|

Investment and Property Subcommittee Wednesday 27 January 2021 at 1.00pm

|

|

|

|

|

|

Investment and Property Subcommittee Wednesday 27 January 2021 at 1.00pm

|

|

|

|

|

Investment and Property Subcommittee

27 January 2021

Investment and Property Subcommittee Agenda

Meeting to be held in the Council Chamber

36 Water Street, Whangārei

on Wednesday 27 January 2021, commencing at 1.00pm

Recommendations contained in the agenda are NOT decisions of the meeting. Please refer to minutes for resolutions.

MEMBERSHIP OF THE Investment and Property Subcommittee

Chairperson, NRC Councillor Rick Stolwerk

|

Councillor Justin Blaikie |

Councillor Colin Kitchen |

Councillor Jack Craw |

|

Ex-Officio Penny Smart |

Independent Advisor Jonathan Eriksen |

Independent Audit & Risk Advisor Danny Tuato'o |

|

Independent Advisor Stuart Henderson |

|

|

Item Page

1.0 Housekeeping

2.0 apologies

3.0 declarations of conflicts of interest

4.1 Confirmation of Minutes - 25 November 2020 3

5.1 Receipt of Action Sheet 7

6.1 Mount Tiger Forest Half Year Report July - December 2020 28

6.2 Introduction of the Fermat Capital Management - ILS Yield fund into Councils Long Term Investment Fund 46

6.3 Proposals to Rebalance the Asset Mix of the Managed Fund Investment Portfolio 50

6.4 Performance of Managed Fund Portfolio to 31 Dec 2020; and Proposals to De-Risk the Long Term Fund 67

7.0 Business with the Public Excluded 95

7.1 Confirmation of Confidential Minutes - 25 November 2020

Investment and Property Subcommittee item: 4.1

27 January 2021

|

TITLE: |

Confirmation of Minutes - 25 November 2020 |

|

ID: |

A1405503 |

|

From: |

Judith Graham, Corporate Excellence P/A |

|

Authorised by Group Manager: |

Bruce Howse, Group Manager - Corporate Excellence, on |

That the minutes of the Investment & Property Subcommittee meeting held on 25 November 2020 confirmed as a true and correct record.

Attachments/Ngā tapirihanga

Attachment 1: Investment & Property

Subcommittee Minutes 25 November 2020 ⇩ ![]()

Investment and Property Subcommittee item: 5.1

27 January 2021

|

TITLE: |

Receipt of Action Sheet |

|

ID: |

A1403935 |

|

From: |

Judith Graham, Corporate Excellence P/A |

|

Authorised by Group Manager: |

Bruce Howse, Group Manager - Corporate Excellence, on |

Executive summary/Whakārapopototanga

The purpose of this report is to enable the meeting to receive the current action sheet.

That the action sheet be received.

Attachments/Ngā tapirihanga

Attachment 1: Action sheet form Council

meeting 17 November 2020 for admendments to Subcommittee and working party

terms of reference ⇩ ![]()

Attachment 2: Investment & Property

Subcommittee Terms of Reference ⇩ ![]()

Attachment 3: 2020 z FINAL DRAFT 2020

Treasury Management Policy as part of LTP ⇩ ![]()

Investment and Property Subcommittee item: 6.1

27 January 2021

|

TITLE: |

Mount Tiger Forest Half Year Report July - December 2020 |

|

ID: |

A1404677 |

|

From: |

Nicole Inger, Property Officer |

|

Authorised by Group Manager: |

Phil Heatley, Strategic Projects and Facilities Manager, on 20 January 2021 |

Executive summary/Whakarāpopototanga

The purpose of this report is to present an update on Council’s Mount Tiger Forest by way of the attached report from Ian Jenkins of Jenksmax Consulting Limited, Council’s Forestry Consultant. Mr Jenkins will be present at the meeting to answer any questions.

That the report ‘Mount Tiger Forest Half Year Report July - December 2020’ by Nicole Inger, Property Officer and dated 18 January 2021, be received.

Background/Tuhinga

Background/Tuhinga

As per the Forestry Management Plan, council’s consultant, Jenksmax Consulting Limited, is to report back to Council half yearly to provide an update of the Mount Tiger Forest. The significant matters reported in H1 July to December 2020 are as follows:

· In this period no Health and Safety issues have arisen.

· Harvest of the last 3.9ha of the forests first harvest rotation is scheduled for 2023.

· Mid rotation inventory of the 42.6ha 2004 area is scheduled for June 2021.

· 16.4ha planted July 2020 costing $16,400, followed by aerial spraying in November 2020 at a cost of $5,470.

· The July 2020 rainfall event resulted in some significant damage with remedial works originally estimated at $25,000. Actual cost of works undertaken in September 2020, $31,654.

· NRC held carbon units of 17,460 have increased in value to $37.50 per unit in December 2020.

· Regular forest checks (15) have been undertaken for checking after storms, maintenance, trespass, operational planning, H&S inductions and general forest inspections.

· Previous IPSC Health & Safety and Forest Risk queries addressed and opened for discussion.

Attachments/Ngā tapirihanga

Attachment 1: NRC H1 (end December

2020) Forestry Report ⇩ ![]()

Attachment 2: Leithwick H&S

Induction ⇩ ![]()

27 January 2021

|

TITLE: |

Introduction of the Fermat Capital Management - ILS Yield fund into Councils Long Term Investment Fund |

|

ID: |

A1400937 |

|

From: |

Simon Crabb, Finance Manager |

|

Authorised by Group Manager: |

Bruce Howse, Group Manager - Corporate Excellence, on 11 January 2021 |

Executive summary/Whakarāpopototanga

Council agreed at its December 2020 meeting to delegate the Investment and Property Subcommittee the authority to introduce (or not) the Fermat Capital Management ILS Yield Fund into the Long-Term Investment Fund (LTF).

The Fermat ILS yield fund is a portfolio of Insurance Linked Securities with an emphasis on catastrophe bonds (cat bonds). An ILS fund is a good diversifier in an investment portfolio as its performance is less correlated to the general financial markets but more linked to insurance related non-financial risks such as natural disasters (earthquakes, hurricanes, tornados, wildfires etc.). Essentially, investors in the ILS asset class share in the same risks that insurers and reinsurers do, by charging higher yields on the bonds to offset the potential losses if a qualifying catastrophe occurred.

More detail is provided in the research brief prepared by EriksensGlobal, and included as Attachment One. Jonathan Eriksen will also join the meeting to facilitate discussion and answer any questions on this proposal.

Should the Subcommittee proceed with the Fermat Fund proposal it is recommended that the 50% of the Blackrock FIGO fund balance (approx. NZ$607K as at 30 November 2020) is transferred into the Fermat ILS Yield fund. The Blackrock FIGO Fund has generated a one year NZD return to 30 November 2020 of 4.7% pa, outperforming its benchmark target of 4.4%. The Fermat fund generated a 1 year return to 30 September 2020 of 5% pa.

As a result of this proposal the LTF overall target return and risk profile will remain unchanged at 6.5% pa and a chance of a negative return in any year at once in seven years.

1. That the report ‘Introduction of the Fermat Capital Management - ILS Yield fund into Councils Long Term Investment Fund’ by Simon Crabb, Finance Manager and dated 6 January 2021, be received.

2. That the Fermat Capital Management ILS yield fund is introduced into the Long-Term Investment Fund

3. That 50% of the Blackrock FIGO fund balance is transferred into the Fermat Capital Management ILS yield fund.

4. That the Statement of Investment Policy and Objects (SIPO) is updated to reflect the approved recommendations.

Options

|

No. |

Option |

Advantages |

Disadvantages |

|

1 |

Introduce the Fermat Capital Management ILS Yield Fund into the Long- Term Investment Fund and undertake the recommended transaction. |

Take advantage of a new diversifying asset class and potentially generate a higher level of return than currently realised. |

Take on risk of losing capital if a qualifying catastrophe or named peril event should occur. |

|

2 |

Do not introduce the Fermat Capital Management ILS Yield Fund into the Long- Term Investment Fund |

Continue with the same return objective and risk profile provided by the Blackrock Figo Fund. |

Continue with the same diversification profile, and level of exposure to the volatility of the financial markets. |

The staff’s recommended option is 1

Considerations

1. Environmental Impact

This decision will have no impact on the ability of council to protectively respond to the impacts of climate change now or in the future.

2. Community views

Being a purely administrative matter, Community Views are not applicable

3. Māori impact statement

This report relates to a council administrative matter and therefore does not have a direct impact on Māori. Any potential impacts of future related decisions will be addressed in the relevant reports.

4. Financial implications

The recommendations in this report proposes to transfer approx. $607K out of the Blackrock FIGO fund which has generated a historical 1 year return of 4.7% pa (equivalent to 5.3% pa after adjusting for the impact of the AUD/NZD cross rate) to the Fermat fund that has generated an annual return since inception (7/2/2012) of 6.5%. However, it should be noted that the returns from managed funds can fluctuate over a given time and historical returns do not necessarily form the basis for forecasted returns.

5. Implementation issues

Being a purely administrative matter, there are no applicable implementation issues.

6. Significance and engagement

In relation to section 79 of the Local Government Act 2002, this decision is considered to be of low significance when assessed against council’s Significance and Engagement Policy because it is part of council’s day to day activities. This does not mean that this matter is not of significance to tangata whenua and/or individual communities, but that council is able to make decisions relating to this matter without undertaking further consultation or engagement.

7. Policy, risk management and legislative compliance

The activities detailed in this report are in accordance with council’s Treasury Management Policy, and the 2018–28 Long Term Plan, both of which were approved in accordance with council’s decision-making requirements of sections 76–82 of the Local Government Act 2002.

The Fermat fund manager and ILS market are inherently ESG-centric. ESG refers to Environmental, Social and Corporate governance and characterise a commitment to sustainable, responsible and ethical investing.

Attachments/Ngā tapirihanga

Attachment 1: EriksensGlobal Fund

Manager Brief - Fermat ILS Yield Fund ⇩ ![]()

Investment and Property Subcommittee item: 6.3

27 January 2021

|

TITLE: |

Proposals to Rebalance the Asset Mix of the Managed Fund Investment Portfolio |

|

ID: |

A1401302 |

|

From: |

Simon Crabb, Finance Manager |

|

Authorised by Group Manager: |

Bruce Howse, Group Manager - Corporate Excellence, on 19 January 2021 |

Executive summary/Whakarāpopototanga

The following three proposals are presented to the Subcommittee for consideration in an endeavour to de-risk the managed fund portfolio and help keep council’s accumulated capital and gains secure and protected from any future market volatility.

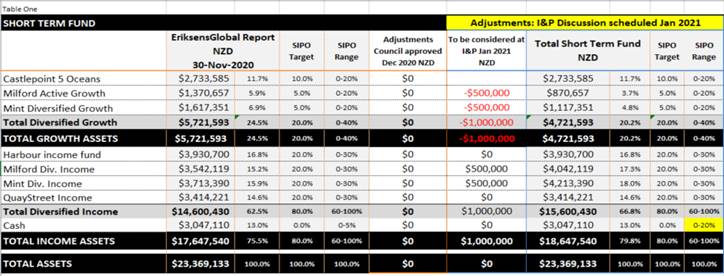

Short Term Fund: Transfer $1M from Growth assets into Income assets

and

Increase the target range for self-managed cash from 0-5% to 0-20%

Long Term Fund: Transfer $3M from Global assets into Private equity assets.

EriksensGlobal have provided input into, and support, all three proposals.

Overall the return targets and risk tolerance profiles of the Long Term and Short Term Investment Funds will remain unchanged.

An updated Statement of Investment Policy and Objectives (SIPO) incorporating the proposed changes is provided as Attachment 1.

1. That the report ‘Proposals to Rebalance the Asset Mix of the Managed Fund Investment Portfolio by Simon Crabb, Finance Manager and dated 7 January 2021, be received.

2. That $500K is transferred from the Short-Term Mint Growth fund and $500K is transferred from the Short-Term Milford Growth funds, into the respective Short-Term Income funds.

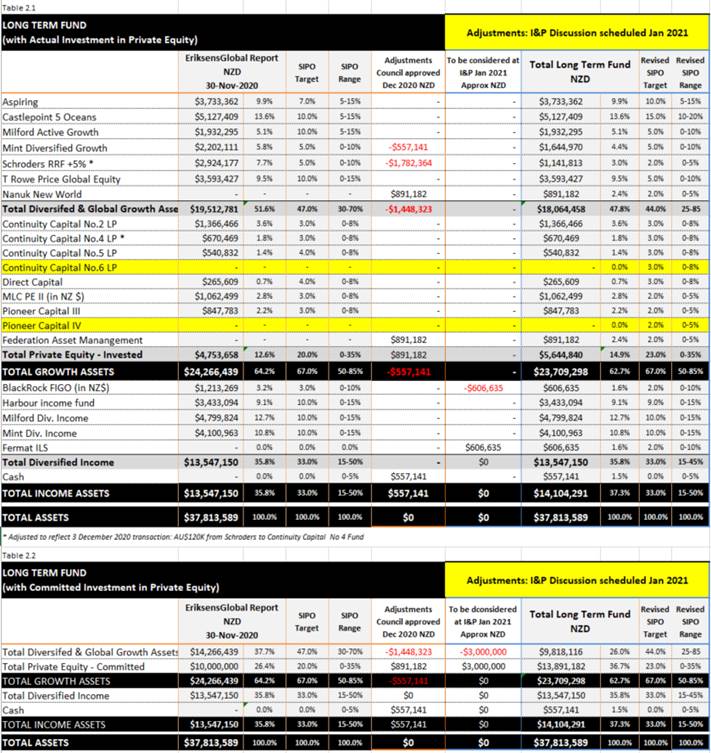

3. That the subcommittee endorse a recommendation to council that the Pioneer Capital No IV private equity fund, and the Continuity Capital PE No.6 LP private equity fund are introduced into the Long-Term Investment Fund.

4. That the subcommittee endorse a recommendation to council that an investment of $1M is committed to the Pioneer Capital No IV private equity fund, and $2M is committed to the Continuity Capital PE No.6 LP private equity fund; and that all investments into these two new funds are paid out of Long Term Growth funds, in accordance with EriksensGlobal recommendations.

5. That the subcommittee endorse a recommendation to council that the Statement of Investment Policy and Objectives is revised to replicate the document attached as Attachment One.

Options

|

No. |

Option |

Advantages |

Disadvantages |

|

1 |

Transfer $500K from the STF Mint Growth fund and $500K from the STF Milford Growth funds, into their respective Short-Term income funds |

Adjust the asset mix of the Short-Term fund to reduce exposure to equity market volatility. |

Expected returns on income funds are typically lower than on growth funds. |

|

2 |

Introduce the Pioneer Capital No IV private equity fund (with a capital commitment of $1M), and the Continuity Capital PE No.6 LP private equity fund (with a capital commitment of $2M) into the Long- Term Investment Fund and pay future capital calls from LTF Growth Fund Managers |

Take advantage of two new private equity fund products (from Investment Management companies that council already invests with) to enhance diversification and potentially generate a higher level of return than currently realised. Reduce exposure to equity assets and their associated volatility that can impacts the returns generated from public equity investments.

|

Reduced liquidity associated with investing in a private equity product. |

|

3 |

Do not introduce the recommended private equity fund managers, nor undertake the recommended STF growth to income fund transfers. |

Continue with the same return objective and risk profile provided by Growth Assets (noting that historical returns do not necessarily form the basis for forecasted returns.) |

Risk losing gains and/or investment capital due to uncertainty in the global economic environment, record high equity markets, and a low interest rate environment. |

The staff’s recommended option is 1 and 2

Considerations

1. Environmental Impact

Being a purely administrative matter any decisions arising from this report will not have any environmental impact or environmental implications.

2. Community views

Being a purely administrative matter, Community Views are not applicable

3. Māori impact statement

This report relates to a council administrative matter and therefore does not have a direct impact on Māori. Any potential impacts of future related decisions will be addressed in the relevant reports.

4. Financial implications

The recommendations in this report proposes to transfer investments between asset classes, namely reducing growth assets and increasing income assets and private equity investments and it should be noted that the returns from managed funds can fluctuate over a given time and historical returns do not necessarily form the basis for forecasted returns.

5. Implementation issues

There are no applicable implementation issues.

6. Significance and engagement

In relation to section 79 of the Local Government Act 2002, this decision is considered to be of low significance when assessed against council’s Significance and Engagement Policy because it is part of council’s day to day activities. This does not mean that this matter is not of significance to tangata whenua and/or individual communities, but that council is able to make decisions relating to this matter without undertaking further consultation or engagement.

7. Policy, risk management and legislative compliance

The activities detailed in this report are in accordance with council’s Treasury Management Policy, and the 2018–28 Long Term Plan, both of which were approved in accordance with council’s decision-making requirements of sections 76–82 of the Local Government Act 2002.

Background/Tuhinga

1. Short Term Fund (STF)

1.1 At 30 November 2020 council had $3,047,110 invested in self-managed term deposits as part of the STF. This represents 13% of the total STF balance. The corresponding SIPO cash allocation limit is currently set at 5%, and requires to be reset to a practical level. Consequently, it is recommended that the STF self-managed cash allocation target prescribed in the SIPO is increased from a maximum of 5% to 20%.

1.2 To reduce the risk of losing gains and/or investment capital due to uncertainty in the current global economic and geo-political environments, and record high equity markets, it is recommended that the exposure to Global assets within the STF is reduced by transferring $1m into STF Income Assets.

1.3 Table 1 over the page illustrates the proposed transactions and changes for consideration by the Subcommittee.

2. Long Term Fund (LTF)

2.1 To reduce the LTFs exposure to equity assets and the potential volatility arising from the current global economic and geo-political uncertainties, it is proposed that two new private equity fund products (managed by companies that council already invests with) are introduced into the LTF to provide diversification, potentially generate greater returns, and protect capital and accumulated gains.

2.2 Although no immediate investment will be made into the new private equity funds, a total commitment of $3M will be made to these new funds. This commitment will be paid, when called upon, by withdrawing monies from LTF growth assets in accordance with EriksensGlobal advice.

2.3 Table 2.1 illustrates the proposed new fund managers, proposed transactions, and the revised asset allocations for the LTF.

Based on the amount of current investment council has physically invested into Private Equity funds, Private Equity investments represent 14.9% of the total LTF which is well within the corresponding revised maximum allocation proposal of 35%.

2.4 Table 2.2 summarises the asset allocations and target ranges based on the total amount council has committed to Private Equity funds. Hypothetically, councils fully paid up private equity commitment is $13,891,182 which represents 36.7% of the total LTF, and exceeds the proposed allocation limit of 35%.

However, it should be noted that Private equity funds make frequent distributions back to investors. These distributions reduce the level of total commitment substantially, and the $13,891,182 private equity commitment presented in Table 2.2 would never become the amount ultimately invested in Private Equity under this scenario.

Attachments/Ngā tapirihanga

Attachment 1: 2021 01 27 NRC SIPO

Revised for Investment and Property Subcommittee Consideration (with Marked-up

changes) ⇩ ![]()

27 January 2021

|

TITLE: |

Performance of Managed Fund Portfolio to 31 Dec 2020; and Proposals to De-Risk the Long Term Fund |

|

ID: |

A1405033 |

|

From: |

Simon Crabb, Finance Manager |

|

Authorised by Group Manager: |

Bruce Howse, Group Manager - Corporate Excellence, on 20 January 2021 |

Executive summary/Whakarāpopototanga

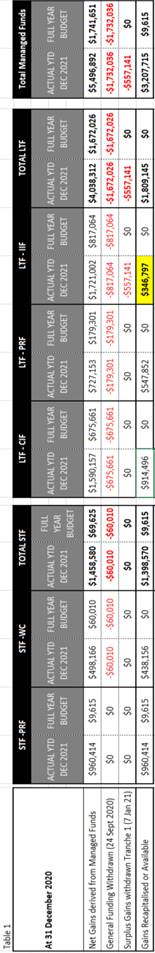

In the six months to the end of December 2020, councils managed fund portfolio generated net gains of $5.5M, far exceeding the corresponding full year budget of $1.7M. Of this $5.5M, $3.2M has been reinvested (recapitalised) back into the Funds.

The EriksensGlobal report detailing the performance of the Long-Term Investment Fund (LTF) and Short Term Investment Fund (STF) for the period ending December 2020 is provided in Attachment 1.

EriksensGlobal recommend surplus gains are withdrawn from the LTF and placed into term deposits in an endeavour to create a buffer against a potential market correction. To undertake this recommendation, it is proposed that:

1. $346,797 of surplus gains are withdrawn from the Infrastructure Investment Fund (IIF) reserved portion of the LTF, invested into STF term deposits, and held as funding for the Enterprise System project.

2. $914,486 of gains attributable to the Community Investment Fund (CIF) reserve portion of the LTF, and $547,852 of gains attributable to the Property Reinvestment Fund (PRF) reserve portion of the LTF are transferred into LTF Term deposits, and held until EriksensGlobal recommend reinvestment back into growth/equity markets. Note, this is a temporary transfer of funds to de-risk, and not a withdrawal of gains to provide a source of general funding.

At 31 December 2020, the STF cash allocation is 12.8%, which breaches its corresponding limit of 5%. EriksensGlobal considers this level of allocation to cash to be prudent for the time being given the current market environment.

1. That the report ‘Performance of Managed Fund Portfolio to 31 Dec 2020; and Proposals to De-Risk the Long Term Fund ’ by Simon Crabb, Finance Manager and dated 20 January 2021, be received.

2. That $346,797 of gains is withdraw from the IIF reserve portion of the LTF in line EriksensGlobal advice, placed into STF term deposits, and held as a funding contribution towards the Enterprise System project.

3. That $914,486 of gains attributable to the CIF reserve portion of the LTF, and $547,852 of gains attributable to the PRF reserve portion of the LTF are transferred into LTF term deposits in line with EriksensGlobal advice, and held until EriksensGlobal recommend reinvestment back into growth/equity markets.

4. That the Subcommittee acknowledge the allocation to cash in the Short-Term Investment Fund is more than the allowable range and consider it a prudent measure for the time being given the current market environment.

Options

|

No. |

Option |

Advantages |

Disadvantages |

|

1 |

Withdraw $346,797 of surplus gains from the IIF reserve portion of the Long-Term Investment Fund, invest into term deposits, and earmark as a funding contribution for the Enterprise System project. |

Protect the gains generated in December 2020, and have these gains secured in term deposits and reserved as a funding contribution towards the costs of the new Enterprise System, in effect reducing the loan funding requirement and the rating burden on the community. |

Earn a lower rate of return, due to holding the withdrawn monies in low returning term deposits. |

|

2 |

Do not withdraw any excess gains from the LTF |

Potentially earn a higher rate of return by recapitalising the gains back into the Long-Term Investment Fund. |

Have an exposure to the risk of losing any gains due to market volatility and the opportunity to use gains as a lever in the 2021 LTP to reduce the rating requirement. |

|

3 |

Transfer the surplus gains attributable to the PRF and CIF reserved portions of the Long-Term Fund, into LTF term deposits with a view to reinvesting back into equities upon advice from EriksensGlobal. |

Further reduce council’s exposure to any potential market correction. |

Earn a lower rate of return, due to holding the withdrawn monies in low returning term deposits. |

The staff’s recommended options are 1 and 3.

Considerations

1. Environmental Impact

Being a purely administrative matter any decisions arising from this report will not have any environmental impact or environmental implications.

2. Community views

Being a purely administrative matter, Community Views are not applicable

3. Māori impact statement

This report relates to a council administrative matter and therefore does not have a direct impact on Māori. Any potential impacts of future related decisions will be addressed in the relevant reports.

4. Financial implications

Holding funds in term deposits is a low risk - low return investment option. The opportunity cost associated with a term deposit is the forgone gains that the investment could have earnt in the Long-Term Investment Fund. As an indication, if $1M was held in a term deposit for six months at a rate of 1.25%pa it would generate approximately $56K less than if invested in the Long-Term Fund (assuming the one year return of 12.4% pa continues). However, investment strategies carry different risk profiles and are subject to different return volatilities. The returns from managed funds can fluctuate over a given time and historical returns do not necessarily form the basis for forecasted returns.

5. Implementation issues

Nil.

6. Significance and engagement

In relation to section 79 of the Local Government Act 2002, this decision is considered to be of low significance when assessed against council’s Significance and Engagement Policy because it is part of council’s day to day activities. This does not mean that this matter is not of significance to tangata whenua and/or individual communities, but that council is able to make decisions relating to this matter without undertaking further consultation or engagement.

7. Policy, risk management and legislative compliance

The Investment and Property Subcommittee have the delegated authority to withdraw gains from the Long-Term Fund and reinvest in the Short-Term fund - in accordance with the advice of councils Independent Investment advisor, and with a requirement that any withdrawals and reinvestments are reported back to council at the next available meeting.

The activities detailed in this report are in accordance with council’s Treasury Management Policy, and the 2018–28 Long Term Plan, both of which were approved in accordance with council’s decision-making requirements of sections 76–82 of the Local Government Act 2002.

Background/Tuhinga

Councils managed fund portfolio generated net gains of $1.22M for the month of December 2020. For the six months to the end of December 2020 the managed funds have generated total net gains of $5.5M, far exceeding the full year budget of $1.7M. Of this $5.5M gains, $3.2M has been reinvested back into the fund managers.

The EriksensGlobal report detailing the performance of the LTF and STF for the period ending December 2020 is provided in Attachment 1. All monthly, quarterly and year to date (YTD) return percentages in the EriksensGlobal report are not annualised.

The 31 December 2020 balance of the STF cash (term deposits) is $3,018,668. This represents 12.8% of the STF balance and exceeds the cash limit of 5%. EriksensGlobal considers this level of allocation to cash to be prudent for the time being given the current market environment. The revised SIPO presented in item 6.3 proposes to increase the cash allocation limit from 5% to 20% to prevent any further breach of policy and reflect the prudent approach to de-risking the portfolio.

Surplus gains of $557K of were withdrawn and deposited into STF term deposits in January 2020, and Eriksens Global recommend further surplus gains are withdrawn from the LTF and placed into term deposits in an endeavour to create a buffer against a potential market correction.

Table one illustrates that $346,797 of surplus gains are available to be withdrawn from the IIF reserve portion of the LTF. It is recommended this amount is withdrawn and held in STF term deposits to be used as funding for the Enterprise System in 2021-22. When aggregated with the $557,141 withdrawn in January 2020, council will hold a funding contribution of $903,938 for the Enterprise System - which reduces the loan funding requirement and ultimately the cost to the ratepayer for this project. Under the Subcommittee’s Terms of Reference, if this transaction is approved (a withdrawal of gains from the LTF) it is required to be reported back to the next council meeting (via the subcommittee minutes).

Table one also illustrates that $914,496 of gains are available to be withdrawn from the CIF reserve portion of the LTF, and $547,852 of gains are available to be withdrawn from the PRF reserve portion of the LTF. It is recommended these two amounts (totalling $1,462,348) are transferred from LTF Fund managers in line with EriksensGlobal advice and placed into LTF term deposits until EriksensGlobal recommend re-entry into the Equity markets. These transactions represent a transfer in asset class within the LTF, and will continue to be represented in the overall LTF balance.

Attachments/Ngā tapirihanga

Attachment 1: EriksensGlobal Quarterly

Report 31 December 2020 ⇩ ![]()

Investment and Property Subcommittee ITEM: 7.0

27 January 2021

|

TITLE: |

Executive Summary

The purpose of this report is to recommend that the public be excluded from the proceedings of this meeting to consider the confidential matters detailed below for the reasons given.

1. That the public be excluded from the proceedings of this meeting to consider confidential matters.

2. That the general subject of the matters to be considered whilst the public is excluded, the reasons for passing this resolution in relation to this matter, and the specific grounds under the Local Government Official Information and Meetings Act 1987 for the passing of this resolution, are as follows:

|

Item No. |

Item Issue |

Reasons/Grounds |

|

7.1 |

Confirmation of Confidential Minutes - 25 November2020 |

The public conduct of the proceedings would be likely to result in disclosure of information, as stated in the open section of the meeting -. |

3. That the Independent Financial Advisors be permitted to stay during business with the public excluded.

Considerations

1. Options

Not applicable. This is an administrative procedure.

2. Significance and Engagement

This is a procedural matter required by law. Hence when assessed against council policy is deemed to be of low significance.

3. Policy and Legislative Compliance

The report complies with the provisions to exclude the public from the whole or any part of the proceedings of any meeting as detailed in sections 47 and 48 of the Local Government Official Information Act 1987.

4. Other Considerations

Being a purely administrative matter; Community Views, Māori Impact Statement, Financial Implications, and Implementation Issues are not applicable.