|

Investment Committee Tuesday 4 March 2025 at 1:30pm

|

|

|

|

|

|

Investment Committee Tuesday 4 March 2025 at 1:30pm

|

|

|

|

|

4 March 2025

Investment Committee Agenda

Meeting to be held in the Council Chamber

36 Water Street, Whangārei

on Tuesday 4 March 2025, commencing at 1:30pm

Recommendations contained in the agenda are NOT decisions of the meeting. Please refer to minutes for resolutions.

MEMBERSHIP OF THE Investment Committee

|

Councillor John Blackwell |

|

Councillor Jack Craw |

|

Councillor Rick Stolwerk |

|

Ex-Officio Geoff Crawford |

|

Independent Tangata Whenua Member George Riley |

|

Independent Investment Advisor – to be confirmed |

|

Independent Investment Advisor – to be confirmed |

|

|

KARAKIA / WHAKATAU

RĪMITI (ITEM) Page

1.0 Ngā Mahi Whakapai/Housekeeping

2.0 Ngā Whakapahā/apologies

3.0 Ngā Whakapuakanga/declarations of conflicts of interest

4.1 Investment Committee Induction 3

5.0 Kaupapa ā Roto / Business with the Public Excluded 14

5.1 Investment Committee Induction Part 2

5.2 Withdrawal of the Planned 2024-25 Annual General Funding Contributions from the Managed Investment Fund Portfolio

5.3 Request for Property Reinvestment Funding

5.4 Update on Council’s Current Redevelopments and Other Property Matters

Investment Committee item: 4.1

4 March 2025

|

TITLE: |

Investment Committee Induction |

|

From: |

Bruce Howse, Pou Taumatua – Group Manager Corporate Services |

|

Authorised by Group Manager/s: |

Bruce Howse, Pou Taumatua – Group Manager Corporate Services, on 25 February 2025 |

Whakarāpopototanga / Executive summary

Council elected on 26 November 2024 to establish an Investment Committee, including representation of independent committee members. Council will appoint independent members to the committee on 25 February 2025.

The meeting of 4 March 2025 will be the first meeting with the independent members and will act as an induction meeting to the Committee.

Scott Hamilton of Rautaki Consulting, former CEO of Quayside Holdings, will lead the induction process.

The induction will include an overview of the Committee Terms of Reference, the proposed annual committee calendar, financial and risk objectives, and an overview of each investment asset and forecast workplan.

That the report ‘Investment Committee Induction’ by Bruce Howse, Pou Taumatua – Group Manager Corporate Services and dated 25 February 2025, be received.

Background/Tuhinga

Investment Committee Purpose

The Terms of Reference notes “The Investment Committee’s function is to monitor and improve the performance of the Council’s investment portfolio. This includes recommendations on investments and resourcing to manage the financial and non-financial risks associated with these activities.

The Committee is expected to identify opportunities that will maximise the value of the portfolio and returns and may also recommend to Council disposal of sub-optimal assets and investments.

The Investment Committee’s areas of responsibility for the investment portfolio are:

Investment property

Forestry

Managed investment funds

Commercial investments using reserve funds

Marsden Maritime Holdings, and investments in subsidiaries, joint ventures and associate”.

The Meeting of the Committee on 4 March is to provide an induction to the members of the committee. The agenda will cover the objectives of the committee, a background understanding of the key assets, and a workplan of key milestones relating to the management of those assets.

The Investment Committee has responsibility for the management of assets of $240 million.

Meetings and Objectives

Council through the addition of an Investment Committee is moving to a more active and deliberate approach to managing its investment assets and investment performance.

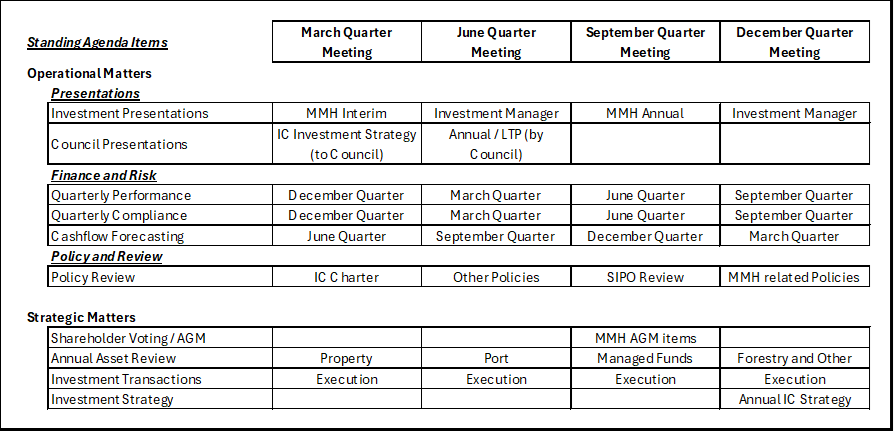

The following indicative timetable will provide a scope for quarterly meetings:

Financial and Risk Objectives

The Investment Portfolio under responsibility of the Investment Committee has some minimum return target expectations to enable Council to achieve its overall objectives.

Cash Income for Council Use

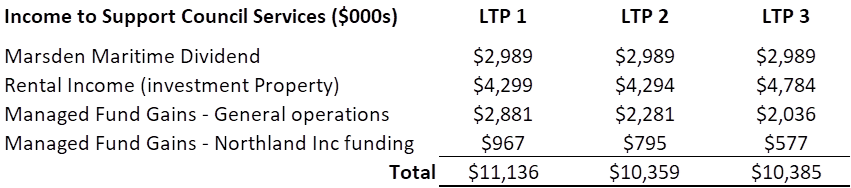

The Long-Term Plan (LTP) includes cash flow earned from the Investment Portfolio and distributed to Council. This provides a benefit to today’s ratepayers from the Investment Portfolio. The annual cash target per the LTP is as follows.

Growth Objectives

Growth Objectives

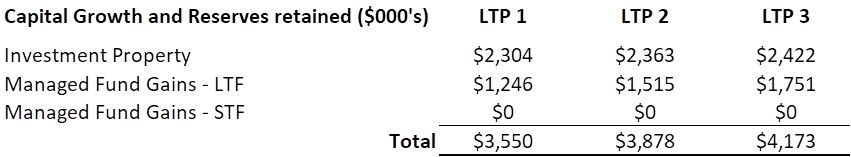

The LTP includes capital growth expectations from the Investment Portfolio. The retention of capital growth in the portfolio allows the benefit of the asset to be retained for future generations and grows the asset base on which future income is derived. The growth targets included in the LTP are as follows.

The value of reserves retained is dependent on any Council application of reserves in accordance with Council policy.

Risk Management

The Investment Committee is expected to manage the Investment Portfolio as a whole, and where appropriate present to Council new opportunities to rebalance the portfolio between the existing asset classes or recommend new asset classes to help achieve the long-term cash and growth objectives.

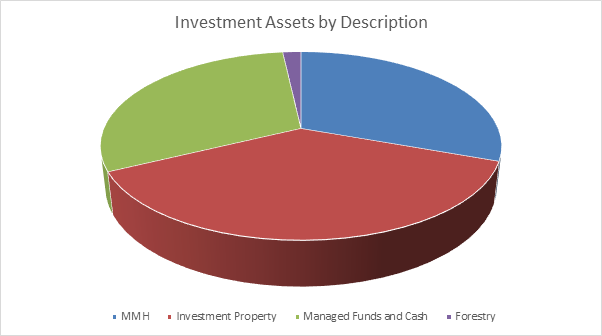

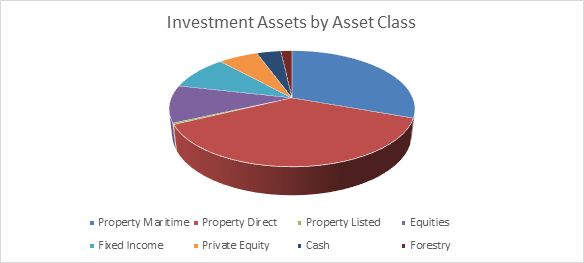

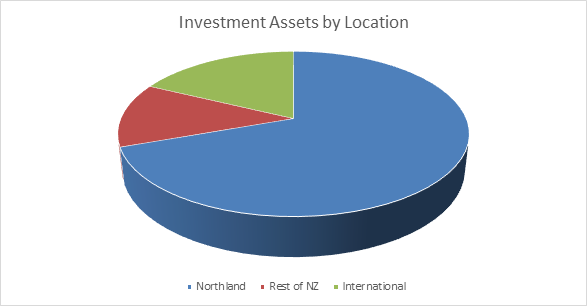

Councils holding in Marsden Maritime (largely Marina berths, industrial land, port land and quayside logistics), its own direct property portfolio, and a small listed property portfolio means the overall Investment Portfolio is 68% exposure to land and property.

The Investment Portfolio is 69% exposed to Northland, and 82% exposed to New Zealand.

Investment Portfolio Assets

The Investment Committee has Responsibility for the investment performance of the following assets.

Marsden Maritime Holdings Limited

Asset: Marsden Maritime Holdings (MMH)

Value: $73.7m at 31 December 2024 (based on $3.33 per share)

Background:

Description of Asset: 53.61% shareholding in the NZX listed MMH. MMH operates marina and industrial facilities at Marsden Point and is a 50% owner of North Port Limited.

History: Regional Councils inherited both ongoing harbour obligations and a shareholding in the Port operating company because of disablement of the Harbour Board in 1991.

Status: Councils shareholding in MMH and the associated shareholding in North Port are both Strategic Assets under Councils Significance and Engagement Policy.

Related Policies: Marsden Maritime Holdings Memorandum of Understanding (MOU).

NRC Significance and Engagement Policy.

Objectives: (per the LTP)

IC Income: Dividends from MMH are used to support Council services in lieu of rates. LTP expectations are $3.0m per annum, or 13.5 cents per annum.

IC Growth: Council holds the shares in MMH at cost. It is expected that MMH as a commercial entity will grow at a rate equal to or greater than inflation.

Performance: (actual)

Capital Growth: MMH is listed on the NZX. The share price is down 26% over the 2024 year.

Income: Dividends of 11.75 cents per share ($2.6m) were received in the 2024 year. Dividends in 2023 were 13.5 cents and in 2022 were 16 cents. Dividends are currently lower than the LTP.

Looking Ahead:

Next Steps: TBD

Investment Property

Asset: Investment Property Portfolio

Value: $82.0 m at 30 June 2024

Background:

Description of Asset: Mix of commercial and industrial assets and land. Many sites are leasehold, with Council owning the land interest and tenants paying leases subject to 7- or 21-year rental agreements. The majority of sites are currently within the Whangarei city limits. Council has, where contiguous land blocks are available acquired the leasehold interest.

History: Regional Councils inherited both leasehold and bare land through the disestablishment of the Harbour Board in 1991, mainly in the Whangarei basin (old port precinct). Council has been active through its Property Strategy in acquiring, selling, or developing sites for both commercial return and civic enhancement.

Status: Investment Property is not a Strategic Asset.

Related Policies: Council Delegations

Objectives

IC Income: Rentals from Investment Property are used to support Council services in lieu of rates. LTP expectations are $4.3m per year 1 of the LTP and increasing over time as rentals renew. The actual rental charged is dependent on the historical legal agreement for land lease (normally a percentage of market value at the time of reset)

IC Growth: Investment Property is revalued annually. The LTP assumes a revaluation of 2.5% per annum.

Performance:

Capital Growth: Land prices had risen sharply during the early 2020’s. The revaluation to 30 June 2024 was of $82.0m, a 3.7% decline on the prior year.

Income: Income earned in the 2024 equated to an average rental yield of 4.99%.

Looking Ahead:

Next Steps: Application of Councils Property Management Plan.

Managed Funds (1)

Asset: Managed Funds – Long Term Fund (LTF)

Value: $65.4m at 30 June 2024 ($63.5m at 31 December 2024)

Background:

Description of Asset: Managed Funds are matched to financial reserves of Council. Reserves allocated to the LTF include proceeds from the sale of Investment Property, Economic Development, Regional Projects, and target rates collected for river and disaster management.

History: Reserves built up over time. Council uses an external investment manager to manage the portfolio.

Status: Managed Funds are not a Strategic Asset.

Related Policies: SIPO (revised and approved 24 September 2024)

Investment Policy

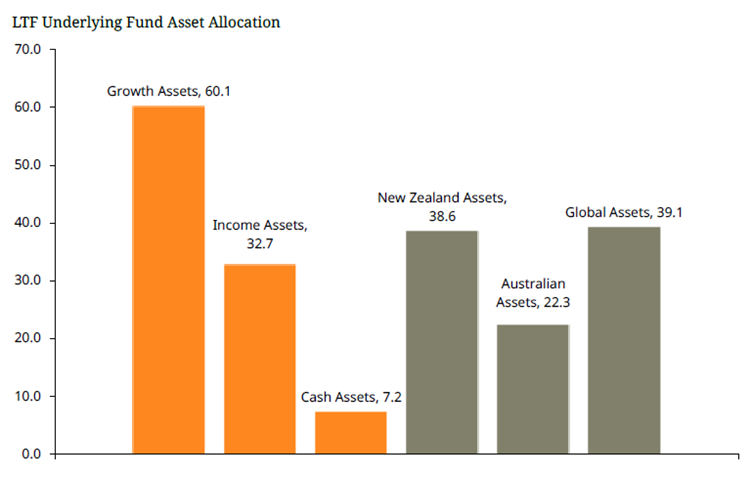

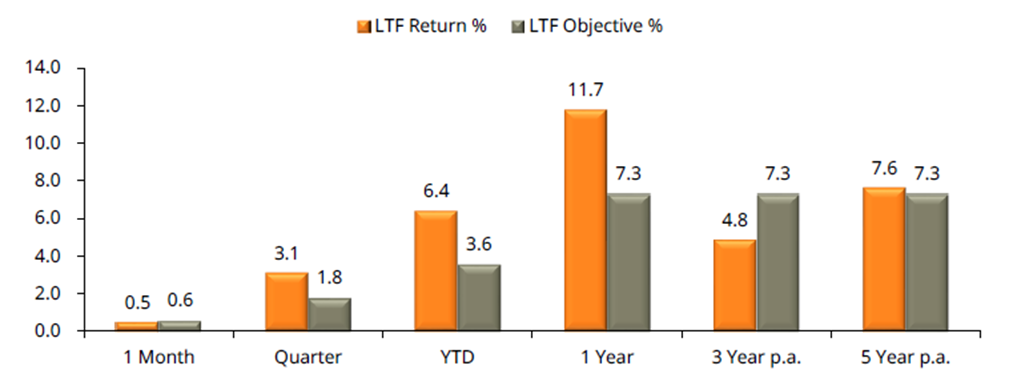

IC Income: The LTF targets a 7.25% total return (net, but gross of fees) in the Long-Term Plan. A portion of the return is directly applied to Council operating expenses and the funding of Northland Inc. Limited with any residual attributed to special reserves for future use by Council.

The current Strategic Asset Allocation of the LTF is 67% growth, 33% defensive.

Asset mix at 31 December 2024:

IC Growth: Some reserves are inflation proofed.

Performance:

Capital Growth: The SIPO set performance objective for the LTF is a five-year real return (after inflation and fees) of 3%.

Income: Income is a portion of above.

Looking Ahead:

Next Steps: Review of SIPO including Strategic Asset Allocation, roles and responsibilities, return objectives, risk assumptions, and responsible investment / ESG considerations. (Target end April 2025)

Review of Investment Management services via an RFP. (Q2 and Q3 2025)

Managed Funds (2)

Asset: Managed Funds – Short Term Fund (STF)

Value: $12.8m at 30 June 2024 ($15.1m at 31 December 2024)

Background:

Description of Asset: Managed Funds are matched to financial reserves and short-term needs of Council. Reserves allocated to the STF include proceeds from operating reserves and surplus, and any historic outperformance from the LTF.

History: Reserves levels are volatile and aligned Councils usage of the proceeds. Council uses a mix of external investment manager and self-management to manage the portfolio.

Status: Managed Funds - STF are not a Strategic Asset.

Related Policies: SIPO (approved 24 September 2024)

Investment Policy

Objectives

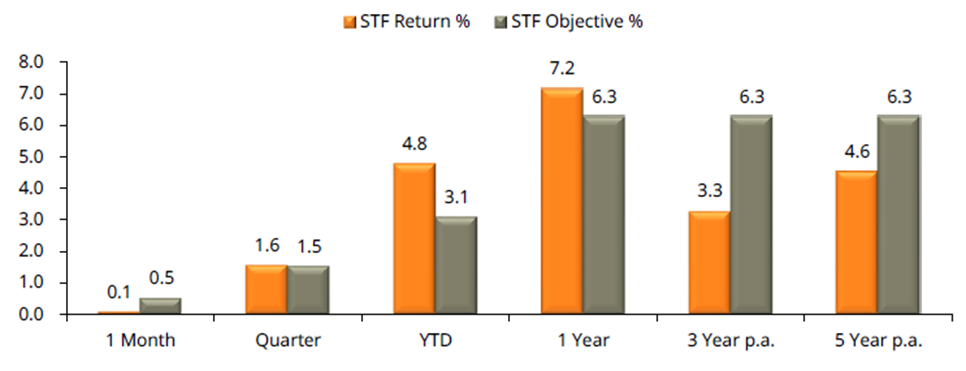

IC Income: The STF targets a 5% return in the LTP.

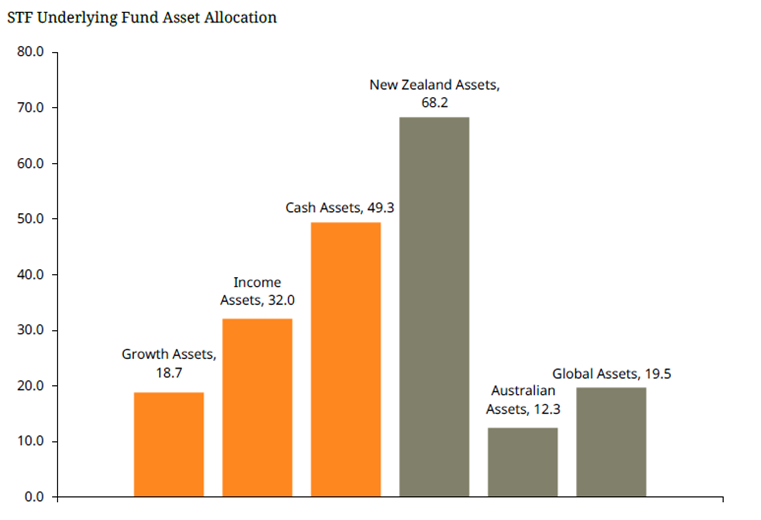

The current Strategic Asset Allocation of the STF is 20% growth, 80% defensive.

Asset mix at 31 December 2024 (representative of the assets with the fund manager, however over 50% of assets are in cash with Council)

IC Growth: Some reserves are inflation proofed.

Performance:

Capital Growth: The SIPO set performance objective for the STF is 2% over the three-year rolling NZ Official Cash Rate.

Income: Income is a portion of above.

Looking Ahead:

Next Steps: Review of SIPO including Strategic Asset Allocation, roles and responsibilities, return objectives, risk assumptions, and responsible investment / ESG considerations.

Review of Investment Management services via an RFP.

Review of the levels of funding in the STF and the level of external support required.

Forestry

Asset: Investment Property Portfolio

Value: $5.9 m at 30 June 2024

Background:

Description of Asset: Council holds land with the equivalent of 295 hectares of pinus radiata of mixed vintage from 3 to 33 years.

History: Land held in forestry assets is held firstly as a means of flood and erosion protection.

Status: Forestry is not a Strategic Asset but may form part of the Councils flood and erosion protection.

Related Policies: None

Objectives

IC Income: Forestry is run-on break-even basis with net earnings from harvesting applied to the Equalisation Reserve. Annual expenses (forestry management, valuation, consulting, and pruning) are similarly deducted from the Equalisation Reserve.

Is the forestry income being optimised?

IC Growth: No growth target is set, other than to break-even long-term cash flows.

Performance:

Capital Growth: Capital growth is largely through forestry revaluation. Land retains importance for Council flood and erosion management.

Income: Cash flow is forecast via harvest in years 4 and 5 of the LTP.

Looking Ahead:

Next Steps: Is the Forestry Income being optimised?

Is the Equalisation reserve income appropriately risk and return managed?

Attachments/Ngā tapirihanga

Nil

Investment Committee ITEM: 5.0

4 March 2025

|

TITLE: |

Whakarāpopototanga / Executive Summary

The purpose of this report is to recommend that the public be excluded from the proceedings of this meeting to consider the confidential matters detailed below for the reasons given.

1. That the public be excluded from the proceedings of this meeting to consider confidential matters.

2. That the general subject of the matters to be considered whilst the public is excluded, the reasons for passing this resolution in relation to this matter, and the specific grounds under the Local Government Official Information and Meetings Act 1987 for the passing of this resolution, are as follows:

|

Item No. |

Item Issue |

Reasons/Grounds |

|

5.1 |

Investment Committee Induction Part 2 |

The public conduct of the proceedings would be likely to result in disclosure of information, the withholding of which is necessary to enable council to carry out, without prejudice or disadvantage, commercial activities s7(2)(h) and the withholding of which is necessary to enable council to carry on, without prejudice or disadvantage, negotiations (including commercial and industrial negotiations) s7(2)(i). |

|

5.2 |

Withdrawal of the Planned 2024-25 Annual General Funding Contributions from the Managed Investment Fund Portfolio |

The public conduct of the proceedings would be likely to result in disclosure of information, the withholding of which is necessary to protect information where the making available of the information would be likely unreasonably to prejudice the commercial position of the person who supplied or who is the subject of the information s7(2)(b)(ii). |

|

5.3 |

Request for Property Reinvestment Funding |

The public conduct of the proceedings would be likely to result in disclosure of information, the withholding of which is necessary to protect information where the making available of the information would be likely unreasonably to prejudice the commercial position of the person who supplied or who is the subject of the information s7(2)(b)(ii), the withholding of which is necessary to enable council to carry out, without prejudice or disadvantage, commercial activities s7(2)(h) and the withholding of which is necessary to enable council to carry on, without prejudice or disadvantage, negotiations (including commercial and industrial negotiations) s7(2)(i). |

|

5.4 |

Update on Council’s Current Redevelopments and Other Property Matters |

The public conduct of the proceedings would be likely to result in disclosure of information, the withholding of which is necessary to protect information where the making available of the information would be likely unreasonably to prejudice the commercial position of the person who supplied or who is the subject of the information s7(2)(b)(ii), the withholding of which is necessary to enable council to carry out, without prejudice or disadvantage, commercial activities s7(2)(h) and the withholding of which is necessary to enable council to carry on, without prejudice or disadvantage, negotiations (including commercial and industrial negotiations) s7(2)(i). |

3. That the Independent Advisors be permitted to stay during business with the public excluded.

Considerations

1. Significance and Engagement

This is a procedural matter required by law. Hence when assessed against council policy is deemed to be of low significance.

2. Policy and Legislative Compliance

The report complies with the provisions to exclude the public from the whole or any part of the proceedings of any meeting as detailed in sections 47 and 48 of the Local Government Official Information Act 1987.

3. Other Considerations

Being a purely administrative matter; Climate Impact, Environmental Impact, Community Views, Māori Impact Statement, Financial Implications, and Implementation Issues are not applicable.