|

Investment Subcommittee Tuesday 31 July 2018 at 8.30am

|

|

|

|

|

|

Investment Subcommittee Tuesday 31 July 2018 at 8.30am

|

|

|

|

|

Investment Subcommittee

31 July 2018

Investment Subcommittee Agenda

Meeting to be held in the Whale Bay Room

36 Water Street, Whangārei

on Tuesday 31 July 2018, commencing at 8.30am

Recommendations contained in the agenda are NOT

decisions of the meeting.

Please refer to minutes for resolutions.

MEMBERSHIP OF THE Investment Subcommittee

Cr John Bain (Chair) Cr Bill Shepherd

Cr Penny Smart Mr Geoff Copstick

Item Page

1.0 apologies

2.0 declarations of conflicts of interest

3.1 Performance

of council's externally managed funds to June 2018

and transfer of PRF funds 3

4.0 UPDATE ON REVIEW OF MANAGED FUNDS

Investment Subcommittee item: 4.1

31 July 2018

|

TITLE: |

Performance of council's externally managed funds to June 2018 and transfer of PRF funds |

|

ID: |

A1089225 |

|

From: |

Simon Crabb, Finance Manager |

Executive Summary

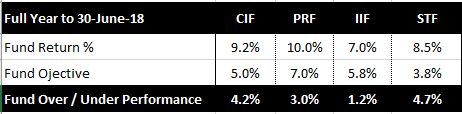

A summary of the returns and target objectives for the full year to 30 June 2018 for each externally managed fund is presented below, with the supporting detail and fund performance for longer periods contained in Attachment 1.

All four funds have outperformed their objective for the year.

As council’s exposure to the PRF Aspiring Fund (23.6%) exceeds the allowable range limit of 20%, it is recommended that $1,000,000 is withdrawn from this fund. Aspiring Asset Management process their withdrawals at month-end, therefore, the subsequent investment of this $1,000,000 will be assessed by EriksensGlobal once we have received the redeemed funds.

1. That the report ‘Performance of council's externally managed funds to June 2018 and transfer of PRF funds’ by Simon Crabb, Finance Manager and dated 20 July 2018, be received.

2. That $1,000,000 is withdrawn from the PRF Aspiring Fund and reinvested into a PRF Fund Manager deemed appropriate by EriksensGlobal at the time the withdrawn funds are received.

Background

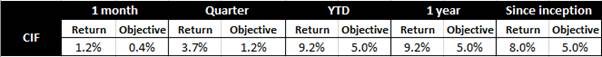

Community Investment Fund (CIF)

At 30 June 2018, the CIF had a market value of $14.2M and had performed as follows:

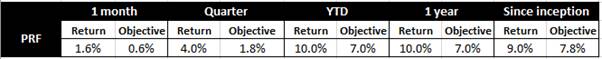

Property Reinvestment Fund (PRF)

At 30 June 2018, the PRF had a market value of $18.48M and performed as follows:

· The exposure to the PRF Aspiring Fund is $4,352,509 equating to 23.6% of the total PRF June balance. At 23.6%, this investment exceeds the allowable limit of 20% stipulated in the PRF Statement of Investment Policy and Objectives, and needs to be reduced.

· Eriksens Global recommends that $1,000,000 is withdrawn from Aspiring immediately (thereby reducing the PRF exposure to approx. 18.2%).

· Aspiring Asset Management do not process any redemptions until the end of each month, so a decision on which Fund Manager to reinvest the $1,000,000 will be assessed when the Aspiring monies are received.

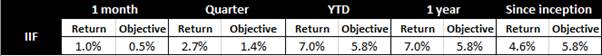

Infrastructure Investment Fund (IIF)

At 30 June 2018, the IIF had a market value of $11M and performed as follows:

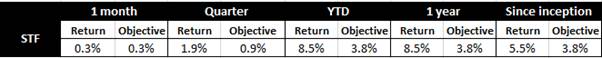

Short Term Investment Fund (STF, formerly known as the WCF)

At 31 30 June 2018, the STF had a market value of $3.0M and performed as follows:

Considerations

1. Options

|

No. |

Option |

Advantages |

Disadvantages |

|

1 |

Withdraw $1,000,000 from the PRF Aspiring Fund |

Reduce the exposure to the PRF Aspiring Fund to permitted range limits stipulated in the PRF Statement of Investment Policy and Objectives, subsequently reducing councils counter- party risk level. |

The Aspiring Fund has returned 13.1% over the past year and any investment transferred to an alternative fund manager may generate a lower rate of return.

|

|

2 |

Status Quo |

Maintain an investment in a fund that has generated a rate of return of 13.1% over the past 12 months. |

Continue to breach the PRF Statement of Investment Policy and Objective counter party risk limit. |

The staff’s recommended option is 1.

2. Significance and engagement

In relation to section 79 of the Local Government Act 2002, this decision is considered to be of low significance because it is part of council’s day-to-day activities and is in accordance with the approved Treasury Management Policy.

3. Policy, risk management and legislative compliance

The activities detailed in this report are in accordance with council’s Treasury Management Policy and the 2018–28 Long Term Plan, both of which were approved in accordance with council’s decision-making requirements of sections 76–82 of the Local Government Act 2002.

Further Considerations

4. Community views

The impact investing in externally managed funds has been consulted on with the community through the 2018–28 Long Term Plan consultative procedure, in accordance with s82 of the Local Government Act 2002

5. Māori impact statement

Targeted consultation on the council’s intention to invest in externally managed funds was undertaken with iwi as part of the 2018–28 Long Term Plan consultation process, using existing relationship channels.

6. Financial implications

Investment strategies carry different risk profiles and are subject to different return volatilities. The returns from managed funds can fluctuate over a given time and period and historical returns do not necessarily form the basis for forecasted future returns.

7. Implementation issues

There are no implementation issues that council needs to be aware of.

Attachments

Attachment 1: Northland Regional

Council Externally Managed Investment Funds- Eriksens Global Monthly Report to

30 June 2018 ⇩ ![]()

Authorised by Group Manager

|

Name: |

Dave Tams |

|

Title: |

Group Manager, Corporate Excellence |

|

Date: |

20 July 2018 |