|

Audit and Risk Subcommittee Wednesday 24 June 2020 at 1.00pm

|

|

|

|

|

|

Audit and Risk Subcommittee Wednesday 24 June 2020 at 1.00pm

|

|

|

|

|

Audit and Risk Subcommittee

24 June 2020

Audit and Risk Subcommittee Agenda

Meeting to be held in the Council Chamber

36 Water Street, Whangārei

on Wednesday 24 June 2020, commencing at 1.00pm

Recommendations contained in the agenda are NOT decisions of the meeting. Please refer to minutes for resolutions.

MEMBERSHIP OF THE Audit and Risk Subcommittee

Chairperson, NRC Councillor Colin Kitchen

|

Councillor John Bain |

Councillor Amy Macdonald |

Councillor Joce Yeoman |

|

Independent Financial Advisor Geoff Copstick |

Independent Audit & Risk Advisor Danny Tuato’o |

|

Item Page

1.0 apologies

2.0 declarations of conflicts of interest

3.0 Risk Management update 3

4.0 Awanui River Project update 4

5.1 Confirmation of Minutes -15 April 2020 5

6.1 2019-20 Annual Report: Timetable and Deloitte Planning Report 10

6.2 $10M Loan Repayment 50

6.3 Local Government Funding Agency: Becoming a Guaranteeing Member 53

6.4 Interest rate for special reserves in surplus 61

6.5 New Regional Rating Collection Reporting (PowerBi Demo) 63

Audit and Risk Subcommittee item: 3.0

24 June 2020

|

TITLE: |

Risk Management update |

|

ID: |

A1329034 |

Executive summary/Whakarāpopototanga

The presentations that will be presented at the meeting are listed below.

That the presentations:

31 Risk Management update.

be received.

Attachments/Ngā tapirihanga

Nil

Authorised by Group Manager

|

Name: |

Dave Tams |

|

Title: |

Group Manager, Corporate Excellence |

|

Date: |

|

Audit and Risk Subcommittee item: 4.0

24 June 2020

|

TITLE: |

Awanui River Project update |

|

ID: |

A1329037 |

Executive summary/Whakarāpopototanga

The presentations that will be presented at the meeting are listed below.

That the presentations:

1 Awanui River Project update.

be received.

Attachments/Ngā tapirihanga

Nil

Authorised by Group Manager

|

Name: |

Dave Tams |

|

Title: |

Group Manager, Corporate Excellence |

|

Date: |

|

Audit and Risk Subcommittee item: 5.1

24 June 2020

|

TITLE: |

Confirmation of Minutes -15 April 2020 |

|

ID: |

A1327159 |

|

From: |

Judith Graham, Corporate Excellence P/A |

That the minutes of the Audit and Risk Subcommittee meeting held on 15 April 2020 be confirmed as a true and correct record.

Attachments/Ngā tapirihanga

Attachment 1: Confirmation of Minutes -

15 April 2020 ⇩ ![]()

Authorised by Group Manager

|

Name: |

Dave Tams |

|

Title: |

Group Manager, Corporate Excellence |

|

Date: |

|

Audit and Risk Subcommittee item: 6.1

24 June 2020

|

TITLE: |

2019-20 Annual Report: Timetable and Deloitte Planning Report |

|

ID: |

A1329230 |

|

From: |

Simon Crabb, Finance Manager |

Executive summary/Whakarāpopototanga

As part of the 2019-20 Annual Report process, Deloitte have prepared a planning report outlining their planned approach, and the key areas of focus for this year’s audit. This report is attached as Attachment 1.

Peter Gulliver of Deloitte (Audit Partner) will attend the June Audit and Risk Subcommittee meeting to discuss the 2019-20 planning report, and answer any questions.

That the report ‘2019-20 Annual Report: Timetable and Deloitte Planning Report’ by Simon Crabb, Finance Manager and dated 18 June 2020, be received.

Background/Tuhinga

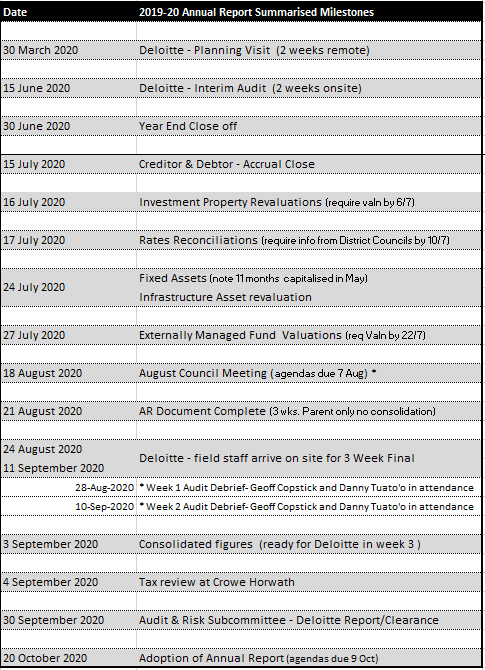

A schedule of the high-level milestone dates for the 2019-20 Audit programme is presented over the page.

The signed Deloitte Audit proposal letter setting out the estimated audit hours and audit fee for the coming three years is attached (Attachment 2) for the committee’s information.

The Deloitte Audit Engagement letter outlining the nature and limitations of the audit, as well as the respective responsibilities of council and Deloitte is also attached (Attachment 3) for the committee’s information.

B

Attachments/Ngā tapirihanga

Attachment 1: Deloitte Planning Report

2019-20 ⇩ ![]()

Attachment 2: Deloitte Proposal Letter

for 2020, 2021 and 2022 financial years ⇩ ![]()

Attachment 3: Deloitte Audit Engagement

Letter ⇩ ![]()

Authorised by Group Manager

|

Name: |

Dave Tams |

|

Title: |

Group Manager, Corporate Excellence |

|

Date: |

|

24 June 2020

|

TITLE: |

$10M Loan Repayment |

|

ID: |

A1328789 |

|

From: |

Simon Crabb, Finance Manager |

Executive summary/Whakarāpopototanga

Council currently has total external borrowings of $19.6M made up of four loans with the LGFA totalling $9.6M, and one loan of $10M acquired from corporate investors.

The Corporate loan of $10M taken out in 2015 is set to mature and be repaid on the 13 August 2020.

It is proposed that the $10M corporate loan is repaid and a subsequent loan of $5.2M is taken with the Local Government Funding Agency (LGFA). The borrowing reduction of $4.8M represents the Net Funds held by council that are dedicated to repaying debt.

That the report ‘$10M Loan Repayment’ by Simon Crabb, Finance Manager and dated 17 June 2020, be received.

Background/Tuhinga

Council currently has total external borrowings of $19.6M made up of four loans with the LGFA totalling $9.6M, and one loan of $10M acquired from corporate investors.

The Corporate loan of $10M was taken out for 5 years in 2015, and is set to mature and be repaid on the 13 August 2020.

The targeted rates collected to repay the $10M loan were set over a period t ranging from 25 to 60 years to provide a level of affordability and intergenerational equity to the affected communities. As such, the full $10M has not been fully recovered yet, and there remains a level of debt owing from the affected communities and still to be collected via future targeted rates.

In addition, there have been capital river works of $1,983,607 undertaken during the 2019-20 financial year. These capital works were funded by targeted rates of $1,175,024 collected in 2019-20 and councils working capital of $808,583. The working capital component needs to be reimbursed from debt funding.

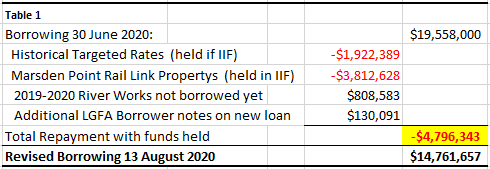

Thus, it is proposed that council’s total borrowings are reduced by $4,796,343 on the 13 August 2020 as illustrated in Table 1.

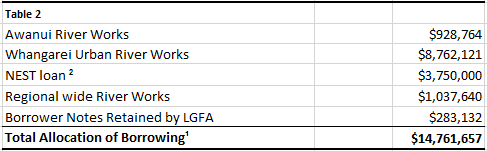

The revised Borrowing of $14,791,657 will be allocated as presented in Table 2.

¹ values are subject to change by year end.

² The Nest Loan will be repaid from the proceeds owing from Northland Emergency Service Trust (NEST) that are due in May 2023

All the projects listed in Table 2 have a dedicated funding source that will be collected over time to ensure all of councils borrowing will be totally repaid.

It should be noted that the outstanding amounts pertaining to the river works projects are tracked and recorded in individual reserves within council’s financial information system.

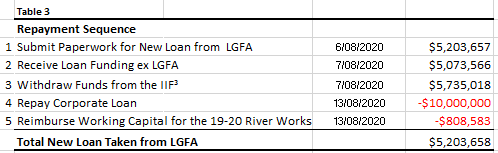

The Sequence of events required to repay the $10M corporate loan and initiate a new LGFA loan to reflect the overall decrease in council borrowing of $4,796,343 is presented in Table 3.

³ The Withdrawal from the Infrastructure Investment Fund (IIF) of $5,735,018 comprises the historical Targeted River Rates collected to repay debt ($1,922,389), and the borrowings allocated to the purchase of Marsden point Rail link properties ($3,812,628).

The $5,203,658 of loan funding received from the LGFA will be invested into the IIF.

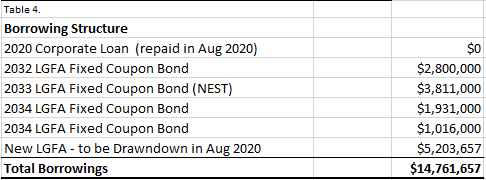

Following the completion of the transactions listed in Table 3, Councils Overall borrowings of $14,761,657 will be structured as per Table 4.

The cost of borrowing of the Corporate Loan is 3.79%. At the time of writing the cost of borrowing of a 12-year loan with the LGFA is 2.17%. The benefit of this lower cost of borrowing will flow through to the Targeted Ratepayers.

All values presented in this paper are draft and are subject to change by year end. The final figures will be presented to full council in July 2020.

Attachments/Ngā tapirihanga

Nil

Authorised by Group Manager

|

Name: |

Dave Tams |

|

Title: |

Group Manager, Corporate Excellence |

|

Date: |

|

Audit and Risk Subcommittee item: 6.3

24 June 2020

|

TITLE: |

Local Government Funding Agency: Becoming a Guaranteeing Member |

|

ID: |

A1328791 |

|

From: |

Simon Crabb, Finance Manager |

Executive summary/Whakarāpopototanga

It is proposed that council becomes a guaranteeing member of the LGFA to obtain the borrowing capacity and agility to secure long term, low cost, loan funding in excess of $20M for any large projects that may eventuate.

The potential risk of being a guarantor is that Council will guarantee a proportion of the obligations of the LGFA. This proportion is based on a pro-rata of annual rates revenue. As an indication, as at June 2019, if NRC was a guarantor its share of the guarantee would be 0.43%. (E.G. if the LGFA called $100,000,000 under the guarantee, council would need to contribute $430,000).

Standards and Poor’s have assessed the chances of the guarantee being called as “extremely low”, with multiple forms of funding available to LGFA before the guarantee is used.

An independent analysis of the Risk and Benefits associated with becoming a guaranteeing member was undertaken by PricewaterhouseCoopers (PwC). The overall Risk: Benefit ratio was assessed as low risk with high benefit.

Council is required to enter in to two legal documents when becoming a guaranteeing member. PricewaterhouseCoopers recommends these two documents are reviewed by council’s legal advisors, noting that there is a level of comfort to be taken from the number of councils who have already undertaken legal advice prior to signing these documents.

At March 2020, 66 councils have joined the LGFA with 54 of those councils as a guarantor council.

The PwC report is attached as Attachment 1.

1. That the report ‘Local Government Funding Agency: Becoming a Guaranteeing Member’ by Simon Crabb, Finance Manager and dated 17 June 2020, be received.

2. That a legal review is undertaken on the legal documents required to be executed to become a guaranteeing member of the LGFA.

3. That, subject to a satisfactory legal review, the Subcommittee endorse a recommendation to full council that Northland Regional Council becomes a guaranteeing member of the LGFA.

Background/Tuhinga

The Local Government Funding Agency (LGFA) is an AA+ rated council-controlled organisation (CCO) that provides loan funding to the local government sector on terms that are more favourable than commercially available

On 13 December 2016, council passed a resolution to join the Local Government Funding Agency (LGFA) scheme as a borrower and non-guarantor. As a non-guarantor member, council can borrow up to a maximum of NZ$20 in aggregate from the LGFA.

It is proposed that council becomes a guaranteeing member of the LGFA.

Council consulted on becoming a guaranteeing member of the LGFA in the 2018-2028 Long Term Plan.

At the time of writing, council has total borrowings of $9.6M with the LGFA. However, as a result of the proposal to redraw $5.2M of funds from the LGFA, councils total aggregated LGFA borrowings would become $14.8M.

At the time of writing, the borrowing rate of a 12-year loan for a guaranteeing member was 2.07% per annum. The comparable rate for a non-guarantor member was 2.17%.

Potential risk.

The potential risk to being a guarantor is Council guarantees a proportion of the obligations of the LGFA. All guarantor councils share this risk on a pro-rata basis based on their annual rates revenue. As an indication, as at June 2019 if NRC was a guarantor its share of the guarantee would be 0.43%. This means if LGFA called $100,000,000 under the guarantee, council would need to contribute $430,000.

Standards and Poor’s have assessed the chances of the guarantee being called as “extremely low, with multiple forms of funding available to LGFA before the guarantee is used.

LGFA have never had to call on guarantor councils for any of their obligations.

Council is guaranteeing the obligations of the LGFA only and not other councils. It is LGFA’s view that if a council defaulted on its debt this would be unlikely to trigger a call under the guarantee. LGFA would put a Statutory Manager in place and then seek to recover the debt over time through a special rate. LGFA has plenty of access to liquidity so the fact that a council did not repay a loan would not create a problem for LGFA in terms of managing the cashflow.

Independent Assessment of Potential Risk

Alex Wondergem, a partner at PwC who specialises in Treasury Management and Debt Funding was engaged by council staff to prepare a summary of the risks of becoming a guaranteeing member.

The overall risk:benefit ratio of becoming a LGFA guarantor was assessed as low risk with high benefits.

Legal Documents

To become a guaranteeing member Council is required to enter in to two legal documents.

· The Guarantee and Indemnity; and

· The Equity Commitment Deed

PwC recommends these legal documents are reviewed by council’s legal advisors, also noting that there is a level of comfort to be taken from the number of councils who have already undertaken legal advice prior to entering into these documents. At March 2020, 66 councils have joined the LGFA with 54 of those councils as guarantor council.

Considerations

1. Options

|

No. |

Option |

Advantages |

Disadvantages |

|

1 |

Do nothing |

Save the costs of a legal review upon the LGFA documentation. Do not become a party guaranteeing a portion of the indebtedness of the LGFA. |

Council will need to obtain its debt in excess of $20M (aggregated) via trading banks or a private placement. These options generally offer shorter term debt whereas longer term intergenerational debt matches closer with infrastructure expenditure. The borrowing cost of obtaining debt from trading banks or a private placement is typically higher than that sourced from the LGFA - this additional cost will be passed on to the community. |

|

2 |

Undertake a legal review of on the legal documents required to be executed to become a guaranteeing member of the LGFA. |

Obtain legal assurance (prior to entering a binding agreement) to make an informed decision and avoid any unforeseen obligations arising at a later date. |

Incur the cost of a legal review. |

|

3 |

Endorse a recommendation to full council that Northland Regional Council becomes a guaranteeing member of the LGFA. |

Should full council adopt the proposed recommendation, sourcing longer term debt in excess of $20M (aggregated) will be available to council at a lower cost – providing certainty and savings for the community. |

Become a party guaranteeing a portion of the indebtedness of the LGFA should the LGFA not met its obligations |

The staff’s recommended option is 2 and 3.

2. Significance and engagement

In relation to section 79 of the Local Government Act 2002, this decision is considered to be of low significance when assessed against council’s Significance and Engagement Policy because it has previously been consulted on and is in accordance with the approved Treasury Management Policy.

3. Policy, risk management and legislative compliance

The activities detailed in this report are in accordance with council’s Treasury Management Policy and the 2018–28 Long Term Plan

4. Community views

Council consulted on becoming a guaranteeing member of the LGFA it the 2018-2028 Long Term Plan. Close to half (46%) of the submitters agreed with this proposal. 26.5% disagreed with the proposal noting there should be caution when taking on more debt. The remaining submitters were neutral or selected “no option” to the proposal.

5. Financial implications

Borrowing in excess of $20M in aggregate can be sourced, at a lower cost as a LGFA guaranteeing member than a non-guaranteeing member. The financial risk is council guarantees a proportion of the obligations of the LGFA if the LGFA cannot meet its financial obligations

Being a purely administrative matter Māori Impact Statement and Implementation Issues are not applicable.

Attachments/Ngā tapirihanga

Attachment 1: PricewaterhouseCoopers

Report: Becoming a Guaranteeing Member of the Local Government Funding Agency ⇩ ![]()

Authorised by Group Manager

|

Name: |

Dave Tams |

|

Title: |

Group Manager, Corporate Excellence |

|

Date: |

|

24 June 2020

|

TITLE: |

Interest rate for special reserves in surplus |

|

ID: |

A1289797 |

|

From: |

Vincent McColl, Financial Accountant |

Executive summary/Whakarāpopototanga

This report proposes changing the interest rate applied to reserve balances in excess of $50,000 surplus

· from 5% as budgeted in the LTP

· to

the Short-Term Fund (STF) Investment objective of the 90-day bank bill rate

plus 3% per annum. Set at 1 July of each financial year.

1. That the report ‘Interest rate for special reserves in surplus’ by Vincent McColl, Financial Accountant and dated 18 June 2020, be received.

2. That the Audit and Risk Subcommittee endorse a recommendation to full council that the 90-day bank bill rate plus 3% per annum will be used to calculate the interest attributable to special reserves with balances in excess of $50,000, reset annually on 1 July.

Background/Tuhinga

In council’s Long Term Plan (LTP) it specifies a budgeted internal interest rate of 5% for reserves in surplus (or in credit) of $50,000 or higher.

This paper recommends that the rate used instead be matched to the STF Statement of Investment Policy and Objectives (SIPO) investment objective of the 90-day bank bill rate plus 3% per annum. For the 2019-20 financial year, this would equate to 4.6% (1.6% + 3%).

This rate will be reset on 1 July of each financial year.

The reserve balances in excess of $50,000 surplus as at the end of May 2020 are:

· Kaeo River Reserve

· Sporting Facilities Reserve

· Hatea River Reserve

· Waipapa Kerikeri River Reserve

· Far North Transport Reserve

· Emergency Services Reserve

Considerations

1. Options

|

No. |

Option |

Advantages |

Disadvantages |

|

1 |

Endorse the application of 90-day bank bill rate plus 3% per annum when calculating the interest attributable to special reserves with balances in excess of $50,000 |

In line with expected returns from where the cash is held. |

Slightly lowers interest being gained by unspent reserve funds. |

|

2 |

Leave the interest rate at of the LTP rate of 5% |

Surplus reserves receive marginally more money for credit balances that can be used on later works |

Encourages rating and holding of funds rather than doing the work the money was collected for |

The staff’s recommendation is option 1

2. Significance and engagement

Significance and Engagement PolicyThe specifying of internal interest rates is considered to be of low significance because it is part of council’s day to day activities.

3. Policy, risk management and legislative compliance

Council’s decision to apply interest at a specified rate to surplus reserve funds is consistent with council’s policy and legislative requirements.

Further considerations

Being a purely an administrative matter Community Views, Māori Impact Statement, and Implementation Issues are not applicable.

4. Financial implications

Lowering the interest gained by reserves in surplus to 4.6% rather than 5% in 2019-20 would have a total negative impact of $5,082 on the affected special reserves, and a positive impact of $5,082 on council’s net surplus after transfers to reserves for the eleven months to May 2020.

Attachments/Ngā tapirihanga

Nil

Authorised by Group Manager

|

Name: |

Dave Tams |

|

Title: |

Group Manager, Corporate Excellence |

|

Date: |

|

Audit and Risk Subcommittee item: 6.5

24 June 2020

|

TITLE: |

New Regional Rating Collection Reporting (PowerBi Demo) |

|

ID: |

A1328939 |

|

From: |

Simon Crabb, Finance Manager |

Executive summary/Whakarāpopototanga

The quarterly “Regional Rating Collections” report has been converted into a PowerBi dashboard report in an endeavour to make the data easier to understand.

A 5-minute live demonstration of this PowerBi report will be presented to the Subcommittee to explain the visualisations and note any feedback.

Rollout of this report to full council is scheduled for August 2020, and will include the 2019-20 Q4 rating information.

That the report ‘New Regional Rating Collection Reporting (PowerBi Demo)’ by Simon Crabb, Finance Manager and dated 17 June 2020, be received.

Background/Tuhinga

<<enter text>>

Attachments/Ngā tapirihanga

Nil

Authorised by Group Manager

|

Name: |

Dave Tams |

|

Title: |

Group Manager, Corporate Excellence |

|

Date: |

|