|

Investment Subcommittee Tuesday 28 May 2019 at 8.30am

|

|

|

|

|

|

Investment Subcommittee Tuesday 28 May 2019 at 8.30am

|

|

|

|

|

Investment Subcommittee

28 May 2019

Investment Subcommittee Agenda

Meeting to be held in the Whale Bay Room

36 Water Street, Whangārei

on Tuesday 28 May 2019, commencing at 8.30am

Recommendations contained in the agenda are NOT decisions of the meeting. Please refer to minutes for resolutions.

MEMBERSHIP OF THE Investment Subcommittee

Chairman, Councillor John Bain

|

Independent Financial Advisor, Mr Geoff Copstick |

Councillor Bill Shepherd (Ex-Officio) |

Councillor Penny Smart |

Item Page

1.0 apologies

2.0 declarations of conflicts of interest

3.1 Confirmation of Minutes 3

4.1 Final Report - Investment Funds Review

Attachment 1 Northland Regional Council Review - 1 Mar 19 FINAL 7

5.1 Performance of Council's Externally Managed Fund to April 2019 35

5.2 Draft Operating Costs Reserve Policy 59

Investment Subcommittee item: 3.1

28 May 2019

|

TITLE: |

Confirmation of Minutes |

|

ID: |

A1167236 |

|

From: |

Dave Tams, Group Manager, Corporate Excellence |

The purpose of this report is to present for confirmation the minutes of the Investment Subcommittee meeting held on 26 February 2019.

Councils are required to keep minutes of proceedings in accordance with the Local Government Act 2002.

Recommendation

That the minutes of the Investment Subcommittee meeting held on 26 February 2019 be confirmed as a true and correct record.

Attachment 1: Investment Subcommittee

Minutes - 26 February 2019 ⇩ ![]()

Authorised by Group Manager

|

Name: |

Dave Tams |

|

Title: |

Group Manager, Corporate Excellence |

|

Date: |

23 May 2019 |

Investment Subcommittee item: 5.1

28 May 2019

|

TITLE: |

Performance of Council's Externally Managed Fund to April 2019 |

|

ID: |

A1174425 |

|

From: |

Simon Crabb, Finance Manager |

Executive summary/Whakarāpopototanga

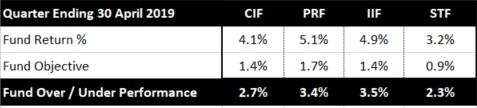

A summary of the returns and target objectives for the Quarter ending 30 April 2019 for each externally managed fund is presented below, with the supporting detail and fund performance for longer periods contained in Attachment 1.

That the report ‘Performance of Council's Externally Managed Fund to April 2019’ by Simon Crabb, Finance Manager and dated 8 May 2019, be received.

Background/Tuhinga

Community Investment Fund (CIF)

At 30 April 2019, the CIF had a market value of $14.7M and performed as follows:

![]()

Property Reinvestment Fund (PRF)

At 30 April 2019, the PRF had a market value of $18.3M and performed as follows:

![]()

Infrastructure Investment Fund (IIF)

At 30 April 2019, the IIF had a market value of $20.9M and performed as follows:

![]()

Short Term Investment Fund (STF)

At 30 April 2019, the STF had a market value of $7.1M and performed as follows:

![]()

Attachments/Ngā tapirihanga

Attachment 1: NRC Externally Managed

Investment Funds - Monthly Report to 30 April 2019 ⇩ ![]()

Authorised by Group Manager

|

Name: |

Dave Tams |

|

Title: |

Group Manager, Corporate Excellence |

|

Date: |

23 May 2019 |

28 May 2019

|

TITLE: |

Draft Operating Costs Reserve Policy |

|

ID: |

A1195504 |

|

From: |

Simon Crabb, Finance Manager |

Executive summary/Whakarāpopototanga

The purpose of an Operating Costs Reserve is to ensure the delivery of work programs, employment, and ongoing day to day operations in the event of an unforeseen shortfall in revenue.

The intention of the attached Draft Operating Costs Reserve Policy is to have sufficient funding set aside in liquid assets should the budgeted revenue stream from councils Managed Fund portfolio not eventuate as anticipated.

It is proposed the amount of the Operating Costs Reserve would increase (or decrease) to reflect the annual amount of general funding required from Managed Funds as presented in the budgets approved by council.

The 2019-20 budgets (yet to be adopted) signal that $2,068,981 would be the target amount initially required in the proposed Operating Costs Reserve. It is proposed that the $2,068,981 would come from this years surplus Managed Fund gains with any shortfall coming from historical Managed Fund gains.

The Draft Operating Costs Reserve Policy for Subcommittee review is presented as Attachment 1

1. That the report ‘Draft Operating Costs Reserve Policy’ by Simon Crabb, Finance Manager and dated 22 May 2019, be received.

2. That the Investment Subcommittee endorse that the Draft Operating Costs Reserve Policy is presented to full council for approval

Considerations

1. Options

|

No. |

Option |

Advantages |

Disadvantages |

|

1 |

Endorse that the Draft Operating Costs Reserve Policy is presented to full Council |

An Operating Costs Reserve provides assurance and stability over the delivery of council’s mission, work programmes, employment and day to day operations. |

The returns associated with term deposits are typically lower than the returns generated if funding remained in Managed Funds (however this does reflect the fact that term deposits carry less risk and why they are aligned to the Draft policy) |

|

2 |

Do not pursue this policy any further |

None |

Remain at risk to a volatile economy and its implications on councils managed fund returns and detrimental impact on a funding source relied upon to fund work programmes |

The staff’s recommended option is 1

2. Significance and engagement

In relation to section 79 of the Local Government Act 2002, this decision is considered to be of low significance because it is part of council’s day-to-day activities and is in accordance with the approved Treasury Management Policy

3. Policy, risk management and legislative compliance

The activities detailed in this report are in accordance with council’s Treasury Management Policy, the 2018–28 Long Term Plan both of which were approved in accordance with council’s decision-making requirements of sections 76–82 of the Local Government Act 2002.

Being a purely administrative matter, Community Views, Māori Impact Statement, Financial Implications and Implementation Issues are not applicable.

Attachments/Ngā tapirihanga

Attachment 1: DRAFT Operating Costs

Reserve Policy ⇩ ![]()

Authorised by Group Manager

|

Name: |

Dave Tams |

|

Title: |

Group Manager, Corporate Excellence |

|

Date: |

23 May 2019 |

Investment Subcommittee

28 May 2019

Operating Costs Reserve Policy

This policy establishes a dedicated unrestricted reserve (“the Operating Costs Reserve”) within the equity of Northland Regional Council. The purpose of the reserve and the cash holdings representing it, is to ensure that portion of annual operating costs in any year that are intended to be funded from gains from Northland Regional Council’s managed funds is guaranteed and not exposed to volatility in financial markets or other adverse circumstances.

Purpose

The purpose of the Operating Costs Reserve Policy is to ensure the stability of work-programs, employment, and ongoing day to day operations of the Northland Regional Council.

The Operating Costs Reserve is intended to provide a source of funds to cover any unanticipated loss in councils funding arising from adverse economic conditions or volatility in financial markets.

The Operating Costs Reserve is not intended to replace a permanent loss of funding or eliminate an ongoing budget gap.

The Operating Costs Reserve Policy will be implemented in line with council’s other governance and financial policies and is intended to support council’s strategic goals and operational plans.

Target amount for the Operating Costs reserve

The Operating Costs Reserve is a designated fund set aside at a target amount equal to the annual budgeted amount of general funding required from councils managed fund portfolio.

The target amount will exclude investment fees. Investment fees will be funded by Managed Fund gains and any shortfall will be funded from the capital balance of the corresponding Managed Fund.

The target amount will be calculated each year after council approval of the annual budgets.

It is the intention of Northland Regional Council that the Operating Costs Reserve is replenished, increased or decreased to its targeted amount within a reasonably short period of time.

Accounting for the Operating Costs Reserve

The Operating Costs Reserve will be held in segregated fixed rate term deposits or other liquid assets in accordance with council’s treasury management policy.

Interest or gains generated from the assets representing the Operating Costs Reserve will be reinvested back into the Operating Costs Reserve.

Assets representing the Operating Costs Reserve will be repaid to councils managed fund portfolio when their total exceeds the target amount.

As the costs to be covered by the Operating Costs Reserve are known, the cash holdings which represent the reserve must have the lowest feasible risk setting most likely to be cash and term deposits of appropriate duration. Any fixed vs floating parameters set under council’s Treasury Management Policy therefore do not apply to such cash and term deposits

The Operating Costs Reserve will be established by council resolution and will be recognised in the financial statements as a council designated unrestricted special reserve.

Funding of Operating Costs Reserve

The Operating Costs Reserve will be funded from unrestricted surplus operating funds and historical investment gains.

Council may from time to time direct that a specific source of revenue be set aside in the Operating Costs Reserve.

Use of Operating Costs Reserve (book entry and cash withdrawal)

Use of the Operating Costs Reserve requires three steps:

1. Identification of appropriate use of the Operating Costs Reserve

The Chief Executive will identify the need for access to the Operating Costs Reserve and confirm that the use is consistent with the purpose of the reserve as described in this Policy.

2. Authority to use Operating Costs Reserve

a. Authority for recognising the use of the Operating Costs Reserve (by way of a transfer from reserve in the financial statements) is delegated to the Chief Executive.

b. Authority to physically withdraw funding from the assets representing the Operating Costs Reserve is delegated to the Chief Executive in consultation with the Chair of the Audit and Finance Working party.

3. Reporting and monitoring.

The Chief Executive is responsible for ensuring that the Operating Costs Reserve is maintained and used as described in this Policy.

The Chief Executive will report the withdrawal of any funding from the Operating Costs Reserve to council at their next scheduled meeting, accompanied by a plan to restore the Operating Costs Reserve to its target amount.

Review of Policy

This Policy will be reviewed by the Audit and Finance working party when warranted by internal or external events or changes.

Changes to the Policy will be recommended by the Audit and Finance working party to for resolution by Council