|

Extraordinary Council Meeting Tuesday 4 June 2019 at 9.30am

|

|

|

|

|

|

Extraordinary Council Meeting Tuesday 4 June 2019 at 9.30am

|

|

|

|

|

Extraordinary Council Meeting

4 June 2019

Northland Regional Extraordinary Council Meeting Agenda

Meeting to be held in the Council Chamber

36 Water Street, Whangārei

on Tuesday 4 June 2019, commencing at 9.30am

Recommendations contained in the council agenda are NOT council decisions. Please refer to council minutes for resolutions.

Item Page

Housekeeping

1.0 apologies (whakapahĀ)

2.0 DECLARATIONS OF CONFLICTS OF INTEREST (WHAKAPUAKANGA O MUA)

3.1 Adoption of User Fees and Charges 2019/20 | Kaupapa Here a Utu 3

3.2 Adoption of the Annual Plan 2019/20 | Mahere-a-Tau 2019/20 72

3.3 Rates for the year 1 July 2019 to 30 June 2020 139

Extraordinary Council Meeting item: 3.1

4 June 2019

|

TITLE: |

Adoption of User Fees and Charges 2019/20 | Kaupapa Here a Utu |

|

ID: |

A1194707 |

|

From: |

Kyla Carlier, Corporate Planning Manager and Robyn Broadhurst, Policy Specialist |

Executive summary/Whakarāpopototanga

This report presents the user fees and charges, and associated policy, contained within the User Fees and Charges 2019/20 schedule for adoption by council.

Council’s User Fees and Charges 2019/20 underwent a period of public consultation concurrently with the Annual Plan 2019/20.

1. That the report ‘Adoption of User Fees and Charges 2019/20 | Kaupapa Here a Utu’ by Kyla Carlier, Corporate Planning Manager and Robyn Broadhurst, Policy Specialist and dated 20 May 2019, be received.

2. That council adopts the User Fees and Charges 2019/20 as included as Attachment 1 to this report.

3. That council authorises Jonathan Gibbard, Group Manager –Strategy, Governance and Engagement to make any necessary minor drafting, typographical, rounding, or presentation corrections to the User Fees and Charges 2019/20 prior to final publication of the document.

Council’s User Fees and Charges 2019/20 comprises the charges that council is authorised to set under the various pieces of legislation that it works under. These are reviewed annually, and have been reviewed and consulted on in conjunction with the process of developing the Annual Plan 2019/20.

All charges in the User Fees and Charges have been adjusted for inflation with a rate of 2.2% applied. This increase is slightly lower than the actual inflation budgeted for fees and charges within the Long Term Plan 2018-2028.

In addition to the inflationary increase, other minor changes included clarification to wording, minor updates to charges, and removal of redundant charges. Three new charges were also added for deemed permitted activities, new moorings in a moorings area, and reinstatement of a mooring following suspension/ cancellation. This was in response to recent changes in the RMA.

A new fee structure for water permit charges was also proposed to ensure fees and charges are fair, equitable and relevant to the amount consented. During deliberations council requested that an alternative option to the proposed fee structure be presented for consideration. Staff submitted an alternative table, with 11 fee bandwidths as opposed to the original proposed seven. Council deliberated on this further on 21 May and decided to proceed with the original seven-bandwidth structure, as proposed and consulted on.

No other changes to the User Fees and Charges 2019/20 were made as a result of council deliberations

Considerations

1. Options

Section 150 of the LGA sets out the process by which a local authority may prescribe fees and charges in respect of any matter provided for, either under a bylaw or under any other enactment, if the enactment does not authorise the local authority to charge a fee. Section 36 of the Resource Management Act 1991 authorises local authorities to fix charges, and specifies that such charges must be fixed in the manner set out by section 150 of the LGA.

Council has completed a review of fees and charges and followed the relevant process for consultation required under section 82 and 83 of the LGA.

|

No. |

Option |

Advantages |

Disadvantages |

|

1 |

Adopt the User Fees and Charges 2019/20 |

Policy, fees and charges can be updated for the 2019/20 financial year. |

None |

|

2 |

Do not adopt the User Fees and Charges 2019/20 |

None |

Fees and charges will not be able to be updated for the 2019/20 financial year, resulting in inaccurate costs, and the inability of council to recover the cost of activities. |

Staff recommend option 1, to adopt the User Fees and Charges 2019/20, inclusive of amendments and additional charges, as consulted.

2. Significance and engagement

Section 76AA of the LGA directs that council must adopt a policy setting out how significance will be determined and the level of engagement that will be triggered. This policy assists council in determining how to achieve compliance with the LGA requirements in relation to decisions.

Consultation on the User Fees and Charges 2019/20 has been completed, achieving compliance with council’s Significance and Engagement Policy.

3. Policy, risk management and legislative compliance

The decision to confirm and adopt the User Fees and Charges 2019/20 is in accordance with section 150 of the LGA and is consistent with the policy and legislative requirements of the various pieces of legislation that council sets charges under, including the Resource Management Act and the Biosecurity Act.

Further considerations

4. Community views

The views of the community on the amendments and alterations in the User Fees and Charges 2019/20, were obtained during a period of consultation in accordance with sections 82 and 83 of the LGA. Community views have been provided to council by way of links to full submissions and a summary of submissions report which included a comprehensive report of feedback received at the councillor/community feedback meeting.

Council has considered the proposals included in the User Fees and Charges 2019/20 by way of a deliberations meeting on 7 May 2019 that centred upon the public feedback received.

5. Māori impact statement

While there were no proposals in this User Fees and Charges that were considered to have significant and specific impacts on Māori over and above those of the general public, the process of consultation included engagement with Māori. This occurred by way of pānui circulated to all iwi and hapū groups on council’s database, and reporting to the Tai Tokerau Māori and Council working party.

6. Financial implications

The User Fees and Charges 2019/20 sets out the fees and charges for the 2019/20 financial year, which make up a portion of council’s income sources. An estimation of the income received from these fees and charges, that contributes to budgeted income for the 2019/20 financial year, is reflected in the financial statements set out in council’s Annual Plan 2019/20

7. Implementation issues

It is not anticipated there will be any implementation issues for the User Fees and Charges 2019/20 following adoption.

Attachments/Ngā tapirihanga

Attachment 1: User Fees and Charges

2019/20 ⇩ ![]()

Authorised by Group Manager

|

Name: |

Jonathan Gibbard |

|

Title: |

Group Manager - Strategy, Governance and Engagement |

|

Date: |

29 May 2019 |

4 June 2019

|

TITLE: |

Adoption of the Annual Plan 2019/20 | Mahere-a-Tau 2019/20 |

|

ID: |

A1163608 |

|

From: |

Kyla Carlier, Corporate Planning Manager |

Executive summary/Whakarāpopototanga

The purpose of this report is to present the Annual Plan 2019/20 for final adoption, following a process of development, consultation and council deliberation.

1. That the report ‘Adoption of the Annual Plan 2019/20 | Mahere-a-Tau 2019/20 ’ by Kyla Carlier, Corporate Planning Manager and dated 15 May 2019, be received.

2. That in accordance with section 95 of the Local Government Act 2002, the council adopts the Annual Plan 2019/20, as included at Attachment 1 to this report.

3. That the council authorises Jonathan Gibbard, Group Manager – Strategy and Governance to make any necessary minor drafting, typographical, rounding, or presentation corrections to the Annual Plan 2019/20 prior to the document going to print.

Background/Tuhinga

The Local Government Act 2002 (LGA) requires council to develop an annual plan for years two and three of the Long Term Plan to identify any changes from what was set out in the Long Term Plan. The LGA outlines the process for determining if consultation is required as part of the development of an annual plan, and prescribes the process of consultation to be followed.

Council identified several changes from the Long Term Plan 2018 – 2028 that it proposed be incorporated into the Annual Plan 2019/20, and carried out consultation on these using the principles of consultation as outlined in section 82 of the LGA. The changes comprised five funding initiatives, adding a total of $192,500 to overall rates take.

The process of consultation has now been completed, with the majority of feedback received being supportive. Council deliberated on the proposals on 7 May 2019, deciding at that time to support all of the proposed initiatives, and add funding of $20,000 for a scoping study of the health of the Hokianga Harbour.

The final Annual Plan 2019/20 is attached, and contains a summary of what has changed from what was set out in the Long Term Plan 2018-2028. The Annual Plan also contains council’s funding and rates statements for the 2019/20 year.

Any content, including financial information and policies, not legally required to be located within an annual plan have not been included in this final document in an effort to avoid unnecessary duplication and keep the document size to a minimum. Where possible, relevant information will be made available on council’s website.

Considerations

1. Options

Section 95 of the LGA requires adoption of an annual plan for each financial year and that the annual plan must be adopted before the commencement of the year to which it relates.

Two options are set out below.

|

No. |

Option |

Advantages |

Disadvantages |

|

1 |

Adopt the Annual Plan 2019/20 |

Council will achieve compliance with the LGA and will have a budget, and forecast financial statements, in place for the 2019/20 financial year. |

None |

|

2 |

Do not adopt the Annual Plan 2019/20 |

None |

Council will not achieve compliance with the LGA and will enter the 2019/20 financial year without an approved budget. |

Staff recommend option 1; to adopt the Annual Plan 2019/20

1. Significance and Engagement

Section 76AA of the LGA directs that council must adopt a policy setting out how significance will be determined and the level of engagement that will be triggered. This policy assists council in determining how to achieve compliance with the LGA requirements in relation to decisions.

The proposals and content included in this annual plan resulted in the Council Services Rate exceeding a 2% increase, and consultation was carried out in accordance with section 82 of the LGA.

The decision to approve and adopt the Annual Plan 2019/20 is considered to be compliant with council’s Significance and Engagement Policy.

2. Policy and Legislative Compliance

The adoption of an Annual Plan is a requirement of section 95 of the LGA and the process to be followed is set out in Part 6 of this Act, which encompasses the council’s decision making (sections 76 to 81), planning (sections 95 to 96) and consultation (sections 82 and 82A) processes.

Adoption of the Annual Plan 2019/20 is consistent with the policy and legislative requirements outlined above.

Further Considerations:

3. Community Views

The views of the community on the proposals included in the Annual Plan 2019/20 were obtained during a period of consultation, in accordance with section 82 of the LGA. Community views have been provided to council by way of links to full submissions and a summary of submissions report which included a comprehensive report of feedback received during the Councillor/Community feedback meeting.

Council has discussed the proposals included in the Annual Plan 2019/20 by way of a deliberations meeting on 7 May 2019 that centred upon the public feedback received.

4. Māori Impact Statement

While there were no proposals in the Annual Plan 2019/20 that were considered to have significant and specific effects on Māori over and above those of the general public, the process of consultation included engagement with Māori. This occurred by way of pānui circulated to all iwi and hapū groups on council’s database, and reporting to the Tai Tokerau Māori and Council working party.

5. Financial Implications

This annual plan sets out the budget, forecast financial statements, and rates examples for the 2019/20 financial year.

All activities outlined in the final Annual Plan 2019/20 have been budgeted for.

6. Implementation issues

There are no anticipated implementation issues for the Annual Plan 2019/20 following adoption of the plan at this meeting.

Attachments/Ngā tapirihanga

Attachment 1: Annual Plan 2019/20 |

Mahere-a-Tau 2019/20 ⇩ ![]()

Authorised by Group Manager

|

Name: |

Jonathan Gibbard |

|

Title: |

Group Manager - Strategy, Governance and Engagement |

|

Date: |

29 May 2019 |

4 June 2019

|

TITLE: |

Rates for the year 1 July 2019 to 30 June 2020 |

|

ID: |

A1196118 |

|

From: |

Dave Tams, Group Manager, Corporate Excellence and Casey Mitchell, Assistant Management Accountant |

Executive summary/Whakarāpopototanga

Under sections 23, 24, 57 and 58 of the Local Government (Rating) Act 2002 (LGRA), the council is required to set its rates, due dates and penalty regime by resolution.

Under section 55 of the LGRA, the council may provide for a discount on the rates if payment is made by a specified date before the due date or dates, in accordance with a policy made under section 55.

This paper provides for the council to set its rates, due dates, penalty regime and discounts for the year commencing on 1 July 2019 and ending on 30 June 2020.

This paper has been prepared in accordance with the revenue and financing policy in the LTP 2018-2028 and rates section (including the funding impact statement) contained within the 2019–2020 Annual Plan.

1. That the report ‘Rates for the year 1 July 2019 to 30 June 2020’ by Dave Tams, Group Manager, Corporate Excellence and Casey Mitchell, Assistant Management Accountant and dated 24 May 2019, be received.

2. That council notes that it has had regard to section 100T of the Biosecurity Act 1993 and confirms that its analysis of Section 100T of the Biosecurity Act 1993, as included in the Long Term Plan 2018-2028, remains appropriate in relation to setting the Pest Management Rate for 2019/20.

3. That the Northland Regional Council resolves to set the following rates under the Local Government (Rating) Act 2002 (LGRA) for the financial year commencing 1 July 2019 and ending 30 June 2020:

a. Targeted council services rate

A targeted rate as authorised by the LGRA. The rate is calculated on the total projected capital value, as determined by the certificate of projected valuation of each constituent district in the Northland region. An additional $1.73 (including GST) per each rateable separately used or inhabited part (SUIP) of a rating unit is to be assessed across the Whangārei constituency to provide funding for the ongoing maintenance of the Hātea River Channel. The rate is differentiated by location in the Northland region and assessed as a fixed amount per each rateable separately used or inhabited part (SUIP) of a rating unit in the Far North and Whangārei districts, and on each rateable rating unit (RU) in the Kaipara district. The rate is set as follows:

Including GST

Far North District $82.16 per SUIP

Kaipara District $112.05 per RU

Whangārei District $104.25 per SUIP

The Whangārei District targeted council services rate amount of $104.25 (including GST) per SUIP includes funding for the Hātea River Channel amount of $1.73 (including GST).

b. Targeted land management rate

A targeted rate as authorised by the LGRA. The rate is assessed on the land value of each rateable rating unit in the region. The rate is set per dollar of land value. The rate per dollar of land value is different for each constituent district because the rate is allocated based on projected land value, as provided for in section 131 of the LGRA. The rate is set as follows:

Including GST

Far North District $0.0001168 per dollar of land value

Kaipara District $0.0001063 per dollar of land value

Whangārei District $0.000991 per dollar of land value

c. Targeted freshwater management rate

A targeted rate as authorised by the LGRA. The rate is assessed on the land value of each rateable rating unit in the region. The rate is set per dollar of land value. The rate per dollar of land value is different for each constituent district because the rate is allocated based on projected land value, as provided for in section 131 of the LGRA. The rate is set as follows:

Including GST

Far North District $0.0002379 per dollar of land value

Kaipara District $0.0002166 per dollar of land value

Whangārei District $0.0002022 per dollar of land value

d. Targeted pest management rate

A targeted rate as authorised by the LGRA. The rate is calculated on the total projected capital value, as determined by the certificate of projected valuation of each constituent district in the Northland region. The rate is a fixed amount, differentiated by location in the Northland region. The rate will be assessed on each rateable separately used or inhabited part (SUIP) of a rating unit in the Far North and Whangārei districts and each rateable rating unit (RU) in the Kaipara District. The rate is set as follows:

Including GST

Far North District $46.78 per SUIP

Kaipara District $63.80 per RU

Whangārei District $58.37 per SUIP

e. Targeted flood infrastructure rate

A targeted rate as authorised by the LGRA. The rate is a fixed amount assessed on each rateable separately used or inhabited part (SUIP) of a rating unit in the Far North and Whangārei districts and each rateable rating unit (RU) in the Kaipara District. The rate is set as follows:

Including GST

Far North District $26.02 per SUIP

Kaipara District $26.02 per RU

Whangārei District $26.02 per SUIP

f. Targeted civil defence and hazard management rate

A targeted rate as authorised by the LGRA. The rate is calculated on the total projected capital value, as determined by the certificate of projected valuation of each constituent district in the Northland region. The rate is a fixed amount, differentiated by location in the Northland region. The rate will be assessed on each rateable separately used or inhabited part (SUIP) of a rating unit in the Far North and Whangārei districts and each rateable rating unit (RU) in the Kaipara District. The rate is set as follows:

Including GST

Far North District $16.58 per SUIP

Kaipara District $22.61 per RU

Whangārei District $20.68 per SUIP

g. Targeted emergency services rate

A targeted rate as authorised by the LGRA. The rate is a fixed amount assessed on each rateable separately used or inhabited part (SUIP) of a rating unit in the Far North and Whangārei districts and each rateable rating unit (RU) in the Kaipara District. The rate is set as follows:

Including GST

Far North District $11.69 per SUIP

Kaipara District $11.69 per RU

Whangārei District $11.69 per SUIP

h. Targeted regional sporting facilities rate

A targeted rate as authorised by the LGRA. The rate is a fixed amount assessed on each rateable separately used or inhabited part (SUIP) of a rating unit in the Far North and Whangārei districts and each rateable rating unit (RU) in the Kaipara District. The rate is set as follows:

Including GST

Far North District $16.74 per SUIP

Kaipara District $16.74 per RU

Whangārei District $16.74 per SUIP

i. Targeted regional infrastructure rate

A targeted rate as authorised by the LGRA. This rate is assessed on the land value of each rateable rating unit in the region. The rate is set per dollar of land value. The rate per dollar of land value is different for each constituent district, because the rate is allocated based on projected land value, as provided for in section 131 of the LGRA. The rate is set as follows:

Including GST

Far North District $0.0000297 per dollar of land value

Kaipara District $0.0000270 per dollar of land value

Whangārei District $0.0000253 per dollar of land value

j. Targeted Whangārei transport rate

A targeted rate as authorised by the LGRA. The rate is a fixed amount assessed on each rateable separately used or inhabited part of a rating unit (SUIP) in the Whangārei District. The rate is set as follows:

Including GST

Whangārei District $22.83 per SUIP

k. Targeted Far North transport rate

A targeted rate as authorised by the LGRA. The rate is a fixed amount assessed on each rateable separately used or inhabited part of a rating unit (SUIP) in the Far North District. The rate is set as follows:

Including GST

Far North District $8.68 per SUIP

l. Targeted Awanui River management rate

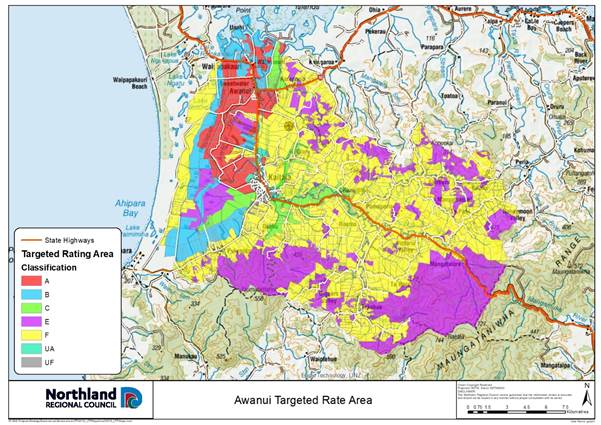

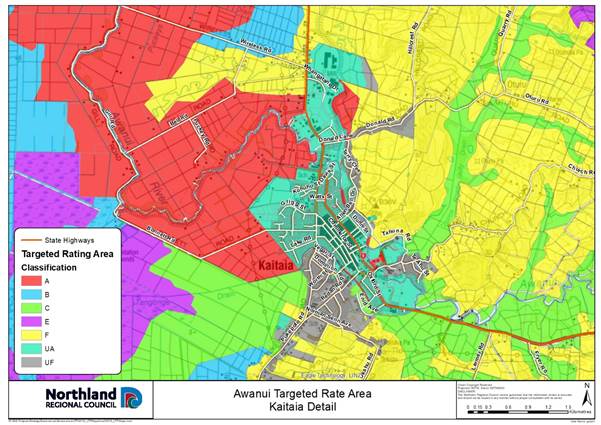

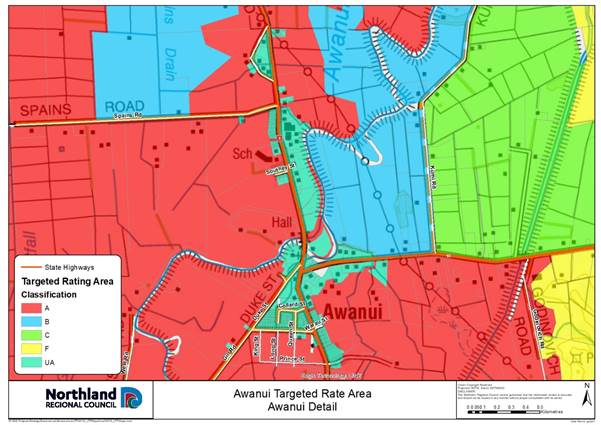

A targeted rate set under the LGRA, set differentially by location and area of benefit as defined in the Awanui River Flood Management Plan, and as defined in the following table:

The rate is set differentially as follows:

|

Category |

Description |

Rate including GST |

|

|

|

UA |

Urban rate class UA (floodplain location) $297.95 direct benefit plus $30.01 indirect benefit per separately used or inhabited part of a rating unit (SUIP). |

$327.96 per SUIP |

|

|

|

UA |

Urban rate class UA – commercial differential. |

$983.87 per SUIP |

|

|

|

UF |

Urban rate classes UF (higher ground) $30.00 direct benefit plus $30.01 indirect benefit per separately used or inhabited part of a rating unit. |

$60.01 per SUIP

|

|

|

|

UF |

Urban rate class UF – commercial differential. |

$180.03 per SUIP |

|

|

|

Rural |

Rural rate differentiated by class, $13.35 per separately used or inhabited part of a rating unit (SUIP) of indirect benefit plus a rate per hectare for each of the following classes of land in the defined Kaitāia flood rating district as illustrated in the following maps and table. |

$13.35 per SUIP |

|

|

|

Class |

Description |

Rate including GST |

|

|

|

A & B |

High benefit; rural land which receives high benefit from the Awanui scheme works due to reduced river flooding risk and/or reduced duration of flooding and/or coastal flooding – all rateable land other that in the commercial differential. |

$24.47 per hectare |

|

|

|

A & B commercial differential |

$73.40 per hectare |

|||

|

C |

Moderate benefit; land floods less frequently and water clears quickly – all rateable land other that in the commercial differential. |

$11.07 per hectare |

|

|

|

C commercial differential |

$33.21 per hectare |

|||

|

F |

Contributes runoff waters, and increases the need for flood protection - all rateable land other that in the commercial differential. |

$1.09 per hectare |

|

|

|

F commercial differential |

$3.27 per hectare |

|||

The rating classifications are illustrated in the following

maps:

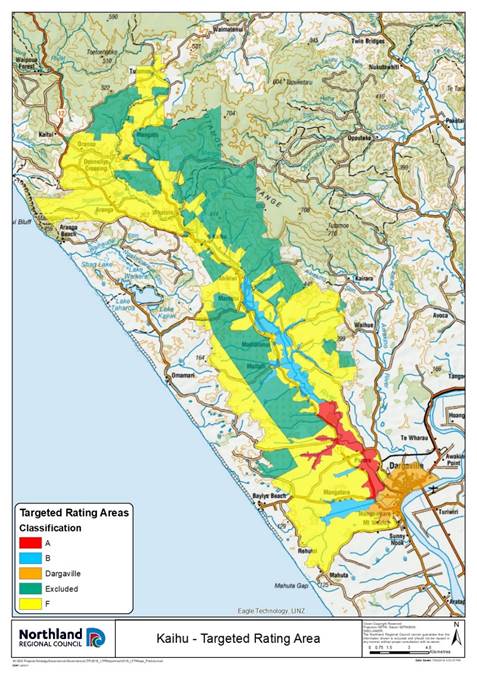

m. Targeted Kaihū River management rate

A targeted rate set under the LGRA, and set differentially by location and area of benefit as defined in the following table:

|

Class |

Description |

Rate Including GST |

|

|

A |

Land on the floodplain and side valleys downstream of Rotu Bottleneck. |

$23.72 per hectare |

|

|

B |

Land on the floodplain and tributary side valleys between Ahikiwi and the Rotu Bottleneck and in the Mangatara Drain catchment upstream of SH12. |

$11.68 per hectare |

|

|

F |

Land within the Kaihū River rating area not falling within Class A and Class B. |

$1.64 per hectare |

|

|

Urban Contribution – A contribution from the Kaipara District Council instead of a separate rate per property: |

$5,015 per annum |

||

The rating classifications are

illustrated in the following map:

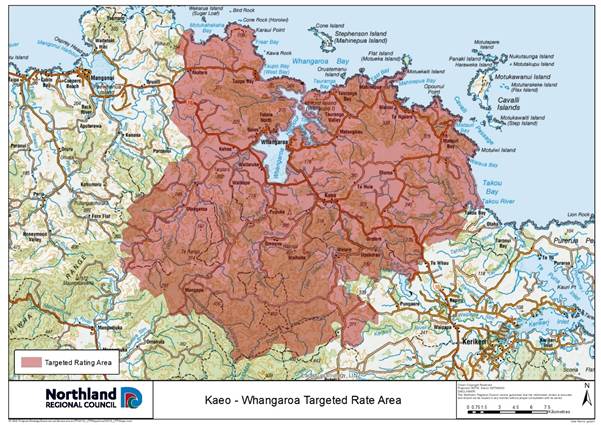

n. Targeted Kaeo-Whangaroa rivers management rate

A targeted rate set under the LGRA, set on a uniform basis in respect of each rateable separately used or inhabited part of a rating unit falling within the former Whangaroa Ward rating rolls of 100-199, as illustrated in the map below:

Including GST

Former Whangaroa Ward $52.06 per SUIP

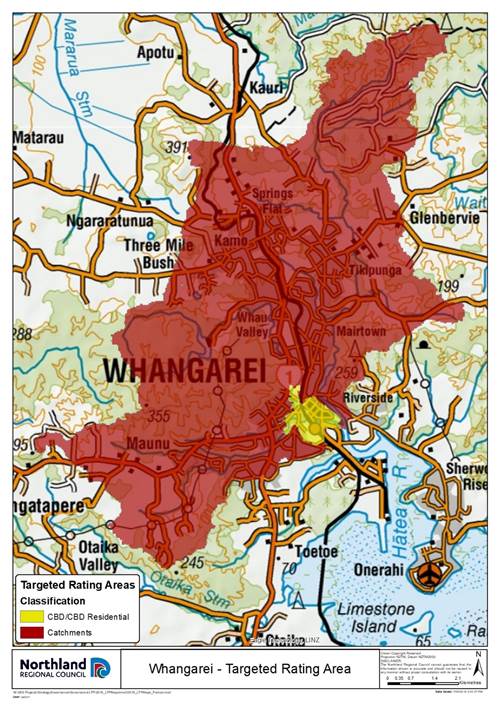

o. Targeted Whangārei urban rivers management rate

A targeted rate set under the LGRA, and assessed on all rateable properties defined by reference to the differential categories, and differentiated by location (illustrated in the map below) and, for some categories, land use. It is set as a fixed amount per each rateable separately used or inhabited part (SUIP) of a rating unit, as follows:

|

Category |

|

Including GST |

|

1 |

Commercial properties located in the Whangārei Central Business District flood area:

|

$352.25 per SUIP |

|

2 |

Residential properties located in the Whangārei Central Business District flood area:

|

$174.16 per SUIP |

|

3 |

Properties located in the contributing water catchment area (including properties falling in the Waiarohia, Raumanga, Kirikiri and Hātea River Catchments): |

$43.34 per SUIP |

Differential categories for the Whangārei urban rivers management rate:

|

Residential properties in the Whangārei central business district |

Residential properties in the Whangārei central business district (CBD) flood area are defined as all rating units which are used principally for residential or lifestyle residential purposes, including retirement villages, flats etc. Residential properties also includes multi-unit properties, these being all separate rating units used principally for residential purposes, and on which is situated multi-unit type residential accommodation that is used principally for temporary or permanent residential accommodation and for financial reward, including, but not limited to, hotels, boarding houses, motels, tourist accommodation, residential clubs and hostels but excluding any properties that are licensed under the Sale and Supply of Alcohol Act 2012. |

|

Commercial properties in the Whangārei central business district |

Commercial properties in the Whangārei CBD flood area are all separate rating units used principally for commercial, industrial or related purposes or zoned for commercial, industrial or related purposes in accordance with the Whangārei district plan. For the avoidance of doubt, this category includes properties licensed under the Sale and Supply of Alcohol 2012; and private hospitals and private medical centres. |

4. Payment dates for rates, discounts, and penalty regime

That the Northland Regional Council resolves the following:

Far North District constituency:

All rates within the Far North District constituency are payable in four equal instalments, on the following dates:

|

Instalment |

Due date for payment |

|

Instalment 1 |

20 August 2019 |

|

Instalment 2 |

20 November 2019 |

|

Instalment 3 |

20 February 2020 |

|

Instalment 4 |

20 May 2020 |

The Northland Regional Council resolves to add the following penalties to unpaid Far North District constituency rates:

· In accordance with section 58(1)(a) of the LGRA, a penalty of ten percent (10%) will be added to any portion of each instalment of Far North District constituency rates assessed in the 2019/20 financial year that is unpaid on or by the respective due date for payment as stated above. These penalties will be added on the following dates:

|

Instalment |

Date penalty will be added |

|

Instalment 1 |

27 August 2019 |

|

Instalment 2 |

27 November 2019 |

|

Instalment 3 |

27 February 2020 |

|

Instalment 4 |

27 May 2020 |

Kaipara District constituency:

All rates within the Kaipara District constituency are payable in four equal instalments, on the following dates:

|

Instalment |

Due date for payment |

|

Instalment 1 |

20 August 2019 |

|

Instalment 2 |

20 November 2019 |

|

Instalment 3 |

20 February 2020 |

|

Instalment 4 |

20 May 2020 |

The Northland Regional Council resolves to add the following penalties to unpaid Kaipara District constituency rates:

· In accordance with section 58(1) (a) of the LGRA, a penalty of ten percent (10%) of so much of each instalment of the Kaipara District constituency rates assessed in the 2019/20 financial year that are unpaid after the relevant due date for each instalment will be added on the relevant penalty date for each instalment stated below, except where a ratepayer has entered into an arrangement by way of direct debit authority, or an automatic payment authority, and honours that arrangement. These penalties will be added on the following dates:

|

Instalment |

Date penalty will be added |

|

Instalment 1 |

21 August 2019 |

|

Instalment 2 |

21 November 2019 |

|

Instalment 3 |

21 February 2020 |

|

Instalment 4 |

21 May 2020 |

· In accordance with section 58(1)(b) of the LGRA, a penalty of ten per cent (10%) of the amount of all Kaipara District constituency rates (including any penalties) from any previous financial years that are unpaid on 01 July 2019 will be added on 03 July 2019.

· In accordance with section 58(1)(c) of the LGRA, a penalty of ten per cent (10%) of the amount of all Kaipara District constituency rates to which a penalty has been added under the point immediately above and which remain unpaid will be added on 06 January 2020.

Whangārei District constituency:

All rates within the Whangārei District constituency are payable in four equal instalments, on the following dates:

|

Instalment |

Due date for payment |

|

Instalment 1 |

20 August 2019 |

|

Instalment 2 |

20 November 2019 |

|

Instalment 3 |

20 February 2020 |

|

Instalment 4 |

20 May 2020 |

The Northland Regional Council resolves to add the following penalties to unpaid Whangārei District constituency rates:

· In accordance with section 58(1)(a) of the LGA, a penalty of ten percent (10%) will be added to any portion of each instalment of Whangārei District constituency rates assessed in the 2019/20 financial year that is unpaid on or by the respective due date for payment as stated above. These penalties will be added on the following dates:

|

Instalment |

Date penalty will be added |

|

Instalment 1 |

23 August 2019 |

|

Instalment 2 |

25 November 2019 |

|

Instalment 3 |

25 February 2020 |

|

Instalment 4 |

25 May 2020 |

· In accordance with section 58(1)(b) of the LGRA, a penalty of ten per cent (10%) will be added to any Whangārei District constituency rates (including any penalties) from any financial year prior to 1 July 2019 that still remain unpaid as at 4 July 2019. This penalty will be added on 4 September 2019.

The Northland Regional Council resolves to apply the following discount to Whangārei District constituency rates:

· In accordance with section 55(3) of the LGRA, where the total rates assessed for the 2019/20 year and any arrears on a rating unit in the Whangārei District constituency are paid in full on or by the due date of the first instalment, a discount of two percent (2%) of the total rates assessed on that rating unit in the 2019/20 financial year will be applied.

Background/Tuhinga

The Northland Regional Council is scheduled to adopt its 2019–2020 Annual Plan at the council meeting to be held on 4 June 2019. All formal requirements to resolve the rates for the year ended 30 June 2020 are in place and permit the following resolution to proceed.

The final rates have been calculated in accordance with the resolutions made by council on 7 May 2019; and the updated rating units, separately used or inhabited parts of a rating unit (SUIPs), capital values and land values provided by the district councils.

Under section 23 of the Local Government (Rating) Act 2002 (LGRA) the council is required to set its rates by resolution. This paper provides for the council to set rates for the year commencing on 1 July 2019 and ending on 30 June 2020.

Rates for the 2019/20 year are set out on a GST inclusive basis. This means that the amount of the rates stated includes the council’s GST obligations. Penalties are added to the amount of unpaid rates.

Section 24 of the LGRA requires that the council state the due date for payment of the rates in its resolution setting rates.

Section 57 of the LGRA states that a local authority may, by resolution, authorise penalties to be added to rates that are not paid by the due date. The resolution must state how the penalty is calculated and the date the penalty is to be added to the amount of unpaid rates. Section 58 of the LGRA sets out the penalties that may be imposed.

Pursuant to section 23(5) of the LGRA, within 20 working days of the making of this resolution, a copy will be sent to the Secretary of Local Government.

Pursuant to section 28(4) of the LGRA the rating information database was made available for public inspection during May 2019.

Council carries out its pest management activities in accordance with its Northland Regional Pest and Marine Pathway Management Plan 2017–2027. Section 100T of the Biosecurity Act requires that a regional council must decide the extent to which it funds the implementation of its regional pest and/or pathway management plan from a general rate, targeted rate, or a combination of both.

Council gave full regard to Section 100T during the process of developing the Long Term Plan 2018-2028, and adopted the analysis for the purpose of setting the Pest Management Rate. The full analysis was included in the Long Term Plan.

Council also carried out an analysis of funding of the Regional Pest and Marine Pathway Management Plan and in the Cost Benefit Analysis to the plan.

No significant changes have been made to the Pest Management Rate as a result of the Annual Plan 2019/20, and the analysis adopted by council remains applicable. This report confirms council’s adoption of this analysis.

The full details of the rates calculations and rates collected from each constituent district of the Northland region will be as set out in the tables below:

Table One: Valuations by district (including equalised values)

SUIP = Separately used or inhabited part of a rating unit.

Table Two: Northland Regional Council rates for the 2019/20 financial year

|

Budgeted Rates 2019/20 (including GST) |

Far North District |

Kaipara District |

Whangārei District |

Total $ |

Total $ |

|

Targeted council services rate |

|||||

|

Rate per SUIP |

$82.16 |

3,109,982 |

3,023,383 |

||

|

Rate per RU |

$112.05 |

1,631,669 |

1,561,189 |

||

|

Rate per SUIP |

$104.25 |

4,755,947 |

4,634,917 |

||

|

9,497,598 |

9,219,489 |

||||

|

Freshwater management rate |

|||||

|

Rate per $ of Actual LV |

$0.0002379 |

1,845,620 |

1,823,491 |

||

|

Rate per $ of Actual LV |

$0.0002166 |

1,082,154 |

1,064,161 |

||

|

Rate per $ of Actual LV |

$0.0002022 |

2,855,984 |

2,751,351 |

||

|

5,783,758 |

5,639,003 |

||||

|

Targeted pest management rate |

|||||

|

Rate per SUIP |

$46.78 |

1,770,784 |

1,721,475 |

||

|

Rate per RU |

$63.80 |

929,051 |

888,921 |

||

|

Rate per SUIP |

$58.37 |

2,663,165 |

2,595,393 |

||

|

5,363,000 |

5,205,789 |

||||

|

Targeted land management rate |

|||||

|

Rate per $ of Actual LV |

$0.0001168 |

906,054 |

895,546 |

||

|

Rate per $ of Actual LV |

$0.0001063 |

531,165 |

522,627 |

||

|

Rate per $ of Actual LV |

$0.0000991 |

1,400,168 |

1,351,234 |

||

|

2,837,387 |

2,769,407 |

||||

|

Targeted flood infrastructure rate |

|||||

|

Rate per SUIP |

$26.02 |

984,883 |

957,458 |

||

|

Rate per RU |

$26.02 |

378,898 |

362,532 |

||

|

Rate per SUIP |

$26.02 |

1,187,074 |

1,156,865 |

||

|

2,550,855 |

2,476,855 |

||||

|

Targeted civil defence and hazard management rate |

|||||

|

Rate per SUIP |

$16.58 |

627,428 |

609,957 |

||

|

Rate per RU |

$22.61 |

329,184 |

314,965 |

||

|

Rate per SUIP |

$20.68 |

943,619 |

919,606 |

||

|

1,900,231 |

1,844,528 |

||||

|

Targeted regional sporting facilities rate |

|||||

|

Rate per SUIP |

$16.74 |

633,474 |

615,835 |

||

|

Rate per RU |

$16.74 |

243,706 |

233,180 |

||

|

Rate per SUIP |

$16.74 |

763,523 |

744,092 |

||

|

1,646,994 |

1,593,107 |

||||

|

Targeted regional infrastructure rate |

|||||

|

Rate per $ of Actual LV |

$0.0000297 |

230,274 |

227,152 |

||

|

Rate per $ of Actual LV |

$0.0000270 |

135,100 |

132,562 |

||

|

Rate per $ of Actual LV |

$0.0000253 |

357,469 |

342,735 |

||

|

722,842 |

702,449 |

||||

|

Targeted emergency services rate |

|||||

|

Rate per SUIP |

$11.69 |

442,406 |

430,087 |

||

|

Rate per RU |

$11.69 |

170,200 |

162,848 |

||

|

Rate per SUIP |

$11.69 |

533,230 |

519,660 |

||

|

1,145,836 |

1,112,595 |

||||

|

Targeted Whangārei transport rate |

|||||

|

Rate per SUIP |

$22.83 |

1,041,703 |

1,015,194 |

||

|

Targeted Far North transport rate |

|||||

|

Far North District |

$8.68 |

328,621 |

319,470 |

||

|

Targeted Awanui River management rate |

|||||

|

Far North District - Rural |

210,330 |

207,969 |

|||

|

Far North District - Urban |

892,913 |

882,383 |

|||

|

1,103,243 |

1,090,352 |

||||

|

Targeted Kaihū River management rate |

|||||

|

Kaipara District (Kaihū river area only) |

79,869 |

79,869 |

|||

|

Targeted Kaeo-Whangaroa rivers management rate |

|||||

|

Far North (Kaeo only) |

$52.06 |

123,981 |

116,645 |

||

|

Targeted Whangārei urban rivers management rate |

|||||

|

Rates per SUIP |

1,167,409 |

1,154,250 |

|||

|

Total rates |

Gross $ |

Net $ |

|||

|

Far North District |

12,106,715 |

11,830,850 |

|||

|

Kaipara District |

5,510,995 |

5,322,854 |

|||

|

Whangārei District |

17,669,291 |

17,185,296 |

|||

|

TOTAL RATES |

35,287,001 |

34,339,001 |

|||

Considerations

1. Options

|

No. |

Option |

Advantages |

Disadvantages |

|

1 |

Adopt the recommendations presented in this report. |

Legally generate the rating revenue required to fund the council’s 2019/20 work programmes. |

None |

|

2 |

Do not adopt the recommendations presented in this report. |

None |

Inability to legally strike the 2019/20 rates. Consequently, unless alternative funding streams were obtained, the council would fail to deliver all its 2019/20 work programmes. |

The staff’s recommended option is to adopt the recommendations presented in this report.

2. Significance and engagement

The council’s 2019–2020 Annual Plan has been developed in accordance with sections 93 and 93A-93G of the Local Government Act 2002, and contains details of the proposed rates.

The rates being set have been established as part of the 2019–2020 Annual Plan process that included consultation with the public who have had the opportunity to fully consider the issues and present their views to the council, which have in turn been taken into consideration.

Consequently, this resolution is required to enact previous decisions of council through the annual plan process and is an administrative decision that does not itself trigger the Significance and Engagement Policy.

The decisions in this report are in accordance with sections 76 to 82 of the Local Government Act 2002 and the Local Government (Rating) Act 2002.

The public will have access to the final 2019–2020 Annual Plan and rates resolution through the council’s website.

3. Policy, risk management and legislative compliance

This report has been independently reviewed by Simpson Grierson, and meets all the statutory requirements under the Local Government (Rating) Act 2002 for the setting of 2019/20 rates.

This report has been independently reviewed by the auditors Deloittes.

Further considerations

4. Community views

The impact of the 2019–2020 Annual Plan budgets on council’s rates has been consulted on with the community through the 2019–2020 Annual Plan consultative procedure in accordance with s82 of the Local Government Act 2002.

5. Māori impact statement

Targeted consultation on the council’s rates funding requirement was undertaken with iwi as part of the 2019–2020 Annual Plan consultation process using existing relationship channels.

6. Financial implications

This report discusses setting of rates for the 2019/20 financial year. The financial impacts of the recommendations in this report are significant as it determines council’s ability to collect rate revenue.

7. Implementation issues

There are no implementation issues that the council needs to be aware of.

Attachments/Ngā tapirihanga

Nil

Authorised by Group Manager

|

Name: |

Dave Tams |

|

Title: |

Group Manager, Corporate Excellence |

|

Date: |

29 May 2019 |