 February

2020

|

|

Instalment 4

|

25 May 2020

|

· In accordance with section 58(1)(b) of the LGRA, a

penalty of ten per cent (10%) will be added to any Whangārei District

constituency rates (including any penalties) from any financial year

prior to 1 July 2019 that still remain unpaid as at 4 July 2019. This

penalty will be added on 4 September 2019.

The

Northland Regional Council resolves to apply the following discount to

Whangārei District constituency rates:

· In accordance

with section 55(3) of the LGRA, where the total rates assessed for the 2019/20

year and any arrears on a rating unit in the Whangārei District

constituency are paid in full on or by the due date of the first instalment,

a discount of two percent (2%) of the total rates assessed on that rating

unit in the 2019/20 financial year will be applied.

Carried

|