|

Extraordinary Council Meeting Tuesday 22 June 2021 at 10.00am

|

|

|

|

|

|

Extraordinary Council Meeting Tuesday 22 June 2021 at 10.00am

|

|

|

|

|

Extraordinary Council Meeting

22 June 2021

Northland Regional Extraordinary Council Meeting Agenda

Meeting to be held in the Council Chamber

36 Water Street, Whangārei

on Tuesday 22 June 2021, commencing at 10.00am

Recommendations contained in the council agenda are NOT council decisions. Please refer to council minutes for resolutions.

RĪMITI (Item) Page

1.0 Ngā Mahi Whakapai (Housekeeping)

Key Health and Safety points to note:

· If the fire alarm goes off – exit down the stairwell to the assembly point which is the visitor carpark.

· Earthquakes – duck, cover and hold

· Visitors please make sure you have signed in at reception, and that you sign out when you leave. Please wear your name sticker.

· The toilets are on the opposite side of the stairwell.

2.0 Karakia Timatanga – Tauāki ā roto (Opening karakia)

3.0 Ngā Whakapahā (apologies)

4.0 Ngā Whakapuakanga (DECLARATIONS OF CONFLICTS OF INTEREST)

5.0 Ngā Take (Decision Making Matters)

5.1 Adoption of the Long Term Plan 2021-2031 Revenue and Financing Policy, Financial Contributions Policy, Significance and Engagement Policy, Financial Strategy and Infrastructure Strategy 3

5.2 Adoption of User Fees and Charges 2021/22 | Kaupapa Here a Utu 8

5.3 Rating Considerations Under S100T of the Biosecurity Act 1991 75

5.4 Rates for the year 1 July 2021 to 30 June 2022 80

5.5 Adoption of rating policies pertaining to the Kaipara, Whangārei and Far North districts, including policies on remission and postponement of rates on Māori freehold land 97

5.6 Joint Delivery of Local Government Economic Development Services in Northland 162

Extraordinary Council Meeting item: 5.1

22 June 2021

|

TITLE: |

Adoption of the Long Term Plan 2021-2031 Revenue and Financing Policy, Financial Contributions Policy, Significance and Engagement Policy, Financial Strategy and Infrastructure Strategy |

|

ID: |

A1447343 |

|

From: |

Kyla Carlier, Acting Strategy Policy and Planning Manager |

|

Authorised by Group Manager: |

Bruce Howse, Group Manager - Corporate Excellence, on 15 June 2021 |

Executive summary/Whakarāpopototanga

The purpose of this report is to present the final Long Term Plan 2021-23 (LTP) for adoption, and provide background information on the revisions made to the plan as a result of deliberations.

Deliberations on the LTP proposals were held on 19 May 2021 following a month long period of extensive public consultation. Staff made 107 recommendations for council to consider, and the final plan has been prepared in accordance with council resolutions resulting from these deliberations.

Following council adoption of the LTP, the final document will be published and made available on council’s website, with hard copies made available at all council offices around the region. Submitters will be contacted to inform them that final decisions have been made, directing them to a summary of decisions, and to the final document itself.

1. That the report ‘Adoption of the Long Term Plan 2021-2031 Revenue and Financing Policy, Financial Contributions Policy, Significance and Engagement Policy, Financial Strategy and Infrastructure Strategy’ by Kyla Carlier, Acting Strategy Policy and Planning Manager and dated 25 May 2021, be received.

2. That having undertaken consultation in accordance with sections 82 and 82A by way of the Special Consultative Procedure in accordance with section 87, and pursuant to section 76AA of the Local Government Act 2002, the council adopt the Significance and Engagement Policy (as included in the final draft Long Term Plan 2021-2031, attached under separate cover).

3. That in accordance with the requirements of sections 101A and 101B of the Local Government Act 2002, the council adopts the Financial Strategy and Infrastructure Strategy as included in the final draft Long Term Plan 2021-2031 (attached under separate cover).

4. That, having undertaken consultation in accordance with the Special Consultative Procedure, and pursuant to section 93 of the Local Government Act 2002, the council adopts as its Long Term Plan 2021-2031, the final draft Long Term Plan 2021-2031 (attached under separate cover).

5. That having undertaken consultation in accordance with sections 82 and 82A, and pursuant to section 102 of the Local Government Act 2002, the council adopt the following policies (as included in the final draft Long Term Plan 2021-2031, attached under separate cover):

a. Revenue and Financing Policy; and

b. Financial Contributions Policy.

6. That council delegate to the Group Manager – Governance and Engagement the authority to approve any minor accuracy, grammatical, typographical or formatting amendments to the Long Term Plan 2021-2031 prior to it being published.

Options

|

No. |

Option |

Advantages |

Disadvantages |

|

1 |

Adopt the Long Term Plan 2021-2031, and all policies presented here for adoption. |

Council will achieve compliance with the LGA, and will have budgets, forecast financial statements, statements of service provision, and required policies in place for the 2021/22 financial year, for the next three years in detail, and 10 years in principle. |

Additional workload on staff to deliver the programmes of work set out in the plan, and an increase in rates across the region. |

|

2 |

Do not adopt the Long Term Plan 2021-2031, or all policies presented here for adoption. |

No additional workload for staff to deliver programmes of work, and no increase in rates across the region. |

Council will not achieve compliance with the LGA, and will not legally be able to set rates for the 2021/22 financial year. |

Staff’s recommended option is Option 1, to adopt the Long Term Plan 2021-2031, as well as all policies presented for adoption.

Considerations:

1. Environmental Impact

The work programmes that comprise the Long Term Plan 2021-2031 significantly increase council’s ability to respond to environmental issues and opportunities.

The risks and impacts of these proposals have been considered by council over the past seven months with staff, by way of a series of workshops, and in council’s deliberations on the proposals by way of extraordinary council meeting on 19 May 2021.

2. Community views

The views of the community on the proposals and policies included in the Long Term Plan 2021-2031 were obtained by way of extensive consultation, in accordance with the Special Consultative Procedure (section 83) of the LGA. Community views have been provided to council by way of a summary of submissions report and full submission book, and were also summarised in council’s deliberations report.

Council has discussed the proposals and policies included in the Long Term Plan by way of a deliberations meeting that centred upon the public feedback received.

3. Māori impact statement

The process of consultation on this Long Term Plan included circulation of a pānui inviting feedback on the Long Term Plan proposals to over 300 recipients on council’s iwi and hapū database. The long term plan process involved early engagement with Māori through the Māori Technical Advisory Group during the development of the proposals. The Te Tai Tokerau Māori and Council Working Party has been provided with progress updates.

4. Financial implications

This long term plan sets out the budget, forecast financial statements, and rates examples for the 2021/22 financial year and for each consecutive year covered by the plan.

All resources involved in producing the final Long Term Plan 2021-2031 have been budgeted for.

5. Implementation issues

The Long Term Plan 2021-2031 sets out an increase in work programmes across council’s key areas of work, and significant capital expenditure. Council and staff were cognisant of potential implementation and delivery issues that could result from the large increase in the level of service. As such, during the development of the plan it was ensured that adequate support services were budgeted to support the larger areas of work.

While budget has been approved in this long term plan for projects incurring large capital spend, further implementation issues including design, detailed cost allocation, and ownership will be brought to council for their consideration and approval at a future date.

6. Significance and engagement

Section 76AA of the LGA directs that council must adopt a policy setting out how significance will be determined and the level of engagement that will be triggered. This policy assists council in determining how to achieve compliance with the LGA requirements in relation to decisions.

The process of developing and adopting council’s Long Term Plan 2021-2031 triggers council’s Significance and Engagement Policy as it currently stands (as set out in the Long Term Plan 2015–2025) specifically ‘we will consult when we are required to by law’.

Council has carried out extensive engagement with the community, following the Special Consultative Procedure as set out in section 83 of the LGA.

The decision to approve and adopt the Long Term Plan 2021-2031 is considered to be compliant with council’s Significance and Engagement Policy.

7. Policy, risk management and legislative compliance

The adoption of a long term plan is a requirement of section 93 of the LGA, which specifies that a local authority must have a long term plan at all times, and that this must be adopted before the commencement of the first year to which it relates, and continue in force until the close of the third consecutive year to which it relates.

The process to be followed in making a long term plan is set out in Part 6 of the LGA, which encompasses the council’s decision making (sections 76 to 81), planning (sections 93 to 94) and consultation (section 83) processes. Schedule 10, Part 1 of the LGA sets out the information requirements for a Long Term Plan.

The requirements for policies addressed by this agenda item are set out in Section 76AA, and section 102 of the LGA, with consultation requirements set out in section 82.

The Long Term Plan 2018-2028 is due to come to a close on 30 June 2021, and adoption of the Long Term Plan 2021-2031 is consistent with the policy and legislative requirements outlined above.

Background/Tuhinga

Deliberations on the Long Term Plan 2021-2031 (LTP) proposals were held on 19 May 2021. Staff made 107 recommendations to council, the majority of which were in line with council’s preferred options as consulted. However, where public feedback indicated that council should do the work as proposed but also ‘do more’, recommendations were provided with options for further work.

Council carried all staff recommendations as presented during deliberations with the exception of an amendment made and carried in relation to a recommendation in the main (pubic) part of the report. In the confidential section of the report, one amendment to a recommendation was made and carried, and one new recommendation was made and carried . A brief summary of decisions is set out later in this report.

Council consulted on three key policies concurrently with the long term plan consultation, with these policies included in the final LTP document:

o Revenue and Financing Policy;

o Financial Contributions Policy; and

o Significance and Engagement Policy.

No changes were made to the Significance and Engagement Policy or Financial Contributions Policy as a result of deliberations. The Revenue and Financing Policy remained largely as consulted with minor adjustment made subsequent to consultation, to provide additional clarification on council’s ability to borrow to fund large projects. These policies are included for adoption in this agenda item.

Since deliberations, staff have revised the content of the LTP, including text and financial statements, to reflect the decisions made by council and to reflect most recent rating information from the district councils. This included alterations to the Financial Strategy and Infrastructure Strategy, including alteration to the Infrastructure Strategy to reflect changes to work in Kawakawa, and additional wording in the Financial Strategy on the Oruku landing fit-out rate.

Council’s auditors (Deloitte) have conducted a final audit of the long term plan process and have issued an opinion in advance, with the final opinion to be issued after council adoption of the plan. Deloitte has indicated that there are no issues with the revisions of the plan.

Following council adoption of the LTP final formatting alterations may be made and the document will be published and made available on council’s website, with hard copies made available at council offices. Media releases were made soon after the deliberations meeting, and these will be followed up with a release on the final adoption of the plan, together with a social media update.

All submitters will be contacted to inform them that final decisions have been made on the proposals that were consulted on, directing them to a summary of decisions, and to the final document itself.

A debrief of the project will be conducted with staff and councillors to ensure that any improvements for future annual or long term plans are identified and recorded.

Below is a summary of the key decisions made during deliberations on the Long Term Plan 2021-2031:

· To proceed with new funding to address water health as consulted, with the addition of extra funding required in the first year to make changes to the Regional Plan for Northland in accordance with central government requirements.

· To proceed with new funding for the management of water catchments as consulted, with the addition of extra funding for wetland mapping, an increase to the environmental fund for catchment management projects, and to cover an adjustment to the funding model for the Kaipara Moana Remediation programme.

· To proceed with new funding for biodiversity as consulted, with the addition of extra funding for a regional biodiversity strategy.

· To proceed with new funding for biosecurity activities on land as consulted, with the addition of extra funding for work to eradicate feral deer, and for future Predator Free Te Taitokerau projects.

· To proceed with new funding for climate change as consulted, with the addition of extra funding for adaptive pathways planning and council’s zero carbon programme.

· To proceed with new funding for support activities as consulted, with the addition of extra funding for communications in the first year.

· To proceed with flood schemes as consulted, with the exception of the Kawakawa scheme which was re-scoped into ‘deflection bank work’ at a significantly reduced cost.

· To proceed with funding the internal fit-out of the Oruku Landing Conference and Events Centre at a reduced amount of $6M, and with an additional condition added around when works must begin by.

The Long Term Plan 2021-2031 has been developed over the past 14 months, and has undergone full public consultation in accordance with the Special Consultative Procedure (section 83 of the Local Government Act 2002).

Alterations have been made to the plan as a result of council deliberations on feedback from the community, and the final plan is now presented to council for their adoption.

The Long Term Plan 2021-2031 is attached under separate cover.

Attachments/Ngā tapirihanga

Extraordinary Council Meeting item: 5.2

22 June 2021

|

TITLE: |

Adoption of User Fees and Charges 2021/22 | Kaupapa Here a Utu |

|

ID: |

A1446820 |

|

From: |

Robyn Broadhurst, Policy Specialist |

|

Authorised by Group Manager: |

Bruce Howse, Group Manager - Corporate Excellence, on 09 June 2021 |

Executive summary/Whakarāpopototanga

This report presents the user fees and charges, and associated policy, contained within the User Fees and Charges 2021/22 schedule for setting and adoption by council.

Council’s User Fees and Charges 2021/22 underwent a period of public consultation concurrently with the Long Term Plan 2021-2031.

1. That the report ‘Adoption of User Fees and Charges 2021/22 | Kaupapa Here a Utu’ by Robyn Broadhurst, Policy Specialist and dated 24 May 2021, be received.

2. That council sets and adopts the User Fees and Charges 2021/22 included as Attachment 1 pertaining to this item of the 22 June 2021 council agenda.

3. That council authorises Bruce Howse, Group Manager – Corporate Excellence to make any necessary minor drafting, typographical, rounding, or presentation corrections to the User Fees and Charges 2021/22 prior to final publication of the document.

Options

Section 150 of the Local Government Act 2002 (LGA) sets out the process by which a local authority may prescribe fees and charges in respect of any matter provided for, either under a bylaw or under any other enactment, if the enactment does not authorise the local authority to charge a fee. Section 36 of the Resource Management Act 1991 authorises local authorities to fix charges and specifies that such charges must be fixed in the manner set out by section 150 of the LGA.

Council has completed a review of fees and charges and followed the relevant process for consultation required under sections 82 and 83 of the LGA.

|

No. |

Option |

Advantages |

Disadvantages |

|

1 |

Set and adopt the User Fees and Charges 2021/22 |

Policy, fees and charges can be updated for the 2021/22 financial year |

None |

|

2 |

Do not set and adopt the User Fees and Charges 2021/22 |

None |

Fees and charges will not be updated for the 2021/22 financial year, resulting in inaccurate costs, and the inability of council to recover the costs of activities |

The staff’s recommended option is option 1, to set and adopt the User Fees and Charges 2021/2022.

Considerations

1. Community views

The views of the community on the amendments and alterations in the User Fees and Charges 2021/22, were obtained during a period of consultation in accordance with sections 82 and 83 of the LGA. Community views have been provided to council by way of links to full submissions and a summary of submissions report.

Council has considered the proposals included in the User Fees and Charges 2021/22 by way of a deliberations meeting held on 19 May 2021 that centred upon the public feedback received.

2. Māori impact statement

While there were no proposals in the User Fees and Charges 2021/22 that were considered to have significant and specific impacts on Māori over and above those of the general public, the process of consultation included engagement with Māori. This occurred by way of a letter circulated via electronic direct mail to all iwi and hapū groups on council’s database, along with reporting to the Te Taitokerau Māori and Council Working Party.

3. Financial implications

The User Fees and Charges 2021/22 sets out the fees and charges for the 2021/22 financial year, which make up a portion of council’s income sources. An estimation of the income received from these fees and charges, that contributes to budgeted income for the 2021/22 financial year, is reflected in the financial statements set out in council’s Long Term Plan 2021-2031.

4. Significance and engagement

Section 76AA of the LGA directs that council must adopt a policy setting out how significance will be determined and the level of engagement that will be triggered. This policy assists council in determining how to achieve compliance with the LGA requirements in relation to decisions.

Consultation on the User Fees and Charges 2021/22 has been completed, achieving compliance with council’s Significance and Engagement Policy.

5. Policy, risk management and legislative compliance

The decision to confirm and adopt the User Fees and Charges 2021/22 is in accordance with section 150 of the LGA and is consistent with the policy and legislative requirements of the various pieces of legislation that council sets charges under. These are detailed in sections 2.1 – 2.6 of the User Fees and Charges 2021/22, and in addition to the LGA include the Resource Management Act, Northland Regional Council Navigation Safety Bylaw, Maritime Transport Act, the Biosecurity Act, and the Building Act.

Background/Tuhinga

Council’s User Fees and Charges 2021/22 contains the charges that council is authorised to set under the various pieces of legislation that it works under. These are reviewed annually and have been reviewed and consulted on in conjunction with the process of developing the Long Term Plan 2021-2031.

All applicable charges in the user fees and charges schedule have been adjusted for inflation with a rate of 1.5% applied as set by BERL. This is lower than the actual inflation budgeted for fees and charges for 2021/22 within the Long Term Plan 2018-2028, which was 2.2%.

In addition to the inflationary increase, one new charge was also added for the purpose of improved organisation of mooring zones and the recovery of abandoned boats, the fee structure for coastal structures was updated, and a 5% increase applied to all pilotage and shipping navigation and safety services fees. Other minor changes comprised clarification to wording, minor updates to, and simplification of, existing charges, and removal of redundant charges and sections.

No changes to the User Fees and Charges 2021/22 were made as a result of council deliberations held on 19 May 2021.

Attachments/Ngā tapirihanga

Attachment 1: User Fees and Charges

2021/22 ⇩ ![]()

22 June 2021

|

TITLE: |

Rating Considerations Under S100T of the Biosecurity Act 1991 |

|

ID: |

A1447419 |

|

From: |

Kyla Carlier, Acting Strategy Policy and Planning Manager and Don McKenzie, Biosecurity Manager |

|

Authorised by Group Manager: |

Jonathan Gibbard, Group Manager - Environmental Services, on 16 June 2021 |

Executive summary/Whakarāpopototanga

This report is to confirm that council has given due regard to section 100T of the Biosecurity Act when consulting on rates for biosecurity activities which relate to the Northland Regional Pest and Marine Pathway Management Plan 2017-2027.

1. That the report ‘Rating Considerations Under S100T of the Biosecurity Act 1991’ by Kyla Carlier, Acting Strategy Policy and Planning Manager and Don McKenzie, Biosecurity Manager and dated 25 May 2021, be received.

2. That council adopts the section 100T analysis for the purpose of setting the Pest Management Rate, as set out in the Funding Impact Statement of the Long Term Plan 2021 - 2031 and as outlined in this report.

Options

Section 100T of the Biosecurity Act 1993 requires that council decide the extent to which it should fund the implementation of its Regional Pest Management and Pathway Management Plan from a general rate, a targeted rate, or a combination of both, and must do this having regard to the factors outlined in this report.

Two options are set out below:

|

No. |

Option |

Advantages |

Disadvantages |

|

1 |

Adopt the analysis of section 100T of the Biosecurity Act 1993, prior to setting rates to fund the biosecurity activity |

Council will be taking a legally prudent approach to the consideration of section 100T of the Biosecurity Act 1993. |

None |

|

2 |

Do not adopt the analysis of section 100T of the Biosecurity Act 1993, prior to setting rates to fund the biosecurity activity |

None |

Council will have a less robust approach to meeting requirements of section 100T of the Biosecurity Act. |

The staff’s recommended option is option 1.

Considerations

1. Environmental Impact

The decision to consider the requirements of S100T of the Biosecurity Act does not have and environmental impact in itself.

2. Community views

This item relates to matters that have been the subject of public consultation as part of the Long Term Plan process.

3. Māori impact statement

This item relates to matters that have been the subject of iwi consultation.

4. Financial implications

The financial implications of setting rates referred to in this report are addressed in the Long Term Plan 2021-2031.

5. Implementation issues

It is not anticipated that there will be any implementation issues.

6. Significance and engagement

In relation to section 79 of the Local Government Act 2002, this decision is considered to be of low significance when assessed against council’s significance and engagement policy.

This does not mean that this matter is not of significance to tangata whenua and/or individual communities, but that council is able to make decisions relating to this matter without undertaking further consultation or engagement.

7. Policy, risk management and legislative compliance

Consideration of the factors outlined in this report will achieve compliance with section 100T of the Biosecurity Act 1993.

Background/Tuhinga

Section 100T of the Biosecurity Act 1993 requires that council must decide the extent to which it should fund the implementation of biosecurity activities from a general rate, a targeted rate, or a combination of both. Biosecurity activities are described by way of the Northland Regional Pest and Marine Pathway Management Plan 2017-2027.

Council was presented with a draft analysis of section 100T considerations prior to consultation on the Long Term Plan 2021-2031, which was included in the Funding Impact Statement in the Supporting Information to the Long Term Plan 2021-2031 Consultation Document. Council also carried out an analysis of funding of the Regional Pest and Marine Pathway Management Plan and in the Cost Benefit Analysis to the plan.

The analysis is now presented to council for adoption, and consideration in deciding to fund the biosecurity activity from the targeted region-wide Pest Management Rate.

Analysis under S100T of the Biosecurity Act

Council carries out its pest management activities in accordance with its proposed Northland Regional Pest and Marine Pathway Management Plan 2017-2027. Section 100T of the Biosecurity Act requires that a regional council must decide the extent to which it funds the implementation of its regional pest and/or pathway management plan from a general rate, targeted rate, or a combination of both. The factors that council must have regard to in making this decision, and council's analysis in relation to considering the pest management rate, are set out here.

100T (2)(a) The extent to which the plan relates to the interests of occupiers of the properties on which the rate would be levied:

The pest management rate provides a single, clear, region-wide targeted rate for land, freshwater biosecurity activities and marine pest control activities and for raising funds for pest control throughout Northland, and it is council’s conclusion that it is in the interests of everyone in Northland as all occupiers will receive some benefit from the plan either directly or indirectly.

It is proposed that a targeted pest management rate be collected from all properties within Northland to fund land, freshwater and marine pest control activities. In total, $6.6 million for 2021/22 would be collected (GST inclusive).

The regional pest management region-wide targeted rate applies to all property owners. In regard to marine pest activities, the costs will be split in the proportions of 65% to vessel owners and structures by way of a charge on marina berths, boatsheds, commercial ports and mooring owners, and 35% funded from a combination of pest management rate, council investments and other council revenue. This is expected to raise $986K to fund all marine pest activities in the Proposed Northland Regional Pest and Marine Pathway Management Plan 2017–2027.

100T (2)(b) The extent to which the occupiers of the properties on which the rate would be levied will obtain direct or indirect benefits from the implementation of the plan:

Northland ratepayers receive both direct and indirect benefits from the implementation of the Northland Regional Pest and Marine Pathway Management Plan 2017–2027, including protection of native forests and wetland ecosystems found on private land, and supporting communities who are involved in the restoration of iconic fauna such as kiwi, coastal seabirds and kūkupa.

Regarding marine pest activities, the charges will provide protection of the Northland marine environment both now and into the future from the damaging impacts of marine pests on:

• recreational and commercial fishing

• marine tourism, and

• indigenous marine biodiversity.

Regarding the Marine Pathway Plan, vessel owners will directly benefit from having cleaner hulls and a reduced risk of marine pest colonisation. Owners of aquaculture farms will also benefit from the reduced spread of biofouling and marine pests.

The extent to which the benefits are direct rather than indirect depends on how ratepayers use and appreciate the marine environment. Direct benefits may accrue to vessel owners, owners of marine structures because of less biofouling, and those who harvest kai moana.

The extent to which the benefits can be judged as direct rather than indirect depends on how ratepayers use and appreciate the environmental values that pests can affect. Direct benefits may accrue to landowners because of fewer pest plants, protection from kauri dieback disease, prevention of pest arrivals that are new to the region, reductions in marine or animal pests such as possums, stoats and rats, and increases in native biodiversity including growing kiwi populations.

100T (2)(c) The collective benefits of implementing the plan to the occupiers of the properties on which the rate would be levied compared with the collective costs to them of the rate:

It is considered that the collective benefits of a pest management rate outweigh the costs, and the differentiated targeted rate ensures benefits accrue across all ratepayers.

For terrestrial, freshwater, disease and marine pests, only those that have met the requirements for a positive cost-benefit analysis have been included in the Northland Regional Pest and Marine Pathway Management Plan 2017–2027. New pests not yet found in the region were also considered as part of the cost-benefit analysis, as they often require an urgent response to prevent their spread. Consequently the rate will be applied to new incursions where it is relevant to do so.

In regard to the Marine Pathway Plan, the cost-benefit analysis shows that there is a high net positive benefit of implementing this plan. In regard to other pests in the Northland Regional Pest and Marine Pathway Management Plan 2017-2019 species have been selected on the basis that they have all passed a cost benefit evaluation.

100T (2)(d) for the Regional Pest Management Plan, the extent to which the characteristics of the properties on which the rate would be levied and the uses to which they are put contribute to the presence or prevalence of the pest/pests covered by it:

Pests can travel across property boundaries and have an impact regardless of how properties are managed, and many pests have the capability to spread rapidly. The characteristics of properties that influence their establishment and spread are highly complex and variable and depend on biotic and abiotic factors such as access to food, suitable climate and ability to overcome predation and competition. A region-wide targeted rate enables a consistent approach across the whole region, while recognising the presence of individual pests may vary depending on the property characteristics. Therefore, this approach is considered appropriate and fit for purpose.

The characteristics of properties is not a relevant consideration in respect of marine pest activities, as this activity focuses on reducing the spread of biofouling of vessel hulls.

100T (2)(e) for the Marine Pathway Management Plan, the extent to which the characteristics of the properties on which the rate would be levied and the uses to which they are put contribute to the actual or potential risks associated with the pathway:

The characteristics of properties is not a relevant consideration in respect of the Marine Pathway Management Plan, which focuses on reducing the spread of biofouling of vessel hulls –so the characteristics of the properties themselves provide no contribution to the actual or potential risks.

Biofouling on vessels pose the greatest risk of marine pest transfer, and council has determined that the costs will be split in the proportions of 65% to vessel owners and structures by way of a charge on marina berths, boat sheds, commercial ports and mooring owners, with the remaining 35% to be funded from a combination of the pest management rate, council investments and other council revenue.

Attachments/Ngā tapirihanga

Extraordinary Council Meeting item: 5.4

22 June 2021

|

TITLE: |

Rates for the year 1 July 2021 to 30 June 2022 |

|

ID: |

A1447428 |

|

From: |

Simon Crabb, Finance Manager and Casey Mitchell, Management Accountant |

|

Authorised by Group Manager: |

Bruce Howse, Group Manager - Corporate Excellence, on 17 June 2021 |

Executive summary/Whakarāpopototanga

Under sections 23, 24, 57 and 58 of the Local Government (Rating) Act 2002 (LGRA), the council is required to set its rates, due dates and penalty regime by resolution.

Under section 55 of the LGRA, the council may provide for a discount on the rates if payment is made by a specified date before the due date or dates, in accordance with a policy made under section 55.

This paper provides for the council to set its rates, due dates, penalty regime and discounts for the year commencing on 1 July 2021 and ending on 30 June 2022.

This paper has been prepared in accordance with the revenue and financing policy and rates section (including the funding impact statement) contained within the 2021-2031 Long Term Plan.

1. That the report ‘Rates for the year 1 July 2021 to 30 June 2022’ by Simon Crabb, Finance Manager and Casey Mitchell, Management Accountant and dated 14 June 2021, be received.

2. That the Northland Regional Council resolves to set the following rates under the Local Government (Rating) Act 2002 (LGRA) for the financial year commencing 1 July 2021 and ending 30 June 2022:

a. Targeted council services rate

A targeted rate as authorised by the LGRA. The rate is calculated on the total projected capital value, as determined by the certificate of projected valuation of each constituent district in the Northland region. An additional $1.73 (including GST) per each rateable separately used or inhabited part (SUIP) of a rating unit is to be assessed across the Whangārei constituency to provide funding for the ongoing maintenance of the Hātea River Channel. The rate is differentiated by location in the Northland region and assessed as a fixed amount per each rateable separately used or inhabited part (SUIP) of a rating unit in the Far North and Whangārei districts, and on each rateable rating unit (RU) in the Kaipara district. The rate is set as follows:

Including GST

Far North District $111.36 per SUIP

Kaipara District $136.32 per RU

Whangārei District $132.69 per SUIP

The Whangārei District targeted council services rate amount of $132.69 (including GST) per SUIP includes funding for the Hātea River Channel amount of $1.73 (including GST).

b. Targeted land and freshwater management rate

A targeted rate as authorised by the LGRA. The rate is assessed on the land value of each rateable rating unit in the region. The rate is set per dollar of land value. The rate per dollar of land value is different for each constituent district because the rate is allocated based on projected land value, as provided for in section 131 of the LGRA. The rate is set as follows:

Including GST

Far North District $0.0003787 per dollar of land value

Kaipara District $0.0003425 per dollar of land value

Whangārei District $0.0003795 per dollar of land value

c. Targeted pest management rate

A targeted rate as authorised by the LGRA. The rate is calculated on the total projected capital value, as determined by the certificate of projected valuation of each constituent district in the Northland region. The rate is a fixed amount, differentiated by location in the Northland region. The rate will be assessed on each rateable separately used or inhabited part (SUIP) of a rating unit in the Far North and Whangārei districts, and each rateable rating unit (RU) in the Kaipara District. The rate is set as follows:

Including GST

Far North District $64.97 per SUIP

Kaipara District $79.53 per RU

Whangārei District $76.40 per SUIP

d. Targeted flood infrastructure rate

A targeted rate as authorised by the LGRA. The rate is a fixed amount assessed on each rateable separately used or inhabited part (SUIP) of a rating unit in the Far North and Whangārei districts, and each rateable rating unit (RU) in the Kaipara District. The rate is set as follows:

Including GST

Far North District $31.19 per SUIP

Kaipara District $31.19 per RU

Whangārei District $31.19 per SUIP

e. Targeted emergency and hazard management rate

A targeted rate as authorised by the LGRA. The rate is calculated on the total projected capital value, as determined by the certificate of projected valuation of each constituent district in the Northland region. The rate is a fixed amount, differentiated by location in the Northland region. The rate will be assessed on each rateable separately used or inhabited part (SUIP) of a rating unit in the Far North and Whangārei districts, and each rateable rating unit (RU) in the Kaipara District. The rate is set as follows:

Including GST

Far North District $32.21 per SUIP

Kaipara District $39.43 per RU

Whangārei District $37.88 per SUIP

f. Targeted emergency services rate

A targeted rate as authorised by the LGRA. The rate is a fixed amount assessed on each rateable separately used or inhabited part (SUIP) of a rating unit in the Far North and Whangārei districts, and each rateable rating unit (RU) in the Kaipara District. The rate is set as follows:

Including GST

Far North District $11.84 per SUIP

Kaipara District $11.84 per RU

Whangārei District $11.84 per SUIP

g. Targeted regional sporting facilities rate

A targeted rate as authorised by the LGRA. The rate is a fixed amount assessed on each rateable separately used or inhabited part (SUIP) of a rating unit in the Far North and Whangārei districts, and each rateable rating unit (RU) in the Kaipara District. The rate is set as follows:

Including GST

Far North District $16.95 per SUIP

Kaipara District $16.95 per RU

Whangārei District $16.95 per SUIP

h. Targeted regional economic development rate

A targeted rate as authorised by the LGRA. This rate is assessed on the land value of each rateable rating unit in the region. The rate is set per dollar of land value. The rate per dollar of land value is different for each constituent district, because the rate is allocated based on projected land value, as provided for in section 131 of the LGRA. The rate is set as follows:

Including GST

Far North District $0.0000240 per dollar of land value

Kaipara District $0.0000217 per dollar of land value

Whangārei District $0.0000240 per dollar of land value

i. Targeted Whangārei transport rate

A targeted rate as authorised by the LGRA. The rate is a fixed amount assessed on each rateable separately used or inhabited part of a rating unit (SUIP) in the Whangārei District. The rate is set as follows:

Including GST

Whangārei District $23.07 per SUIP

j. Targeted Far North transport rate

A targeted rate as authorised by the LGRA. The rate is a fixed amount assessed on each rateable separately used or inhabited part of a rating unit (SUIP) in the Far North District. The rate is set as follows:

Including GST

Far North District $8.88 per SUIP

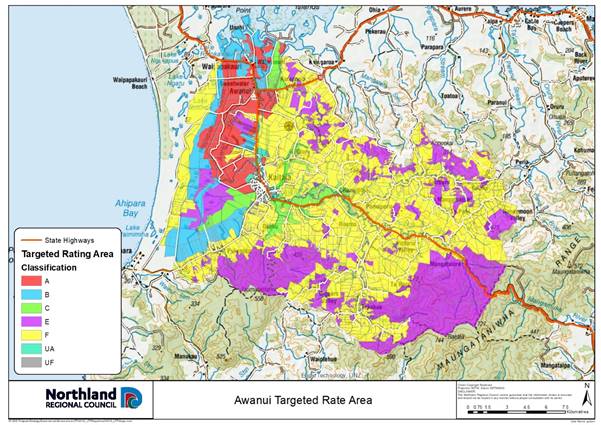

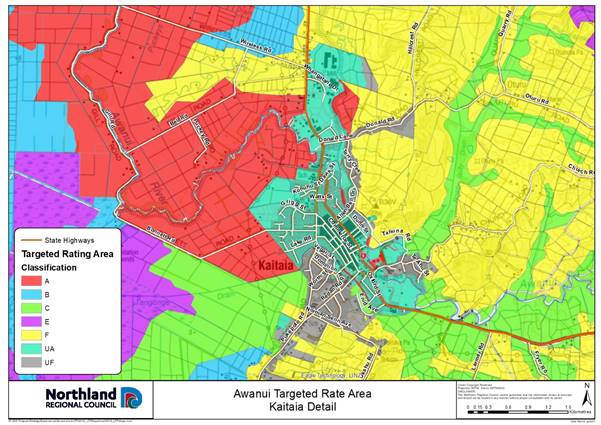

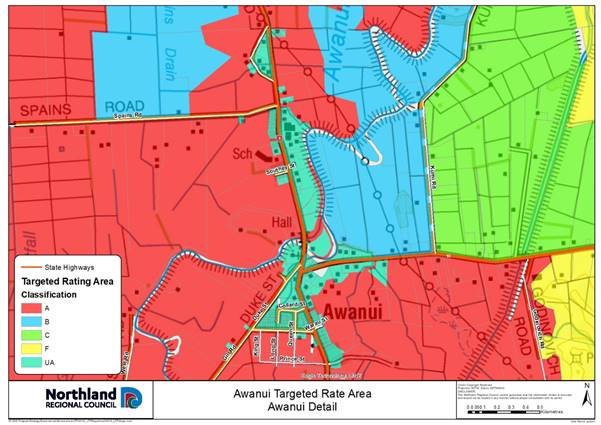

k. Targeted Awanui River management rate

A targeted rate set under the LGRA, set differentially by location and area of benefit as defined in the Awanui River Flood Management Plan, and as defined in the following table:

The rate is set differentially as follows:

|

Category |

Description |

Rate including GST |

|

|

|

UA |

Urban rate class UA (floodplain location) $283.33 direct benefit plus $27.77 indirect benefit per separately used or inhabited part of a rating unit (SUIP). |

$311.10 per SUIP |

|

|

|

UA |

Urban rate class UA – commercial differential. |

$933.30 per SUIP |

|

|

|

UF |

Urban rate classes UF (higher ground) $27.77 direct benefit plus $27.77 indirect benefit per separately used or inhabited part of a rating unit. |

$55.54 per SUIP

|

|

|

|

UF |

Urban rate class UF – commercial differential. |

$166.62 per SUIP |

|

|

|

Rural |

Rural rate differentiated by class, $12.11 per separately used or inhabited part of a rating unit (SUIP) of indirect benefit plus a rate per hectare for each of the following classes of land in the defined Kaitāia flood rating district as illustrated in the following maps and table. |

$12.11 per SUIP |

|

|

|

Class |

Description |

Rate including GST |

|

|

|

A & B |

High benefit; rural land which receives high benefit from the Awanui scheme works due to reduced river flooding risk and/or reduced duration of flooding and/or coastal flooding – all rateable land other that in the commercial differential. |

$23.35 per hectare |

|

|

|

A & B commercial differential |

$70.05 per hectare |

|||

|

C |

Moderate benefit; land floods less frequently and water clears quickly – all rateable land other that in the commercial differential. |

$10.95 per hectare |

|

|

|

C commercial differential |

$32.85 per hectare |

|||

|

F |

Contributes runoff waters and increases the need for flood protection - all rateable land other that in the commercial differential. |

$0.77 per hectare |

|

|

|

F commercial differential |

$2.31 per hectare |

|||

The rating classifications are illustrated in the following

maps:

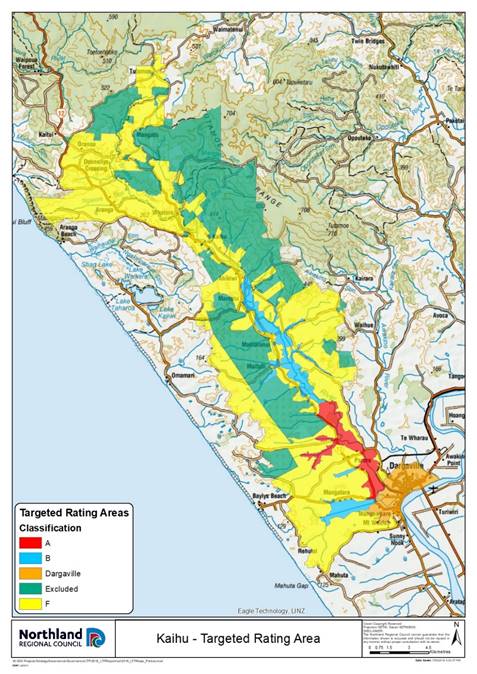

l. Targeted Kaihū River management rate

A targeted rate set under the LGRA, and set differentially by location and area of benefit as defined in the following table:

|

Class |

Description |

Rate Including GST |

|

|

A |

Land on the floodplain and side valleys downstream of Rotu Bottleneck. |

$23.13 per hectare |

|

|

B |

Land on the floodplain and tributary side valleys between Ahikiwi and the Rotu Bottleneck and in the Mangatara Drain catchment upstream of SH12. |

$11.39 per hectare |

|

|

F |

Land within the Kaihū River rating area not falling within Class A and Class B. |

$1.60 per hectare |

|

|

Urban Contribution – A contribution from the Kaipara District Council instead of a separate rate per property: |

$5,015 per annum |

||

The rating classifications are illustrated

in the following map:

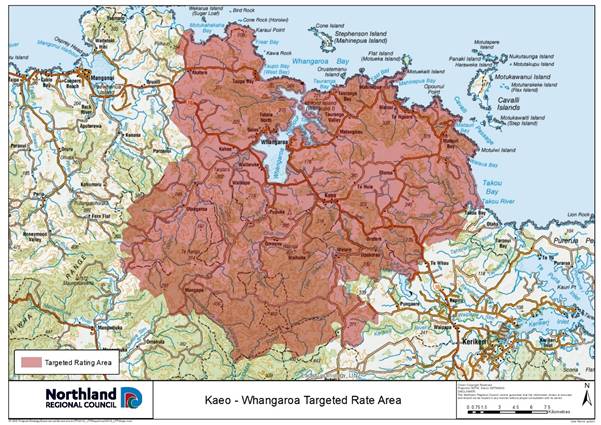

m. Targeted Kaeo-Whangaroa rivers management rate

A targeted rate set under the LGRA, set on a uniform basis in respect of each rateable separately used or inhabited part of a rating unit falling within the former Whangaroa Ward rating rolls of 100-199, as illustrated in the map below:

Including GST

Former Whangaroa Ward $54.52 per SUIP

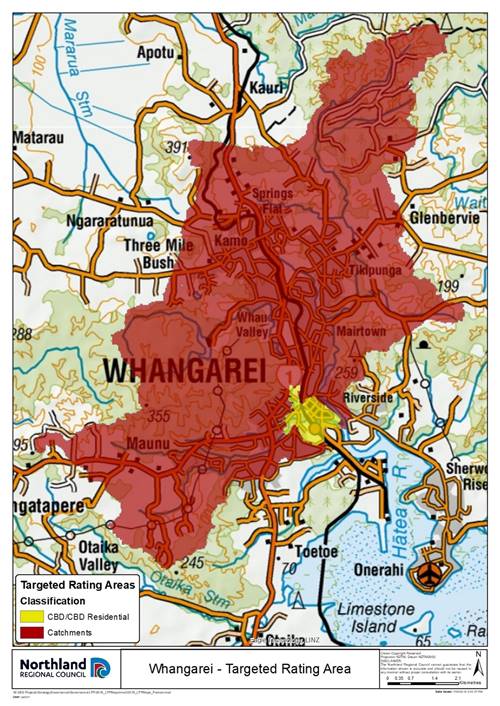

n. Targeted Whangārei urban rivers management rate

A targeted rate set under the LGRA and assessed on all rateable properties defined by reference to the differential categories and differentiated by location (illustrated in the map below) and, for some categories, land use. It is set as a fixed amount per each rateable separately used or inhabited part (SUIP) of a rating unit, as follows:

|

Category |

|

Including GST |

|

1 |

Commercial properties located in the Whangārei Central Business District flood area:

|

$349.49 per SUIP |

|

2 |

Residential properties located in the Whangārei Central Business District flood area:

|

$177.56 per SUIP |

|

3 |

Properties located in the contributing water catchment area (including properties falling in the Waiarohia, Raumanga, Kirikiri and Hātea River Catchments): |

$42.22 per SUIP |

Differential categories for the Whangārei urban rivers management rate:

|

Residential properties in the Whangārei central business district |

Residential properties in the Whangārei central business district (CBD) flood area are defined as all rating units which are used principally for residential or lifestyle residential purposes, including retirement villages, flats etc. Residential properties also includes multi-unit properties, these being all separate rating units used principally for residential purposes, and on which is situated multi-unit type residential accommodation that is used principally for temporary or permanent residential accommodation and for financial reward, including, but not limited to, hotels, boarding houses, motels, tourist accommodation, residential clubs and hostels but excluding any properties that are licensed under the Sale and Supply of Alcohol Act 2012. |

|

Commercial properties in the Whangārei central business district |

Commercial properties in the Whangārei CBD flood area are all separate rating units used principally for commercial, industrial or related purposes or zoned for commercial, industrial or related purposes in accordance with the Whangārei district plan. For the avoidance of doubt, this category includes properties licensed under the Sale and Supply of Alcohol 2012; and private hospitals and private medical centres. |

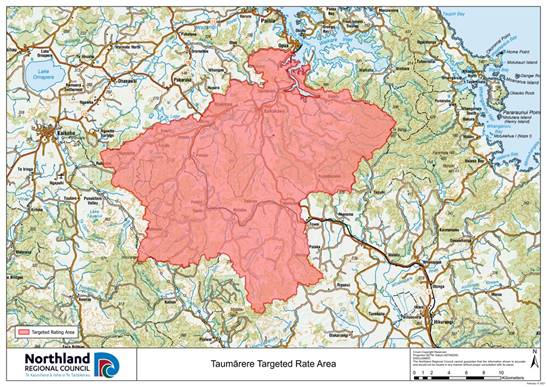

o. Targeted Taumārere rivers management rate

A targeted rate set under the LGRA, set on a uniform basis in respect of each rateable separately used or inhabited part of a rating unit falling within the Tamārere, as illustrated in the map below:

Including GST

Taumārere $61.13 per SUIP

· Payment dates for rates, discounts, and penalty regime

That the Northland Regional Council resolves the following:

Far North District constituency:

All rates within the Far North District constituency are payable in four equal instalments, on the following dates:

|

Instalment |

Due date for payment |

|

Instalment 1 |

20 August 2021 |

|

Instalment 2 |

22 November 2021 |

|

Instalment 3 |

21 February 2022 |

|

Instalment 4 |

20 May 2022 |

The Northland Regional Council resolves to add the following penalties to unpaid Far North District constituency rates:

· In accordance with section 58(1)(a) of the LGRA, a penalty of ten percent (10%) will be added to any portion of each instalment of Far North District constituency rates assessed in the 2021/22 financial year that is unpaid on or by the respective due date for payment as stated above. These penalties will be added on the following dates:

|

Instalment |

Date penalty will be added |

|

Instalment 1 |

27 August 2021 |

|

Instalment 2 |

29 November 2021 |

|

Instalment 3 |

28 February 2022 |

|

Instalment 4 |

27 May 2022 |

Kaipara District constituency:

All rates within the Kaipara District constituency are payable in four equal instalments, on the following dates:

|

Instalment |

Due date for payment |

|

Instalment 1 |

20 August 2021 |

|

Instalment 2 |

20 November 2021 |

|

Instalment 3 |

20 February 2022 |

|

Instalment 4 |

20 May 2022 |

The Northland Regional Council resolves to add the following penalties to unpaid Kaipara District constituency rates:

· In accordance with section 58(1) (a) of the LGRA, a penalty of ten percent (10%) of so much of each instalment of the Kaipara District constituency rates assessed in the 2021/22 financial year that are unpaid after the relevant due date for each instalment will be added on the relevant penalty date for each instalment stated below, except where a ratepayer has entered into an arrangement by way of direct debit authority, or an automatic payment authority, and honours that arrangement. These penalties will be added on the following dates:

|

Instalment |

Date penalty will be added |

|

Instalment 1 |

21 August 2021 |

|

Instalment 2 |

21 November 2021 |

|

Instalment 3 |

21 February 2022 |

|

Instalment 4 |

21 May 2022 |

· In accordance with section 58(1)(b) of the LGRA, a penalty of ten per cent (10%) of the amount of all Kaipara District constituency rates (including any penalties) from any previous financial years that are unpaid on 7 July 2021 will be added on 8 July 2021.

· In accordance with section 58(1)(c) of the LGRA, a penalty of ten per cent (10%) of the amount of all Kaipara District constituency rates to which a penalty has been added under the point immediately above and which remain unpaid on 10 January 2022 will be added on 11 January 2022.

Whangārei District constituency:

All rates within the Whangārei District constituency are payable in four equal instalments, on the following dates:

|

Instalment |

Due date for payment |

|

Instalment 1 |

20 August 2021 |

|

Instalment 2 |

20 November 2021 |

|

Instalment 3 |

20 February 2022 |

|

Instalment 4 |

20 May 2022 |

The Northland Regional Council resolves to add the following penalties to unpaid Whangārei District constituency rates:

· In accordance with section 58(1)(a) of the LGA, a penalty of ten percent (10%) will be added to any portion of each instalment of Whangārei District constituency rates assessed in the 2021/22 financial year that is unpaid on or by the respective due date for payment as stated above. These penalties will be added on the following dates:

|

Instalment |

Date penalty will be added |

|

Instalment 1 |

25 August 2021 |

|

Instalment 2 |

24 November 2021 |

|

Instalment 3 |

23 February 2022 |

|

Instalment 4 |

25 May 2022 |

· In accordance with section 58(1)(b) of the LGRA, a penalty of ten per cent (10%) will be added to any Whangārei District constituency rates (including any penalties) from any financial year prior to 1 July 2021 that still remain unpaid as at 1 July 2021. This penalty will be added on 1 September 2021.

The district councils have advised that their rates adoption dates are as follows:

· Far North District Council – 24 June 2021

· Kaipara District Council – 30 June 2021

· Whangarei District Council – 24 June 2021.

Should their collection and/or penalty dates change through the rate setting process we will need to amend our resolution accordingly.

Background/Tuhinga

The Northland Regional Council is scheduled to adopt its 2021-2031 Long Term Plan at the council meeting to be held on 22 June 2021. Following the adoption of the Revenue and Financing Policy and the 2021-2031 Long Term Plan, all formal requirements to resolve the rates for the year ended 30 June 2022 are in place and permit the following resolution to proceed.

The final rates have been calculated in accordance with the resolutions made by council on 19 May 2021; and the updated rating units, separately used or inhabited parts of a rating unit (SUIPs), capital values and land values provided by the district councils.

Under section 23 of the Local Government (Rating) Act 2002 (LGRA) the council is required to set its rates by resolution. This paper provides for the council to set rates for the year commencing on 1 July 2021 and ending on 30 June 2022.

Rates for the 2021/22 year are set out on a GST inclusive basis. This means that the amount of the rates stated includes the council’s GST obligations. Penalties are added to the amount of unpaid rates.

Section 24 of the LGRA requires that the council state the due date for payment of the rates in its resolution setting rates.

Section 57 of the LGRA states that a local authority may, by resolution, authorise penalties to be added to rates that are not paid by the due date. The resolution must state how the penalty is calculated and the date the penalty is to be added to the number of unpaid rates. Section 58 of the LGRA sets out the penalties that may be imposed.

Pursuant to section 23(5) of the LGRA, within 20 working days after making a resolution, make the resolution publicly available on an Internet site maintained by it or on its behalf to which the public has free access.

Pursuant to section 28(4) of the LGRA the rating information database was made available for public inspection during May/June 2021.

The full details of the rates calculations and rates collected from each constituent district of the Northland region will be as set out in the tables below:

Table One: Valuations by district (including equalised values)

SUIP = Separately used or inhabited part of a rating unit.

Table Two: Northland Regional Council rates for the 2021/22 financial year

|

Budgeted Rates 2021/22 (including GST) |

Far North District |

Kaipara District |

Whangārei District |

Total $ |

Total $ |

|

Targeted council services rate |

|||||

|

Rate per SUIP |

$111.36 |

|

|

$4,136,356 |

$4,006,176 |

|

Rate per RU |

|

$136.32 |

|

$1,924,021 |

$1,909,843 |

|

Rate per SUIP |

|

|

$132.69 |

$5,966,671 |

$5,838,493 |

|

|

|

|

|

$12,027,048 |

$11,754,512

|

|

Targeted land and freshwater management rate |

|||||

|

Rate per $ of Actual LV |

$0.0003787 |

|

|

$3,804,779 |

$3,782,443 |

|

Rate per $ of Actual LV |

|

$0.0003425 |

|

$2,021,774 |

$2,015,780 |

|

Rate per $ of Actual LV |

|

|

$0.0003795 |

$5,330,103 |

$5,308,367 |

|

|

|

|

|

$11,156,656 |

$11,106,590 |

|

Targeted pest management rate |

|||||

|

Rate per SUIP |

$64.97 |

|

|

$2,413,246 |

$2,337,296 |

|

Rate per RU |

|

$79.53 |

|

$1,122,486 |

$1,114,215 |

|

Rate per SUIP |

|

|

$76.40 |

$3,435,479 |

$3,361,676 |

|

|

|

|

|

$6,971,211 |

$6,813,187 |

|

Targeted flood infrastructure rate |

|||||

|

Rate per SUIP |

$31.19 |

|

|

$1,158,521 |

$1,122,060 |

|

Rate per RU |

|

$31.19 |

|

$440,216 |

$436,972 |

|

Rate per SUIP |

|

|

$31.19 |

$1,402,521 |

$1,372,391 |

|

|

|

|

|

$3,001,258 |

$2,931,423 |

|

Targeted emergency and hazard management rate |

|||||

|

Rate per SUIP |

$32.21 |

|

|

$1,196,408 |

$1,158,755 |

|

Rate per RU |

|

$39.43 |

|

$556,515 |

$552,414 |

|

Rate per SUIP |

|

|

$37.88 |

$1,703,350 |

$1,666,758 |

|

|

|

|

|

$3,456,273 |

$3,377,927 |

|

Targeted regional sporting facilities rate |

|||||

|

Rate per SUIP |

$16.95 |

|

|

$629,591 |

$609,776 |

|

Rate per RU |

|

$16.95 |

|

$239,232 |

$237,470 |

|

Rate per SUIP |

|

|

$16.95 |

$762,190 |

$745,817 |

|

|

|

|

|

$1,631,013 |

$1,593,063 |

|

Targeted regional economic development rate |

|||||

|

Rate per $ of Actual LV |

$0.0000240 |

|

|

$241,127 |

$239,269 |

|

Rate per $ of Actual LV |

|

$0.0000217 |

|

$128,094 |

$127,595 |

|

Rate per $ of Actual LV |

|

|

$0.0000240 |

$337,082 |

$335,270 |

|

|

|

|

|

$706,303 |

$702,134 |

|

Targeted emergency services rate |

|||||

|

Rate per SUIP |

$11.84 |

|

|

$439,784 |

$425,944 |

|

Rate per RU |

|

$11.84 |

|

$167,110 |

$165,878 |

|

Rate per SUIP |

|

|

$11.84 |

$532,409 |

$520,972 |

|

|

|

|

|

$1,139,303 |

$1,112,794 |

|

Targeted Whangārei transport rate |

|||||

|

Rate per SUIP |

|

|

$23.07 |

$1,037,389 |

$1,015,103 |

|

Targeted Far North transport rate |

|||||

|

Far North District |

$8.88 |

|

|

$329,839 |

$319,458 |

|

Targeted Awanui River management rate |

|||||

|

Far North District - Rural |

|

|

|

$191,753 |

$189,592 |

|

Far North District - Urban |

|

|

|

$850,705 |

$839,195 |

|

|

|

|

|

$1,042,458 |

$1,028,787 |

|

Targeted Kaihū River management rate |

|||||

|

Kaipara District (Kaihū river area only) |

|

|

|

$79,869 |

$79,869 |

|

Targeted Kaeo-Whangaroa rivers management rate |

|||||

|

Far North (Kaeo only) |

$54.52 |

|

|

$121,860 |

$118,043 |

|

Targeted Taumārere rivers management rate |

|||||

|

Far North (Otira-Moerewa/Kawakawa only) |

$61.13 |

|

|

$116,697 |

$113,278 |

|

Targeted Whangārei urban rivers management rate |

|||||

|

Rates per SUIP |

|

|

|

$1,152,533 |

$1,142,580 |

|

|

|

|

|

|

|

|

Total rates |

|

|

|

Gross $ |

Net $ |

|

Far North District |

|

|

|

$15,630,666 |

$15,261,284 |

|

Kaipara District |

|

|

|

$6,679,317 |

$6,640,036 |

|

Whangārei District |

|

|

|

$21,659,727 |

$21,307,428 |

|

TOTAL RATES |

|

|

|

$43,969,710 |

$43,208,748 |

Options

|

No. |

Option |

Advantages |

Disadvantages |

|

1 |

Adopt the recommendations presented in this report |

Legally generate the rating revenue required to fund the council’s 2021/22 work programmes. |

None

|

|

2 |

Do not adopt the recommendations presented in this report |

None |

Inability to legally strike the 2021/22 rates. Consequently, unless alternative funding streams were obtained, the council would fail to deliver all its 2021/22 work programmes. |

The staff’s recommended option is to adopt the recommendations presented in this report.

Considerations

1. Environmental Impact

The work programmes that comprise the Long Term Plan 2021-2031, funded by rates to the degree discussed in this paper, significantly increase council’s ability to respond to environmental issues and opportunities.

The risks and impacts of these proposals have been considered by council by way of a series of workshops, and in council’s deliberations on the proposals by way of extraordinary council meeting on 19 May 2021.

2. Community views

The impact of the 2021-2031 Long Term Plan budgets on council’s rates has been consulted on with the community through the 2021-2031 Long Term Plan consultative procedure in accordance with s82 of the Local Government Act 2002.

3. Māori impact statement

Targeted consultation on the council’s rates funding requirement was undertaken as part of the consultation on the Long Term Plan, which included circulation of a pānui to over 300 recipients on council’s iwi and hapū database and early engagement with Māori through the Māori Technical Advisory Group during the development of the proposals.

4. Financial implications

This report discusses setting of rates for the 2021/22 financial year. The financial impacts of the recommendations in this report are significant as it determines council’s ability to collect rate revenue.

5. Implementation issues

No implementation issues are anticipated in setting rates for the 2021/22 financial year.

6. Significance and engagement

The council’s 2021-2031 Long Term Plan has been developed in accordance with sections 93 and 93A-93G of the Local Government Act 2002, and contains details of the proposed rates.

The rates being set have been established as part of the 2021-2031 Long Term Plan process that included consultation with the public who have had the opportunity to fully consider the issues and present their views to the council, which have in turn been taken into consideration.

Consequently, this resolution is required to enact previous decisions of council through the long term plan process and is an administrative decision that does not itself trigger the Significance and Engagement Policy.

The decisions in this report are in accordance with sections 76 to 82 of the Local Government Act 2002 and the Local Government (Rating) Act 2002.

The public will have access to the final 2021-2031 Long Term Plan and rates resolution through the council’s website.

7. Policy, risk management and legislative compliance

This report has been independently reviewed by Simpson Grierson, and meets all the statutory requirements under the Local Government (Rating) Act 2002 for the setting of 2021/22 rates.

This report has been independently reviewed by council’s independent auditors, Deloitte Limited.

Attachments/Ngā tapirihanga

Extraordinary Council Meeting item: 5.5

22 June 2021

|

TITLE: |

Adoption of rating policies pertaining to the Kaipara, Whangārei and Far North districts, including policies on remission and postponement of rates on Māori freehold land |

|

ID: |

A1447782 |

|

From: |

Kyla Carlier, Acting Strategy Policy and Planning Manager; Kim Harvey, Assistant Management Accountant and Casey Mitchell, Management Accountant |

|

Authorised by Group Manager: |

Bruce Howse, Group Manager - Corporate Excellence, on 16 June 2021 |

Executive summary/Whakarāpopototanga

The purpose of this report is to present rating policies for adoption and confirmation by council.

The rating policies are differentiated by district, and it is administratively efficient that the council adopts policies on the remission and postponement of rates and penalties, and early payment of rates that are the same as those of the three district councils.

Consultation on the draft rating policies relevant to Northland Regional Council (Council) was carried out concurrently with the process of consultation on the Long Term Plan 2021-2031. This consultation was based on a statement of proposal and the draft rating policies that were being consulted on by the district councils.

The district councils have now completed deliberations on their policies, and it is recommended that the same material changes they have made in their deliberations also be made to the polices by Council. No changes were made to the proposed policies as a result of Northland Regional Council deliberations.

Council is required to consider Schedule 11 of the Local Government Act 2002 (LGA) when determining its policies on the Remission and Postponement of Rates on Māori Freehold Land, and it may consider Schedule 11 in determining its other policies. This consideration is included.

1. That the report ‘Adoption of rating policies pertaining to the Kaipara, Whangārei and Far North districts, including policies on remission and postponement of rates on Māori freehold land’ by Kyla Carlier, Acting Strategy Policy and Planning Manager; Kim Harvey, Assistant Management Accountant and Casey Mitchell, Management Accountant and dated 26 May 2021, be received.

2. That having undertaken consultation in accordance with sections 82 and 83, and pursuant to section 102 and sections 108-110 of the Local Government Act 2002, and sections 55 and 56 of the Local Government (Rating) Act 2002, and having considered Schedule 11 of the Local Government Act 2002, the council adopt the rating policies for the Kaipara district, Whangārei district, and Far North district (including the Policy on the Remission and Postponement of Rates on Māori Freehold Land), that are relevant to the Northland Regional Council effective from 1 July 2021 included as an attachment to this agenda.

3. That council authorise Bruce Howse – Group Manager, Corporate Excellence, to make any necessary minor drafting, typographical, or presentation corrections to the rating policies prior to the document going to print.

Options

|

No. |

Option |

Advantages |

Disadvantages |

|

1 |

Confirm and adopt the rating policies pertaining to the Kaipara, Whangārei, and Far North districts. |

Council will achieve compliance with the LGA, and have rating policies consistent with each district council, allowing administrative efficiency. |

Different rating policies will apply in each district. |

|

2 |

Do not confirm and adopt the rating policies pertaining to the Kaipara, Whangārei, and Far North districts. |

None |

Council will not achieve compliance with the LGA, and will have inconsistent rating policies with each district council, causing administrative inefficiency. |

|

3 |

Establish our own rating policies which apply across Northland. |

A single set of rating policies across Northland. |

Council will not achieve compliance with the LGA as these policies could not be drafted and adopted by 1 July 2021; and will have inconsistent rating policies with each district council, causing administrative inefficiency and potential confusion for ratepayers. |

Staff recommend option 1, to confirm and adopt the rating policies.

Considerations

1. Environmental Impact

No direct environmental impact is anticipated as a result of this decision.

2. Community views

The views of the community on the amendments and alterations in the rating policies were obtained during a period of consultation in accordance with sections 82 and 83 of the LGA. Community views have been provided to council by way of a summary of submissions report and full submission book, and were also summarised in council’s deliberations report.

Council has considered the proposals included in the rating policies by way of a deliberations meeting that centred upon the public feedback received.

3. Māori impact statement

The rating policies were consulted concurrently with the Long Term Plan 2021-2031 consultation.

The process of consultation on the Long Term Plan included circulation of a pānui inviting feedback on the Long Term Plan proposals to over 300 recipients on council’s iwi and hapū database. The long term plan process involved early engagement with Māori through the Māori Technical Advisory Group during the development of the proposals.

The Te Tai Tokerau Māori and Council Working Party has been provided with progress updates.

4. Financial implications

The expected rates remissions as a result of the adoption of these rating policies are being taken account of in setting the rates for 2021-2031. This process will occur every financial year.

5. Implementation issues

We do not anticipate any implementation issues for the rating policies following adoption.

6. Significance and engagement

Section 76AA of the LGA directs that council must adopt a policy setting out how significance will be determined and the level of engagement that will be triggered. This policy assists council in determining how to achieve compliance with the LGA requirements in relation to decisions.

Council is required to consult with the community in accordance with Section 82 of the LGA, and has done so.

The decision to approve and adopt the rating policies is considered to be compliant with council’s Significance and Engagement Policy.

7. Policy, risk management and legislative compliance

Section 102 of the Local Government Act 2002 (LGA) requires local authorities to adopt a policy on the remission and postponement of rates on Māori freehold land. In development of these policies, the council has considered Schedule 11 of the LGA and recognises that the nature of Māori freehold land is different to general title land.

Section 102 also allows a local authority to adopt rates remission and postponement policies.

Sections 108 and 109 of the LGA require the policies to be reviewed at least once every six years.

Sections 55 and 56 of the Local Government (Rating) Act 2002 allow a local authority to adopt policies for the early payment of rates.

Section 102 of the LGA specifies that these policies must be consulted on in a manner that gives effect to the section 82 of the LGA. This required processes have been carried out.

Background/Tuhinga

The council’s rating policies set out its policies on: remission and postponement of rates on Māori freehold land, remission and postponement of rates and penalties, and early payment of rates.

The Far North, Kaipara and Whangārei district councils collect rates on Northland Regional Council's (NRC) behalf. It is administratively efficient that the council adopts policies on the remission and postponement of rates and penalties, and early payment of rates that are the same as those of the three district councils.

NRC does not adopt the policies, or parts of policies, that do not relate to rates collected on our behalf (for example, a policy, or part of a policy, related solely to water rates).

Council produced a statement of proposal for the purposes of consultation on the policies, which itemised the relevant policies and proposed amendments.

In summary these were:

Far North District Council

• More detail has been added to definitions, background information, objectives, scope and conditions of many of the policies.

• Timeframes for some provisions in the policies have been added, changed or removed.

• New requirements for applications (eg. cashflow analysis) and authority (e.g. decision is Council’s and is final) have been added.

Kaipara District Council

· No changes to policies that relate to rates collection on NRC’s behalf.

Whangārei District Council

· Some changes to existing policy wording, including clearer language with standardised format.

· Outside of wording clarifications, the changes that relate to rates collected on NRC’s behalf included:

- Policy on remission of general rates for qualifying residential properties

- Policy on discount for early repayment of rates in current financial year

- Policy on remission of uniform annual general charges (UAGC) and/or targeted rates applied on a uniform basis to certain separately used or inhabited parts of ratings units (SUIPS)

- Policy on remission of rates for community, sports and other organisations

- Remission of rates on unoccupied Māori freehold land

- Postponement of rates on Māori freehold land

- Early Payment of Rates for Subsequent Years

The rating policies were consulted on in conjunction with the consultation for the Long Term Plan 2021-2031, in accordance with section 83 of the Local Government Act 2002 (LGA).

As a result of their consultation and deliberations on the policies, the district council’s made changes as follows:

Far North District Council:

- Cosmetic changes where definitions have been made clearer

- Changes to ML21/01 to reflect the Whenua Māori amendments to the Local Government (Rating) Act 2002

Kaipara District Council:

- No changes to policies that relate to rates collection on NRC’s behalf.

Whangārei District Council:

- For all policies: clarified the wording, re-numbered and standardised the format.

- Remission of uniform annual general charges (UAGC) and/or targeted rates applied on a uniform basis to certain separately used or inhabited parts of ratings units (SUIPS): provided relief for commercial ratepayers with a large number of SUIPS in excess of their use of services.

- Remission of rates for community, sports and other organisations: added papakainga housing used for transitional support.

- Remission of rates on unoccupied Māori freehold land: modified to include changes to the rating of Whenua Māori.

- Postponement of rates on Māori freehold land: modified to include changes to the rating of Whenua Māori.

- Discount for early repayment of rates in current financial year: this should be cost neutral to ratepayers and for 2021-22 the discount percentage will be 0%. The discount percentage is defined in funding impact statement of the Long Term Plan 2021-31.

These changes to policies that relate to rates collection on NRC’s behalf are what was consulted on by Whangarei District Council with expanded wording added by Whangarei District Council for clarification purposes only.

Attachments/Ngā tapirihanga

Attachment 1: Rating policies of the

Far North, Kaipara and Whangārei District Councils ⇩ ![]()

22 June 2021

|

TITLE: |

Joint Delivery of Local Government Economic Development Services in Northland |

|

ID: |

A1450759 |

|

From: |

Emmanouela Galanou, Economic Policy Advisor and Darryl Jones, Economist |

|

Authorised by Group Manager: |

Ben Lee, GM - Strategy, Governance and Engagement, on |

Executive summary/Whakarāpopototanga

The purpose of this report is to seek council approval on a set of decision to give effect to decisions made at previous council meetings (16 June 2020 and 15 September 2020) to move to the joint delivery of local government economic development services in Northland with FNDC and KDC. These decisions include those required to transition Northland Inc Limited (Northland Inc), currently a council-controlled organisation (CCO) that is 100% owned by Northland Regional Council (NRC), to a CCO jointly and equally owned by NRC, Far North District Council (FNDC) and Kaipara District Council (KDC). It also seeks council agreement to establish the Joint Regional Economic Development Committee (JREDC) and appointing the elected representative members. A new version of the Criteria and procedures for allocating funding from the Investment and Growth Reserve (IGR) also needs to be approved.

The content of these documents has been discussed at numerous council workshops, the latest being on 25 May 2021. The Regional Economic Development Service Delivery Working Party (REDSDWP) has also provided input into and reviewed the various documents being adopted by council. FNDC and KDC will be making similar decisions on these matters at their LTP adoption meetings on 24 June 2021 and 30 June 2021 respectively. Staff recommend that council approve the suite of recommendations.

1. That the report ‘Joint Delivery of Local Government Economic Development Services in Northland’ by Emmanouela Galanou, Economic Policy Advisor and Darryl Jones, Economist and dated 10 June 2021, be received.

3. That council authorises Chair Penny Smart to sign the Northland Inc Limited Shareholder Agreement (Attachment Three) which includes the Constitution of Northland Inc Limited.

4. That council authorises the establishment of a Joint Regional Economic Development Committee with Far North District Council and Kaipara District Council, pursuant to clause 30(1)(b) and 30A of Schedule 7 of the Local Government Act 2002.

5. That council adopt the Terms of Reference for the Joint Regional Economic Development Committee (Attachment Four), delegates those responsibilities and duties to the Joint Regional Economic Development Committee and acknowledges that this fulfils the requirements of clause 30A(1) of Schedule 7 of the Local Government Act 2002.

6. That council appoints Cr Justin Blaikie and Cr Terry Archer as council’s representatives on the Joint Regional Economic Development Committee and appoints Cr __________ as the alternative elected member.

7. That council agrees to the new Criteria and procedures for the allocation of funding from the Investment and Growth Reserve (Attachment Five).

Options

|

No. |