|

Investment and Property Subcommittee Wednesday 30 March 2022 at 1.00pm

|

|

|

|

|

|

Investment and Property Subcommittee Wednesday 30 March 2022 at 1.00pm

|

|

|

|

|

Investment and Property Subcommittee

30 March 2022

Investment and Property Subcommittee Agenda

Meeting to be held remotely

on Wednesday 30 March 2022, commencing at 1.00pm

Recommendations contained in the agenda are NOT decisions of the meeting. Please refer to minutes for resolutions.

MEMBERSHIP OF THE Investment and Property Subcommittee

Chairperson, NRC Councillor, Rick Stolwerk

|

Ex-Officio Penny Smart |

Councillor Justin Blaikie |

Councillor Colin Kitchen |

|

Councillor Jack Craw |

Councillor Terry Archer |

Independent Consultant Jonathan Eriksen |

|

Independent Audit & Risk Advisor Danny Tuato'o |

Independent Advisor Stuart Henderson |

|

KARAKIA / WHAKATAU

RĪMITI (ITEM) Page

1.0 Ngā Mahi Whakapai/Housekeeping

2.0 Ngā Whakapahā/apologies

3.0 Ngā Whakapuakanga/declarations of conflicts of interest

4.0 Ngā Whakaae Miniti (Confirmation of Minutes)

4.1 Confirmation of Minutes - 24 November 2021 3

5.1 Performance of Councils Externally Managed Funds to 28 February 2022 7

5.2 Responsible Investment Report December 2021 40

5.3 Mount Tiger Forest Report 52

6.0 Kaupapa ā Roto (Business with the Public Excluded) 59

6.1 Confirmation of Confidential Minutes - 24 November 2021

6.2 Northland Private Equity Fund Update

6.3 Summary of Kensington Crossing Redevelopment Project

6.4 Update on Council’s Current Property Redevelopments

6.5 Current Property Negotiations

6.6 Council's Water Street Offices

Investment and Property Subcommittee item: 4.1

30 March 2022

|

TITLE: |

Confirmation of Minutes - 24 November 2021 |

|

From: |

Judith Graham, Corporate Services P/A |

|

Authorised by Group Manager/s: |

Bruce Howse, Pou Taumatua – Group Manager Corporate Services, on |

That the minutes of the Investment and Property Subcommittee meeting held on 24 November 2021 be confirmed as a true and correct record.

Attachments/Ngā tapirihanga

Attachment 1: Investment and Property

Subcommittee minutes 24 November 2021 ⇩ ![]()

30 March 2022

|

TITLE: |

Performance of Councils Externally Managed Funds to 28 February 2022 |

|

From: |

Simon Crabb, Finance Manager |

|

Authorised by Group Manager/s: |

Bruce Howse, Pou Taumatua – Group Manager Corporate Services, on 18 March 2022 |

Whakarāpopototanga / Executive summary

In the month of February 2022, councils Externally Managed Fund Portfolio incurred losses of ($565k). For the 8 months to the end of February, the portfolio has now recorded an overall loss of ($118k).

A summary of the returns and target objectives for the 8 months ending 28 February for councils 2 managed funds is presented below, with the supporting detail and fund performance for longer periods contained in the attached EriksensGlobal Report (Attachment 1).

Jonathan Eriksen from EriksensGlobal will be joining in via Zoom to answer any questions.

All monthly, quarterly and year to date (YTD) return percentages in this report and its attachment are not annualised.

That the report ‘Performance of Councils Externally Managed Funds to 28 February 2022 ’ by Simon Crabb, Finance Manager and dated 17 March 2022, be received.

Background/Tuhinga

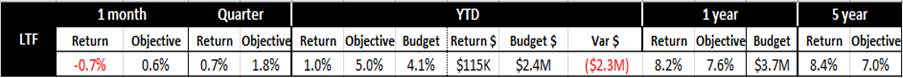

Long Term Investment Fund (LTF)

At 28 February 2022, the LTF has an overall market value of $62.8m, comprising of funds attributable to:

· Economic Development of $17.4m,

· Property Reinvestment of $28.6m, and

· Regional Project Development of $14.6m.

· Rates collected for Debt repayment and Depreciation $2.2m

The LTF has performed as follows:

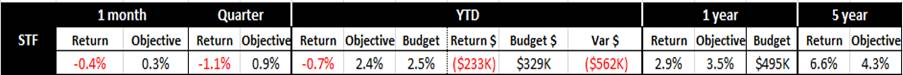

Short Term Investment Fund (STF)

At 28 February 2022, the STF has an overall market value of $19.4m, comprising funds attributable to:

· Working capital requirements of $9.4m

· Property Reinvestment of $8.9m.

· Investment and Growth reserve requirements of $1.1m

The STF has performed as follows:

Non-compliance with the Statement of Investment Policy and Objectives (SIPO)At 28 February 2022, the Short-Term Investment Fund allocation to the QuayStreet Income fund was 30.6% which is slightly above its upper limit of 30%. This over exposure is being progressively reduced as cashflow requirements are managed from the Short-Term Fund. Furthermore, QuayStreet is a low-risk product that is favoured to preserve capital in volatile markets.

Attachments/Ngā tapirihanga

Attachment 1: EriksensGlobal - NRC

Externally Managed Investment Funds Monthly Report 28 February 2022 ⇩ ![]()

30 March 2022

|

TITLE: |

Responsible Investment Report December 2021 |

|

From: |

Judith Graham, Corporate Services P/A |

|

Authorised by Group Manager/s: |

Bruce Howse, Pou Taumatua – Group Manager Corporate Services, on 03 March 2022 |

Executive summary/Whakarāpopototanga

Responsible investing, also known as ethical investing or sustainable investing, is a holistic approach to investing, where social, environmental, corporate governance (ESG) and ethical factors are considered alongside financial performance when making an investment decision.

Councils Statement of Investment Policy and Objectives (SIPO) is the key document that sets out council’s responsible investment expectations in regards to its externally managed fund portfolio. Specifically, transitioning away from any investments listed below over a five-year time horizon:

· Fossil fuels (exploration, extraction and processing)

· Alcohol

· Tobacco

· Gambling

· Military weapons

· Civilian firearms

· Nuclear power

· Adult entertainment

The EriksensGlobal responsible investment report as at 31 December 2021 is attached. This report presents councils exposure to restricted investments, as well as it investments in companies that support environmental sustainability.

1. That the report ‘Responsible Investment Report December 2021’ by Judith Graham, Corporate Services P/A and dated 03 March 2022 be received.

Attachments/Ngā tapirihanga

Attachment 1: Responsible Investment

Report December 2021 ⇩ ![]()

Investment and Property Subcommittee item: 5.3

30 March 2022

|

TITLE: |

Mount Tiger Forest Report |

|

From: |

Nicole Inger, Property Officer |

|

Authorised by Group Manager/s: |

Bruce Howse, Pou Taumatua – Group Manager Corporate Services, on 17 March 2022 |

Executive summary/Whakarāpopototanga

The purpose of this agenda item is to present an update on Councils Mount Tiger Forest by way of the attached report from George Dods of Northland Forest Managers Limited, Councils Forestry Consultant. Mr Dods will be present at the meeting to answer any questions.

This item also presents interim findings on the Biodiversity Values of the Mount Tiger Forest undertaken by the NRC Biodiversity team to March 2022 detailed in an attached report. Stephanie Tong, Biodiversity Advisor and Lisa Forester, Biodiversity Manager will be present to answer any questions.

1. That the report ‘Mount Tiger Forest Report’ by Nicole Inger, Property Officer and dated 16 March 2022, be received.

Background/Tuhinga

As per the Forestry Management Plan, council’s consultant, Northland Forest Managers Ltd, is to report back to Council every six months. Key points to note are as follows:

· In this period no adverse Health and Safety (H&S) matters have arisen.

· H&S induction for the Biodiversity Survey team has been completed prior to Survey start up.

· No forest harvesting or silviculture was undertaken in the second half of 2021.

· Trees and small slips, along with large rock placements at the Drews Main Road gate, were completed in December 2021 at a cost of $1925.00.

An ongoing biodiversity survey of Mount Taika Forest currently underway. The report is attached for Councillors information.

Attachments/Ngā tapirihanga

Attachment 1: NFM Report Mt Tiger

Forest July-Dec 2021 ⇩ ![]()

Attachment 2: Biodiversity Values of

the NRC managed land at Mt Tiger Plantation Forestry Block Interim findings

March 2022 ⇩ ![]()

Investment and Property Subcommittee ITEM: 6.0

30 March 2022

|

TITLE: |

Whakarāpopototanga / Executive Summary

The purpose of this report is to recommend that the public be excluded from the proceedings of this meeting to consider the confidential matters detailed below for the reasons given.

1. That the public be excluded from the proceedings of this meeting to consider confidential matters.

2. That the general subject of the matters to be considered whilst the public is excluded, the reasons for passing this resolution in relation to this matter, and the specific grounds under the Local Government Official Information and Meetings Act 1987 for the passing of this resolution, are as follows:

|

Item No. |

Item Issue |

Reasons/Grounds |

|

6.1 |

Confirmation of Confidential Minutes - 24 November 2021 |

The public conduct of the proceedings would be likely to result in disclosure of information, as stated in the open section of the meeting -. |

|

6.2 |

Northland Private Equity Fund Update |

The public conduct of the proceedings would be likely to result in disclosure of information, the withholding of which is necessary to enable council to carry out, without prejudice or disadvantage, commercial activities s7(2)(h). |

|

6.3 |

Summary of Kensington Crossing Redevelopment Project |

The public conduct of the proceedings would be likely to result in disclosure of information, the withholding of which is necessary to protect information where the making available of the information would be likely unreasonably to prejudice the commercial position of the person who supplied or who is the subject of the information s7(2)(b)(ii) and the withholding of which is necessary to enable council to carry out, without prejudice or disadvantage, commercial activities s7(2)(h). |

|

6.4 |

Update on Council’s Current Property Redevelopments |

The public conduct of the proceedings would be likely to result in disclosure of information, the withholding of which is necessary to enable council to carry out, without prejudice or disadvantage, commercial activities s7(2)(h) and the withholding of which is necessary to enable council to carry on, without prejudice or disadvantage, negotiations (including commercial and industrial negotiations) s7(2)(i). |

|

6.5 |

Current Property Negotiations |

The public conduct of the proceedings would be likely to result in disclosure of information, the withholding of which is necessary to protect information where the making available of the information would be likely unreasonably to prejudice the commercial position of the person who supplied or who is the subject of the information s7(2)(b)(ii), the withholding of which is necessary to enable council to carry out, without prejudice or disadvantage, commercial activities s7(2)(h) and the withholding of which is necessary to enable council to carry on, without prejudice or disadvantage, negotiations (including commercial and industrial negotiations) s7(2)(i). |

|

6.6 |

Council's Water Street Offices |

The public conduct of the proceedings would be likely to result in disclosure of information, the withholding of which is necessary to protect information where the making available of the information would be likely unreasonably to prejudice the commercial position of the person who supplied or who is the subject of the information s7(2)(b)(ii) and the withholding of which is necessary to enable council to carry on, without prejudice or disadvantage, negotiations (including commercial and industrial negotiations) s7(2)(i). |

3. That the Independent Financial Advisors be permitted to stay during business with the public excluded.

Considerations

1. Options

Not applicable. This is an administrative procedure.

2. Significance and Engagement

This is a procedural matter required by law. Hence when assessed against council policy is deemed to be of low significance.

3. Policy and Legislative Compliance

The report complies with the provisions to exclude the public from the whole or any part of the proceedings of any meeting as detailed in sections 47 and 48 of the Local Government Official Information Act 1987.

4. Other Considerations

Being a purely administrative matter; Community Views, Māori Impact Statement, Financial Implications, and Implementation Issues are not applicable.