|

Investment and Property Subcommittee Wednesday 31 March 2021 at 3.00pm

|

|

|

|

|

|

Investment and Property Subcommittee Wednesday 31 March 2021 at 3.00pm

|

|

|

|

|

Investment and Property Subcommittee

31 March 2021

Investment and Property Subcommittee Agenda

Meeting to be held in the Council Chamber

36 Water Street, Whangārei

on Wednesday 31 March 2021, commencing at 3.00pm

Recommendations contained in the agenda are NOT decisions of the meeting. Please refer to minutes for resolutions.

MEMBERSHIP OF THE Investment and Property Subcommittee

Chairperson, NRC Councillor Rick Stolwerk

|

Councillor Justin Blaikie |

Councillor Colin Kitchen |

Councillor Jack Craw |

|

Ex-Officio Penny Smart |

Independent Consultant Jonathan Eriksen |

Independent Audit & Risk Advisor Danny Tuato'o |

|

Independent Advisor Stuart Henderson |

|

|

Item Page

1.0 Housekeeping

2.0 apologies

3.0 declarations of conflicts of interest

4.1 Confirmation of Minutes 27 January 2021 3

5.1 Performance of Councils Externally Managed Funds to 28 February 2021 9

5.2 Responsible Investment Report - as at 31 December 2020 32

5.3 Managing Councils Foreign Currency Risk 39

6.0 Business with the Public Excluded 46

6.1 Confirmation of Confdential Minutes - 27 January 2021

6.2 Kensington Crossing Update

6.3 Use of Neighbouring Commercial Property for Council Events & Project Work

6.4 Investment Strategy

Investment and Property Subcommittee item: 4.1

31 March 2021

|

TITLE: |

Confirmation of Minutes 27 January 2021 |

|

ID: |

A1422440 |

|

From: |

Judith Graham, Corporate Excellence P/A |

|

Authorised by Group Manager: |

Bruce Howse, Group Manager - Corporate Excellence, on |

That the minutes of the Investment & Property Subcommittee meeting held on 27 January 2021 be confirmed as a true and correct record.

Attachments/Ngā tapirihanga

Attachment 1: Investment & Property

Subcommittee minutes 27 January 2021 ⇩ ![]()

Investment and Property Subcommittee item: 5.1

31 March 2021

|

TITLE: |

Performance of Councils Externally Managed Funds to 28 February 2021 |

|

ID: |

A1422577 |

|

From: |

Simon Crabb, Finance Manager |

|

Authorised by Group Manager: |

Bruce Howse, Group Manager - Corporate Excellence, on 22 March 2021 |

Executive summary/Whakarāpopototanga

Councils managed fund portfolio generated negative returns of ($200K) for the month of February 2021. For the 8 months to the end of February 2021 the managed funds have produced $5.5m of gains compared to a very conservatively set budget of $1.1m for the same period.

This year’s entire general funding requirement of $1.7m was physically withdrawn from the portfolio in September 2020 and is held in term deposits. A further $904k has also been withdrawn and is currently held, in terms deposits, as dedicated funding for the Enterprise System project.

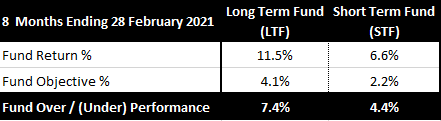

A summary of the returns and target objectives for the 8 months ending 28 February 2021 for councils 2 managed funds is presented below, with the supporting detail and fund performance for longer periods contained in the EriksensGlobal report presented in Attachment 1.

All monthly, quarterly and year to date (YTD) return percentages in this report and its attachment are not annualised.

Jonathan Eriksen will join the meeting via Zoom to brief the Subcommittee on the state of the current financial markets and any necessary asset mix adjustments.

That the report ‘Performance of Councils Externally Managed Funds to 28 February 2021’ by Simon Crabb, Finance Manager and dated 10 March 2021, be received.

Background/Tuhinga

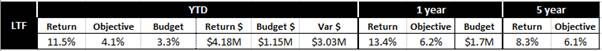

Long Term Investment Fund (LTF)At 28 February 2021, the LTF has an overall market value of $37.8m, comprising of funds attributable to: Infrastructure Investment of $14.8m; Property Reinvestment of $7.0m; and Community Investment of $16.0m.

The LTF has performed as follows:

Short Term Investment Fund (STF)

At 28 February 2021, the STF has an overall market value of $30m, comprising of funds attributable to Working capital requirements of $19m and Property Reinvestment of $11m.

The self-managed cash allocation in the working capital portion of the Short-Term fund exceeds the upper target range limit due to the receipt of $11m relating to the Kaipara Moana Remediation Project. It was deemed prudent to place these monies in term deposits to preserve capital and no action concerning these funds is recommended.

The Opex reserve funding of $1.6m held in term deposits is not included in STF balance.

The STF has performed as follows:

Attachments/Ngā tapirihanga

Attachment 1: Performance of Council

Externally Managed Funds to 28 February 2021 ⇩ ![]()

31 March 2021

|

TITLE: |

Responsible Investment Report - as at 31 December 2020 |

|

ID: |

A1414711 |

|

From: |

Simon Crabb, Finance Manager |

|

Authorised by Group Manager: |

Bruce Howse, Group Manager - Corporate Excellence, on 22 February 2021 |

Executive summary/Whakarāpopototanga

Responsible investing, also known as ethical investing or sustainable investing, is a holistic approach to investing, where social, environmental, corporate governance (ESG) and ethical factors are considered alongside financial performance when making an investment decision.

Councils Statement of Investment Policy and Objectives (SIPO) is the key document that sets out council’s responsible investment expectations in regards to its externally managed fund portfolio. Specifically, transitioning away from any investments listed below over a five-year time horizon:

· Fossil fuels (exploration, extraction and processing)

· Alcohol

· Tobacco

· Gambling

· Military weapons

· Civilian firearms

· Nuclear power

· Adult entertainment

The EriksensGlobal responsible investment report as at 31 December 2020 is attached. This report presents councils exposure to restricted investments, as well as it investments in companies that support environmental sustainability.

That the report ‘Responsible Investment Report - as at 31 December 2020’ by Simon Crabb, Finance Manager and dated 22 February 2021, be received.

Attachments/Ngā tapirihanga

Attachment 1: EriksensGlobal

Responsible Investment Report December 2020 ⇩ ![]()

31 March 2021

|

TITLE: |

Managing Councils Foreign Currency Risk |

|

ID: |

A1422243 |

|

From: |

Simon Crabb, Finance Manager |

|

Authorised by Group Manager: |

Bruce Howse, Group Manager - Corporate Excellence, on 23 March 2021 |

Executive summary/Whakarāpopototanga

This report asks the Subcommittee to consider:

· its appetite to accept foreign currency risk in relation to council’s non-NZD denominated funds under management (currently Australian dollar (AUD) denominated investment funds);

· who has the responsibility for managing council’s foreign currency risk relating to non-NZD denominated funds under management and how this risk should be managed.

It is proposed that the current SIPO and Treasury Policy is updated to document the process and parameters by which foreign currency risk is managed, and delegate the responsibility for undertaking compliant foreign currency hedging to the individual Fund Managers in the first instance and NRC management in the second instance.

1. That the report ‘Managing Councils Foreign Currency Risk’ by Simon Crabb, Finance Manager and dated 9 March 2021, be received.

2. That the Subcommittee endorse a recommendation to council that non-NZD denominated investments can only be made within the Long-Term Investment Fund and cannot exceed 20% of this funds balance.

3. That the Subcommittee endorse a recommendation to council that the responsibility for executing compliant foreign currency hedging lies with the individual Fund Managers in the first instance, and NRC management in the second instance.

4. That the Subcommittee endorse a recommendation to council that:

a. Non-NZD denominated investments must be hedged between 80% -100% when the entry cross rate at the time of inception is below the seven-year rolling average,

b. Non-NZD denominated investments must be hedged between 50% -100% when the entry cross rate at the time of inception is above the seven-year rolling average.

5. That the Subcommittee endorse a recommendation to council that the Statement of Investment Policy and Objectives and the Treasury Management policy are updated in accordance with the Subcommittees recommendations arising from this report.

Options

|

No. |

Option |

Advantages |

Disadvantages |

|

1 |

Update the SIPO and Treasury Management Policy to include an agreed set of parameters and delegate the responsibility of executing foreign currency hedging to the Individual Fund Managers |

Provides stability of asset values by completely or partially eliminating the risk from fluctuations between the Australian and New Zealand exchanges rates. Responsibility of forex Hedging lies with the custodian of the funds |

Gains would be foregone should the NZD depreciate relative to the AUD. |

|

2 |

Update the SIPO and Treasury Management to include an agreed set of parameters and delegate the responsibility of executing foreign currency hedging to council’s independent investment advisor (currently EriksensGlobal) |

Provides stability of asset values by completely or partially eliminating the risk from fluctuations between the Australian and New Zealand exchanges rates. |

Gains would be foregone should the NZD depreciate relative to the AUD. EriksensGlobal are not the custodians of the investment funds and therefore it is difficult to calculate and administer the constant forex hedge trades. |

|

3 |

Update the SIPO and Treasury Management to include an agreed set of parameters and delegate the responsibility of executing foreign currency hedging to council staff subject to advice from councils Treasury Advisors (currently PwC) |

Provides stability of asset values by completely or partially eliminating the risk from fluctuations between the Australian and New Zealand exchanges rates. |

Gains would be foregone should the NZD depreciate relative to the AUD. Impractical for council staff to manage foreign currency risk as they would be constantly trading in hedges and be required to account for any gains and fair value movements on council’s balance Sheet. |

|

4 |

Update the Treasury Management Policy and SIPO to state that council will not enter into any foreign exchange hedging |

Gains arising from the NZD depreciating relative to the AUD would be recognised. |

Council accepts full Forex volatility impact on the value of the AUD denominated investment funds. |

The staff’s recommended option is 1.

Considerations

1. Environmental Impact

This decision will have no impact on the ability of council to protectively respond to the impacts of climate change now or in the future.

2. Financial implications

The recommendation proposed in this report will have an impact on the $5.9m of NZD equivalent investments currently held in AUD funds. Hedging historical investments that were originally transacted at a lower cross rate than the present NZD/AUD cross rate (of approximately 0.9300) will result in a realised foreign currency loss. The weighted average entry level of previous AUD denominated funds is 0.9000. The estimated amount of this foreign currency loss at the time of writing was NZD200k representing a 3.4% loss on the AUD investment funds and 0.5% loss to the LTF. Should the NZD/AUD appreciate to 1.0000 the currency loss will increase to NZD670K. This represents a 11.6% loss on the AUD investment funds and a 1.8% loss to the LTF. Management recommend that any policy changes be implemented over a 6-month transition period.

3. Significance and engagement

In relation to section 79 of the Local Government Act 2002, this decision is considered to be of low significance when assessed against council’s Significance and Engagement Policy because it is part of council’s day to day activities. This does not mean that this matter is not of significance to tangata whenua and/or individual communities, but that council is able to make decisions relating to this matter without undertaking further consultation or engagement

4. Policy, risk management and legislative compliance

The foreign currency risk management activities detailed in this report are in accordance with council’s Treasury Management Policy, and the 2018–28 Long Term Plan, both of which were approved in accordance with council’s decision-making requirements of sections 76–82 of the Local Government Act 2002.

This report addressed the current inconsistencies between the Treasury Management policy and Statement of Investment Policy and Objectives (SIPO) in respect to council’s approach and management of foreign currency risk.

Council is responsible for approving changes to the SIPO, with the Subcommittee reviewing any changes to the Treasury Management policy.

Being a purely administrative matter, community views, Māori impact statement, and implementation issues are not applicable.

Background/Tuhinga

At the end of February 2021 Council had approximately AU$5.5M of Australian denominated investments in its Long-Term Investment fund portfolio, invested across 7 individual Fund Managers.

The associated foreign currency risk of holding these investments is the risk of financial impact arising from the fluctuations between the Australian and New Zealand exchanges rates. Specifically, the Australian dollar denominated investments will lose value because of an adverse exchange rate movement.

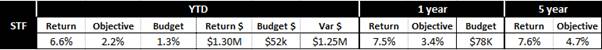

A positive change in the NZD/AUD cross rate is detrimental to council’s bottom line, while a negative movement is beneficial. The average annual range of the NZD/AUD over the last 10 years is AU8 cents (i.e. 0.9000 to 0.9800 low to high).

As an example of the sensitivity to adverse currency movements, for every 1 cent appreciation in the NZD/AUD cross rate (assuming a NZD/AUD of 0.9000 at investment inception and based on the AU$5.5M of funds), the value of the AUD denominated investments would decrease by NZ$67k.

To mitigate this currency risk, it is recommended that the Subcommittee considers currency overlay hedging (Forex Hedging) for its Australian denominated investments. A Forex hedge completely or partially eliminates risk from exposure to foreign currency movements to provide increased stability of asset values. When conducted at the inception of the investment this practice effectively locks in the entry level rate by converting the foreign currency exposure back into NZD at the entry level. However, a Forex hedge would prevent council recognising gains should the NZD depreciate relative to the Australian currency.

The following chart illustrates the past 20-year NZD/AUD cross rate movement. The best time to invest in AUD denominated funds is when the NZD is above the red line if adopting a “no hedge” policy.

Current Council Policies

The Treasury Management Policy and the Statement of investment Policy and Objectives (SIPO) are not aligned in respect to who has the responsibility for managing council’s foreign currency risk:

· Council’s Treasury Management Policy currently states:

o Council will not attempt to manage foreign exchange risk but rather will allow, through the SIPOs governing Council’s managed funds, individual fund managers the discretion to hedge the NZD/AUD as they see fit.

· Council’s SIPO currently states:

o Each Fund Manager is entitled to make use of derivative contracts to protect the capital value of portfolios and gain exposure to appropriate markets.

o Council will oversee the currency risk associated with NZ denominated investments and council will only hedge any foreign exchange risk associated with Non-NZ denominated investments subject to the advice of councils independent Treasury advisors (PwC).

The Treasury Management Policy indicates that individual Fund Managers should manage any foreign exchange risk in alignment with the SIPO, whereas the SIPO indicates that Council should undertake the hedging on its own with guidance from its Treasury Advisor.

Furthermore, neither document discloses the materiality of the risk for investment in non-NZD denominated investments, Council’s risk appetite and any appropriate limits/ restrictions associated with this Forex risk. It also does not disclose the willingness (or otherwise) of Council to hedge foreign currency risk and if so, the appropriate terms and parameters of such Forex hedging.

Risk Appetite Considerations - to frame a decision on whether to hedge foreign currency risk

Council recognises that they must tolerate some risk to achieve the investment objective of its Long-Term Investment fund (LTF). Risk tolerance is affected by three factors:

· Capacity to accept risk,

· Willingness to accept risk,

· Required rate of return.

Capacity to Accept Risk

Council’s capacity to accept risk is a function of its investment time horizon, current financial state, and cash flow requirements. The time horizon of the LTF is 10+ years and (in contrast to the Short-Term investment fund) has a relatively low liquidity (need to withdraw cash). This implies there is capacity to tolerate medium to long term volatility in the value of the Long-Term Investment Fund. This increases the capacity to accept risk.

Willingness to Accept Risk

Council is a risk averse entity and where possible Council seeks to minimise volatility or risk. Notwithstanding, Council is willing to accept risk to increase expected returns in an endeavour to maintain the real value of its funds and generate returns that are used to reduce the burden on the regions ratepayers.

Required Rate of Return

The return objective of the LTF is a real return of 4.5%. if inflation is assumed to be 2% the LTF return would equate to 6.5%. To achieve this level of return council is prepared to accept an investment in fund managers that puts the chance of a negative return in any year, as once in 7 years.

Having assessed its risk appetite, Council then needs to decide if they will accept foreign currency risk or mitigate it.

If council chooses to mitigate foreign currency risk it is proposed that the current SIPO is updated to:

· Articulate the level of Forex Risk Council is prepared to accept and document risk control limits

· document the process and responsibility for managing foreign currency risk, and

· document the parameters by which compliant Forex hedging is to undertaken

Responsibility for Managing Foreign Currency Risk

It is proposed that the responsibility for managing foreign currency risk is, in the first instance, delegated to the Individual Fund Managers as they are the custodians of the funds and control the funds subject to the governing SIPO.

The individual Fund Managers would be assigned the responsibility to calculate the amount of each Forex hedge, manage the trading and settlement of each hedge, and report on the effectiveness of any hedges.

It is considered inappropriate for councils Investment Adviser to manage foreign currency risk as they are in an advisory role and not the custodian of the funds.

In the first instance, it is considered impractical for council staff to primarily manage foreign currency risk. Should Council take a more prescriptive approach to mitigate Forex risk management this would result in regular active management in the execution of hedges. Council will be required to account for the gains and fair value movements of each forex hedge on council’s balance Sheet. However, if the Fund Managers are reluctant to provide this service for non-NZD denominated funds, it would naturally need to default back to council management to meet SIPO and Treasury Policy requirements.

Parameters by which compliant Forex hedging is Undertaken

It is also proposed a set of parameters are incorporated into the SIPO to govern the way that forex hedging is undertaken by the individual fund managers.

An example of the potential parameters that may be incorporated into the SIPO is presented below in Blue Font. Please Note that this is an exemplar only and should be consulted upon and agreed with EriksensGlobal.

a. Investment in approved non – NZD denominated funds can only be made within the LTF and cannot exceed 20% of this fund.

b. Where the entry cross rate of the non-NZD fund is below the seven-year rolling average (weak NZD) at the inception of the investment then this investment must be hedged between 80% -100% by the fund manager or by council management.

c. Where the entry cross rate of the non-NZD fund is above the seven-year rolling average (strong NZD) at the inception of the investment then this investment must be hedged between 50% - 100% by the fund manager or by council management

d. Approved Hedging instruments to manage foreign currency exposure:

i. Forward foreign exchange contracts with a maximum maturity of up to 3 months

ii. Spot foreign exchange contracts

It should be noted that any change in policy requiring forex hedges to be put in place may have an impact on the $5.9m of NZD equivalent investments held in AUD denominated investments. Hedging historical investments that were originally transacted at a lower cross rate than the present NZD/AUD cross rate (of approximately 0.9300) will result in a realised foreign currency loss. The weighted average entry level of previous non- NZD denominated funds is 0.9000. The estimated amount of this foreign currency loss at the time of writing was NZD200K representing a 3.4% loss on the AUD investment funds and 0.5% loss to the LTF. It is proposed that any policy changes be implemented over a 6-month transition period.

Following consultation between the Investment Advisor and the Investment Subcommittee, any proposed amendment to the SIPO will be presented to Council for approval.

Attachments/Ngā tapirihanga

Investment and Property Subcommittee ITEM: 6.0

31 March 2021

|

TITLE: |

Executive Summary

The purpose of this report is to recommend that the public be excluded from the proceedings of this meeting to consider the confidential matters detailed below for the reasons given.

1. That the public be excluded from the proceedings of this meeting to consider confidential matters.

2. That the general subject of the matters to be considered whilst the public is excluded, the reasons for passing this resolution in relation to this matter, and the specific grounds under the Local Government Official Information and Meetings Act 1987 for the passing of this resolution, are as follows:

|

Item No. |

Item Issue |

Reasons/Grounds |

|

6.1 |

Confirmation of Confdential Minutes - 27 January 2021 |

The public conduct of the proceedings would be likely to result in disclosure of information, as stated in the open section of the meeting -. |

|

6.2 |

Kensington Crossing Update |

The public conduct of the proceedings would be likely to result in disclosure of information, the withholding of which is necessary to protect information where the making available of the information would be likely unreasonably to prejudice the commercial position of the person who supplied or who is the subject of the information s7(2)(b)(ii), the withholding of which is necessary to enable council to carry out, without prejudice or disadvantage, commercial activities s7(2)(h) and the withholding of which is necessary to enable council to carry on, without prejudice or disadvantage, negotiations (including commercial and industrial negotiations) s7(2)(i). |

|

6.3 |

Use of Neighbouring Commercial Property for Council Events & Project Work |

The public conduct of the proceedings would be likely to result in disclosure of information, the withholding of which is necessary to enable council to carry out, without prejudice or disadvantage, commercial activities s7(2)(h) and the withholding of which is necessary to enable council to carry on, without prejudice or disadvantage, negotiations (including commercial and industrial negotiations) s7(2)(i). |

|

6.4 |

Investment Strategy |

The public conduct of the proceedings would be likely to result in disclosure of information, the withholding of which is necessary to enable council to carry out, without prejudice or disadvantage, commercial activities s7(2)(h). |

3. That the Independent Financial Advisors be permitted to stay during business with the public excluded.

Considerations

1. Options

Not applicable. This is an administrative procedure.

2. Significance and Engagement

This is a procedural matter required by law. Hence when assessed against council policy is deemed to be of low significance.

3. Policy and Legislative Compliance

The report complies with the provisions to exclude the public from the whole or any part of the proceedings of any meeting as detailed in sections 47 and 48 of the Local Government Official Information Act 1987.

4. Other Considerations

Being a purely administrative matter; Community Views, Māori Impact Statement, Financial Implications, and Implementation Issues are not applicable.