|

Investment and Property Subcommittee Wednesday 26 August 2020 at 1.00pm

|

|

|

|

|

|

Investment and Property Subcommittee Wednesday 26 August 2020 at 1.00pm

|

|

|

|

|

Investment and Property Subcommittee

26 August 2020

Investment and Property Subcommittee Agenda

Meeting to be held in the Council Chamber via Zoom

36 Water Street, Whangārei

on Wednesday 26 August 2020, commencing at 1.00pm

Recommendations contained in the agenda are NOT decisions of the meeting. Please refer to minutes for resolutions.

MEMBERSHIP OF THE Investment and Property Subcommittee

Chairperson, NRC Councillor Rick Stolwerk

|

Councillor Justin Blaikie |

Councillor John Bain |

Councillor Colin Kitchen |

|

Ex-Officio Penny Smart |

Independent Financial Advisor Jonathan Eriksen |

Independent Financial Advisor Geoff Copstick |

|

Independent Audit & Risk Advisor Danny Tuato'o |

|

|

Item Page

1.0 apologies

2.0 declarations of conflicts of interest

3.1 Confirmation of Minutes - Investment and Property Subcommittee 27 May 2020 3

4.1 Mount Tiger Forest Quarterly Report April - June 2020 9

4.2 Performance of Council Externally Managed Funds to 31 July 2020 15

4.3 Strategy to De-Risk the Long Term Investment Fund 34

5.0 Business with the Public Excluded 38

5.1 Confirmation of Confidential Minutes - 27 May 2020

Investment and Property Subcommittee item: 3.1

26 August 2020

|

TITLE: |

Confirmation of Minutes - Investment and Property Subcommittee 27 May 2020 |

|

ID: |

A1350476 |

|

From: |

Judith Graham, Corporate Excellence P/A |

That the minutes of the Investment & Property Subcommittee meeting held on 27 May 2020, be confirmed as a true and correct record.

Attachments/Ngā tapirihanga

Attachment 1: Investment & Property

Subcommittee meeting unconfirmed minutes- 27 May 2020 ⇩ ![]()

Authorised by Group Manager

|

Name: |

Bruce Howse |

|

Title: |

Group Manager - Corporate Excellence |

|

Date: |

|

Investment and Property Subcommittee item: 4.1

26 August 2020

|

TITLE: |

Mount Tiger Forest Quarterly Report April - June 2020 |

|

ID: |

A1351889 |

|

From: |

Nicole Inger, Property Officer |

Executive summary/Whakarāpopototanga

The purpose of this report is to present an update on Council’s Mount Tiger Forest by way of the attached report from Ian Jenkins of Jenksmax Consulting Limited, Council’s Forestry Consultant. Mr Jenkins will be present at the meeting to answer any questions.

That the report ‘Mount Tiger Forest Quarterly Report April - June 2020’ by Nicole Inger, Property Officer and dated 13 August 2020, be received.

Background/Tuhinga

As per the Forestry Management Plan, council’s consultant, Jenksmax Consulting Limited, is to report back to Council every quarter providing an update of the Mount Tiger Forest. The significant matters reported in Quarter Four are as follows:

· In this quarter, and for the 2020 year, no Health and Safety issues have arisen.

· Pre-plant desiccant spray of the 1991 area undertaken post Covid-19 lockdown. Further re-establishment works not required. Planting in July/August 2020.

· Maintenance of roads & roadsides, water tables, water control structures, fences, pest control and tree removal recommenced after Covid-19 lockdown.

· The annual valuation of the tree crop at 30 June 2020 is $3,257,000.

· NRC held carbon units of 17,460 showed a revaluation gain of $156,267.

· Regular forest checks (5) have been undertaken for checking after storms, maintenance, trespass, operational planning, H&S inductions and general forest inspections, including a post Covid-19 Level 4 lockdown inspection.

· The July 2020 rainfall event resulted in some significant damage with remedial works estimated at $25,000. Damage is to be addressed on a case by case basis as some roads will not be utilised for harvest for many years so repair is pre-emptive given the possibility of further weather events.

Attachments/Ngā tapirihanga

Attachment 1: NRC Q4(end June 2020)

2019-20 FYear Report ⇩ ![]()

Authorised by Group Manager

|

Name: |

Phil Heatley |

|

Title: |

Strategic Projects and Facilities Manager |

|

Date: |

13 August 2020 |

26 August 2020

|

TITLE: |

Performance of Council Externally Managed Funds to 31 July 2020 |

|

ID: |

A1355237 |

|

From: |

Simon Crabb, Finance Manager |

Executive summary/Whakarāpopototanga

1. That the report ‘Performance of Council Externally Managed Funds to 31 July 2020’ by Simon Crabb, Finance Manager and dated 21 August 2020, be received.

Background/Tuhinga

Jonathan Eriksen from EriksensGlobal will be joining in via Zoom to answer any questions.

Attachments/Ngā tapirihanga

Attachment 1: Performance of Council

Externally Managed Funds to 31 July 2020 ⇩ ![]()

Authorised by Group Manager

|

Name: |

Bruce Howse |

|

Title: |

Group Manager - Corporate Excellence |

|

Date: |

|

26 August 2020

|

TITLE: |

Strategy to De-Risk the Long Term Investment Fund |

|

ID: |

A1354947 |

|

From: |

Simon Crabb, Finance Manager |

Executive summary/Whakarāpopototanga

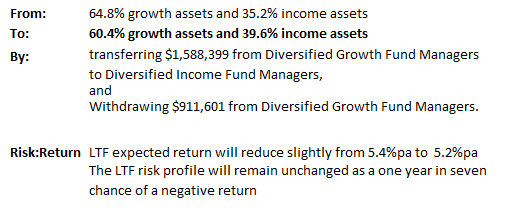

In an endeavour to de-risk the managed fund portfolio and further preserve Councils capital, EriksensGlobal has recommended that the asset mix of the Long-Term Investment Fund is amended:

Refer to Attachment One for the full EriksensGlobal recommendation.

The proposed amendment is within the target asset allocation range specified in councils Statement of Investment Policy and Objectives (SIPO).

1. That the report ‘Strategy to De-Risk the Long Term Investment Fund’ by Simon Crabb, Finance Manager and dated 20 August 2020, be received.

2. That the Long-Term Fund asset mix is amended to 60.4% growth assets and 39.6% income assets (broadly 60:40), in line with the attached EriksensGlobal recommendation.

Background/Tuhinga

In light of the economic impacts of COVID-19 and the approaching NZ and US elections, council’s independent investment advisor, EriksensGlobal, has reviewed the asset allocations of the Long-term Investment Fund (LTF) and proposed a strategy to de-risk the LTF in an endeavour to further preserve Councils capital. The proposed recommendation resets the actual asset mix of the Long-Term Fund as follows:

|

Long Term Investment Fund |

Recommendation |

Target Range |

Benchmark |

|

Growth Assets |

60.4% |

50% - 85% |

67% |

|

Income Assets |

39.6% |

15% - 50% |

33% |

As a result of the proposed amendment the expected return of the LTF will reduce slightly from 5.4% pa to 5.2% pa and the LTF risk profile will remain unchanged at a one year in seven chance of a negative return.

The proposed amendment is within the target asset allocation range specified in councils Statement of Investment Policy and Objectives (SIPO):

To achieve the recommended asset mix, $1,588,399 will be transferred from LTF Diversified Growth Fund Managers (Aspiring, Milford and T Rowe Price) to Diversified Income Managers (Milford and Mint), and a further $911,601 will be physically withdrawn from the Milford Growth Fund Manager.

The withdrawal from Milford Growth is a combination of the August 2020 funding requirement for the Kaipara and Kensington development projects, and the 2019/20 depreciation and investment advisor fee transactions that were approved at the August Council meeting.

At this stage of the year, it is forecast that $2M of the Kiwi rail sale proceeds will be required to fund the remaining development project costs. If there are investment property sales, or greater than budget gains during the year then the $2M requirement can be reduced. There is no debt funding associated with either development project to date, and no future debt funding for these projects is planned.

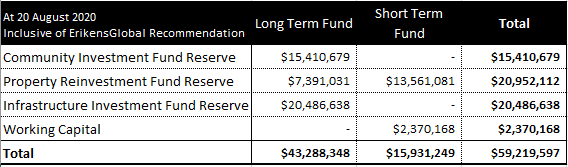

Once the EriksensGlobal recommended transactions are processed, the structure of council’s investment funds will be as follows:

The $13.6M balance in the STF (PRF portion) is aligned to the remaining budgeted cost of the Kensington and Kaipara development projects. When the sale proceeds from Kensington Childcare site are received, it is intended they will be invested into the LTF (PRF portion).

The performance of council’s investment portfolio and the status of local and global economies and financial markets will be continually monitored to evaluate the need for further refinement of the asset mix of council’s investment funds.

The Treasury Management Policy and the Subcommittees Terms of Reference delegate the responsibility to invest and withdraw between fund managers (in line with SIPO), and manage the mix of managed fund investments, to the Investment and Property Subcommittee.

Considerations

1. Options

|

No. |

Option |

Advantages |

Disadvantages |

|

1 |

Amend the asset mix of the Long-Term investment fund to 60.4% growth assets and 39.6% income assets. |

Execute a strategy that enhances capital preservation in a volatile economic climate. |

The expected return of the Long-Term Fund will reduce from 5.4%pa to 5.2% pa |

|

2 |

Do not adjust the current asset mix of the Long-Term Fund. |

Maintain a higher expected level of return (5.4% pa as opposed 5.2% pa) |

Remain exposed to market volatility and a potential economic slowdown |

|

3 |

Amend the asset mix of the Long-Term investment fund to a ratio setting different to that recommended by EriksensGlobal. |

Potentially achieve a Risk:Return setting that is more suitable than that recommended by EriksensGlobal – however with continued monitoring a more conservative or aggressive asset mix can be employed when deemed necessary. |

Potentially move to a Risk:Return setting that is inappropriate to the current and future economic climate. |

The staff’s recommended option is 1, in line with the advice of Council’s independent investment advisor.

2. Significance and engagement

In relation to section 79 of the Local Government Act 2002, this decision is considered to be of low significance when assessed against council’s Significance and Engagement Policy because it is part of the normal day to day treasury operations of council.

3. Policy, risk management and legislative compliance

The activities detailed in this report are in accordance with council’s Treasury Management Policy, the 2018–28 Long Term Plan both of which were approved in accordance with council’s decision-making requirements of sections 76–82 of the Local Government Act 2002. The recommendation is in accordance with council’s Statement of Investment Policy and Objectives (SIPO).

4. Financial implications

Investment strategies carry different risk profiles and are subject to different return volatilities. The returns from Managed Funds can fluctuate over a given time period and historical returns do not necessarily form the basis for forecasted future returns

Being a purely administrative matter, Community Views, Māori Impact Statement, and Implementation Issues are not applicable.

Attachments/Ngā tapirihanga

Attachment 1: August 2020-

EriksensGlobal recommendation to ammend the asset mix of the Long-Term

Investment Fund ⇩ ![]()

Authorised by Group Manager

|

Name: |

Bruce Howse |

|

Title: |

Group Manager - Corporate Excellence |

|

Date: |

21 August 2020 |

Investment and Property Subcommittee ITEM: 5.0

26 August 2020

|

TITLE: |

Executive Summary

The purpose of this report is to recommend that the public be excluded from the proceedings of this meeting to consider the confidential matters detailed below for the reasons given.

1. That the public be excluded from the proceedings of this meeting to consider confidential matters.

2. That the general subject of the matters to be considered whilst the public is excluded, the reasons for passing this resolution in relation to this matter, and the specific grounds under the Local Government Official Information and Meetings Act 1987 for the passing of this resolution, are as follows:

|

Item No. |

Item Issue |

Reasons/Grounds |

|

5.1 |

Confirmation of Confidential Minutes - 27 May 2020 |

The public conduct of the proceedings would be likely to result in disclosure of information, as stated in the open section of the meeting -. |

3. That the Independent Financial Advisor be permitted to stay during business with the public excluded.

Considerations

1. Options

Not applicable. This is an administrative procedure.

2. Significance and Engagement

This is a procedural matter required by law. Hence when assessed against council policy is deemed to be of low significance.

3. Policy and Legislative Compliance

The report complies with the provisions to exclude the public from the whole or any part of the proceedings of any meeting as detailed in sections 47 and 48 of the Local Government Official Information Act 1987.

4. Other Considerations

Being a purely administrative matter; Community Views, Māori Impact Statement, Financial Implications, and Implementation Issues are not applicable.