|

Audit Risk and Finance Committee Monday 18 November 2024 at 9:30am

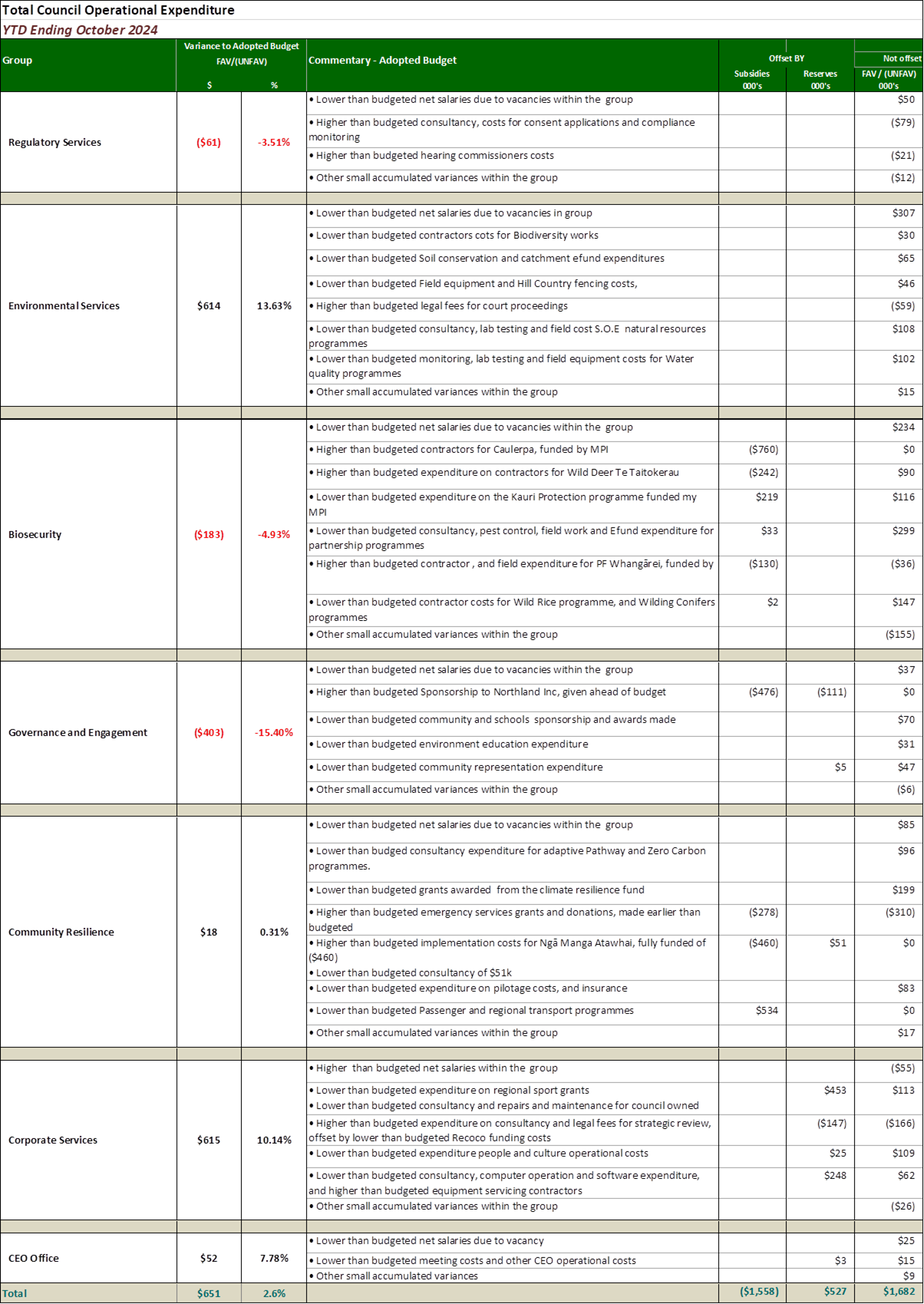

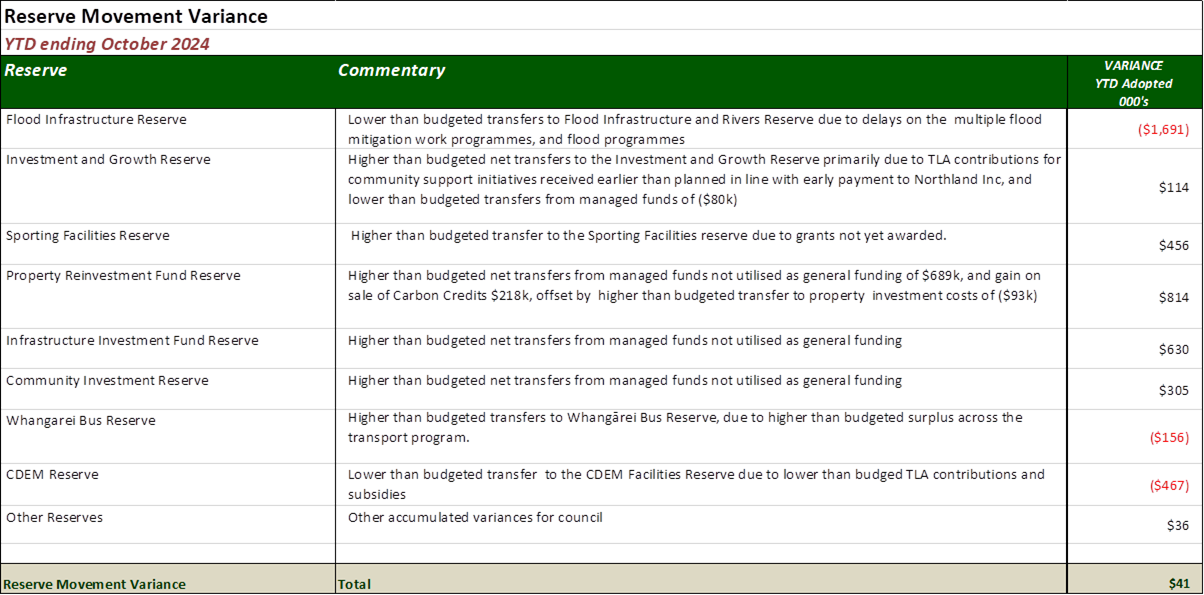

|

|

|

|

|

|

Audit Risk and Finance Committee Monday 18 November 2024 at 9:30am

|

|

|

|

|

Audit Risk and Finance Committee

18 November 2024

Audit Risk and Finance Committee Agenda

Meeting to be held in the Council Chamber

36 Water Street, Whangārei

on Monday 18 November 2024, commencing at 9:30am

Recommendations contained in the agenda are NOT decisions of the meeting. Please refer to minutes for resolutions.

MEMBERSHIP OF THE Audit Risk and Finance Committee

Chairperson, Councillor Peter-Lucas Jones

|

|

Councillor Joe Carr |

|

|

Councillor Jack Craw |

|

Councillor Rick Stolwerk |

|

Ex-officio Councillor Geoff Crawford |

|

Independent Tangata Whenua member George Riley |

|

Independent Tangata Whenua member Dee-Ann Wolferstan |

|

Independent Consultant Jonathan Eriksen |

|

Independent Risk Advisor Steve Watene |

|

|

KARAKIA / WHAKATAU

RĪMITI (ITEM) Page

1.0 Ngā Mahi Whakapai/Housekeeping

2.0 Ngā Whakapahā/apologies

3.0 Ngā Whakapuakanga/declarations of conflicts of interest

4.0 Ngā Whakaae Miniti / Confirmation of Minutes

4.1 Confirmation of Minutes - 28 August 2024 4

5.1 Receipt of Action Sheet 10

6.1 Internal Audit Schedule Update 13

6.2 Risk Management Activity Update 17

6.3 Review of Business Continuity Plan 38

6.4 Fraud, Corruption and Dishonesty Activity Update 50

6.5 Health and Safety report for first quarter of 2024-25 financial year 69

6.6 Regulatory Services Quarterly Report 74

See attached Consents Processing Report – July to September 2024

6.7 Guidelines for Selecting RMA Hearing Commissioners 91

6.8 Financial Report to 31 October 2024 96

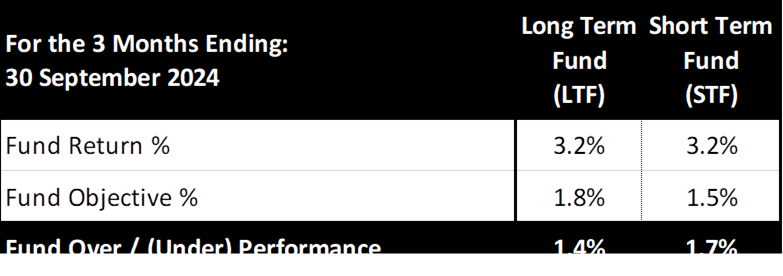

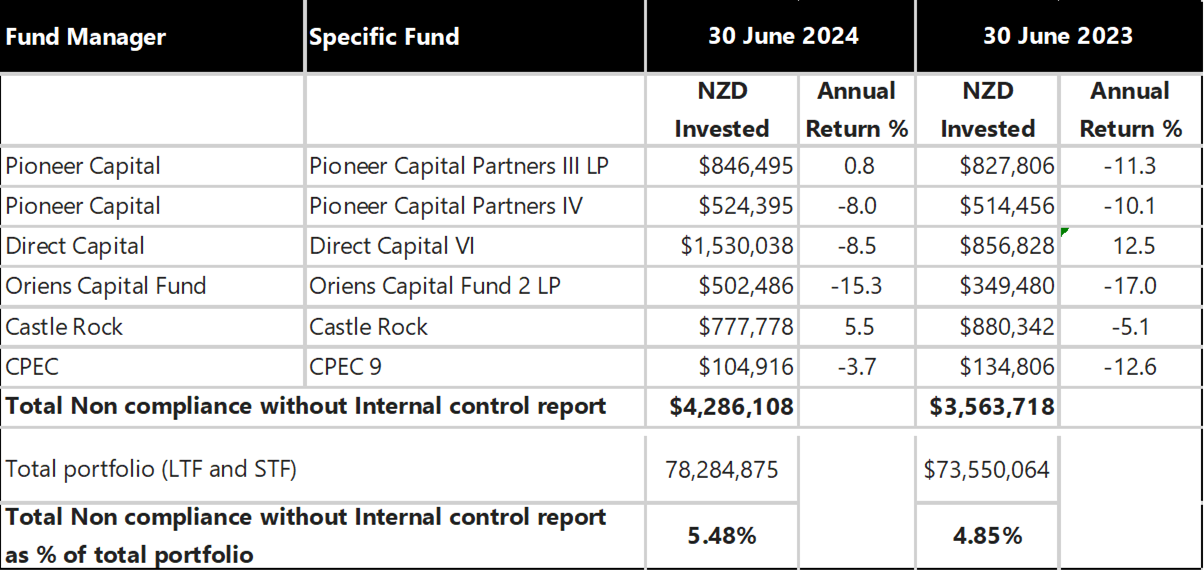

6.9 Performance of Councils Externally Managed Investment Funds - 30 September 2024 102

6.10 Responsible Investment Report - 30 June 2024 132

6.11 Tāika Forest and Forest Management Plan – Reporting Actual Performance Against Targets 2023/2024 159

7.0 Kaupapa ā Roto / Business with the Public Excluded 166

7.1 Confirmation of Confidential Minutes - 28 August 2024

7.2 Report on Litigation and Enforcement July - September 2024

7.3 Update on Council’s Current Redevelopments and Other Property Matters

Audit Risk and Finance Committee item: 4.1

18 November 2024

|

TITLE: |

Confirmation of Minutes - 28 August 2024 |

|

From: |

Margaret Knight, PA to Group Manager Corporate Services |

|

Authorised by Group Manager/s: |

Bruce Howse, Pou Taumatua – Group Manager Corporate Services, on 06 November 2024 |

That the minutes of the Audit, Risk and Finance Committee meeting held on 28 August 2024 be confirmed as a true and correct record and that these be duly authenticated with the Chair’s electronic signature.

Attachments/Ngā tapirihanga

Attachment 1: Audit Risk and Finance

Committee - Minutes ⇩ ![]()

Audit Risk and Finance Committee item: 5.1

18 November 2024

|

TITLE: |

Receipt of Action Sheet |

|

From: |

Margaret Knight, PA to Group Manager Corporate Services |

|

Authorised by Group Manager/s: |

Bruce Howse, Pou Taumatua – Group Manager Corporate Services, on 07 November 2024 |

Whakarāpopototanga / Executive summary

The purpose of this report is to enable the meeting to receive the current action sheet.

That the action sheet be received.

Attachments/Ngā tapirihanga

Attachment 1: Action Sheet - 18

November 2024 ⇩ ![]()

Audit Risk and Finance Committee item: 6.1

18 November 2024

|

TITLE: |

Internal Audit Schedule Update |

|

From: |

Mandy Tepania, Audit and Assurance Lead |

|

Authorised by Group Manager/s: |

Bruce Howse, Pou Taumatua – Group Manager Corporate Services, on 06 November 2024 |

Whakarāpopototanga / Executive summary

The internal audit schedule is provided in Table 1. The schedule shows the timing for each internal audit item and a status update on progress.

A proposed internal audit schedule for 2024/25 onwards is provided in Table 2, noting that the 2025/26 schedule will be developed further over time.

An update is provided on the Contract Management Audit and the Business Continuity Plan (BCP) review.

That the report ‘Internal Audit Schedule Update’ by Mandy Tepania, Audit and Assurance Lead and dated 5 November 2024, be received.

Background/Tuhinga

|

Complete |

Underway |

Deferred |

Not Started |

||

|

Year |

Item |

Status |

|||

|

2024 |

Business Continuity. Audit to review systems and processes in place against national best practice and lessons learned, conduct gap analysis. |

Full audit review underway for all critical functions (14) |

|||

|

2023/2024 |

The Pathway Te Huarahi Tika Quality Review – New Quality program is underway across 24 different service delivery groups within NRC. |

· 14 reviews completed. · 4 reviews underway · 6 reviews scheduled. |

|||

|

2023/2024 |

Health & Safety Improvement Opportunities report was presented to A&R subcommittee in May 2023. The subcommittee supports management implementing the high priority initiatives over the next 18 months subject to obtaining necessary budget approval from council. |

· Safety Champion is now operational · Every department has champions · Incidents / Hazards registers are working as they should |

|||

|

2024 |

Local Government Act Section 17A Service Delivery Audits |

· Economic Development - Completed · Governance - Completed · Māori Relationships - Underway · Communication & Engagement - Completed |

|||

|

2024 |

Internal Audit review on Infocouncil Agenda protocols |

· Decision made to develop a Confidentiality Policy to be delivered 2024/2025 |

|||

|

2024 |

Contract management Audit |

· Audit is underway · Review current contracts · Review extensions to contract · Policy and framework |

|||

|

2024 |

Policy and Procedures Audit |

· Identify and update policies that no longer serve our needs, · Identify processes needing review/update to provide simple steps staff can follow to support policy and service delivery |

|||

|

2024 |

IT Systems and Software Audit |

· Collating a full list of software and services currently used at NRC. · Review of all software used to confirm fit for purpose and support a three-year improvement plan. |

|||

|

2024 |

Fraud Corruption and Dishonesty all staff awareness training |

· Internal Awareness Training package in its final stages and due to be delivered to all staff in September. |

|||

|

2024 |

Payroll audit to provide assurance surrounding relevant processes, controls, compliance with policy as well as provide some benchmarking against similar sized organisations and best practice. |

· External BDO Audit underway |

|||

Table 2: Proposed internal audit schedule 2024/25 onwards.

|

Item |

Status |

|

|

2024/25 |

Forest Management, audit of effectiveness of (outsourced) management, harvest schedule, health, and safety compliance, reporting etc. Biodiversity audit is completed – implementation will be reviewed as part of the overall audit outcomes. |

Review deferred awaiting review outcome end of February 2024 |

|

2024/25 |

Internal Audit – NRC Firearms Officer will complete audit as per the Firearms Standing Operating Procedures (SOP) |

Planned for Feb 2025 |

|

2024 |

Audit – Risk and Assurance Program – progression with Risk Appetite and Maturity following the Deloitte assessment completed in May 2022 |

Planned Q3/4 2024 |

|

2024/25 |

Fraud Detection Review – External provider to review NRC current processes |

Planned for December 2024 |

|

2024/25 |

Financial Staff Benefit Policy Review – this review will include all policy relating to staff /councillor benefits/remuneration: Credit card, Travel, Expenditure, |

Planned for Q3/4 2025 |

|

2025 |

Procurement Management – Audit of current procedures, framework and training needs |

Planned for Q3/3 2025 |

|

2025/2026 |

Analytics (Accounts Payable, Bank Payments) |

Planned for Q4 2025 |

|

2025 |

Internal Audit Maturity review |

Planned for Q3/4 2025 |

|

2024/25 |

Vehicle FBT – Audit on current use |

Planned for Q3 2025 |

|

2025 |

Catering – Audit on consistency with Policy and procedures (Budget, approval) |

Planned for Q3/4 2025 |

|

2025/2026 |

Annual Business Continuity Review – meeting with critical functioning services within NRC to ensure plans are up to date (contacts etc) |

Planned for Q2 2026 |

|

2025 |

Business Continuity Review – Tabletop exercise |

Planned Q3 2025 |

A full review of the NRC Contract management process is underway.

This includes;

o Review of all active contracts held in the contract management register

o Reviewing current folders

o Documents held in these folders and relevance

o User activity relating to folders

o Link between contract management and project hub

o Schedule of annual review

o Risk management documented

o Training and development - current / requirement

o Problematic process - Policy and procedure review

This audit is underway with a plan to have it completed with a set of recommendations by end of November.

Business Continuity Audit

A full review of NRC’s Business Continuity Plans (BCP) has been completed.

This included;

· A full review and update of the organisational plan.

· Completion of all outstanding critical function plans.

· Review and updating of all existing functional plans.

· Updating of NRC’s BCP Policy ready for review and adoption.

· Scheduling of annual review in the NRC audit register.

· Identification of actions for critical function managers for completion. (to be reviewed annually)

Next steps include;

· Adoption of the policy and plan by ELT

· Development of an IT Disaster Recovery plan to support all critical applications and information needs

· Scheduling of a tabletop exercise for September/October next year (2025)

· Development of a Disaster Recovery plan for facilities and fleet (to be completed next week by the Building/Facilities Specialist and Vehicle Fleet Coordinator)

· Annual review of function plans including follow up on agreed actions

Attachments/Ngā tapirihanga

Nil

Audit Risk and Finance Committee item: 6.2

18 November 2024

|

TITLE: |

Risk Management Activity Update |

|

From: |

Mandy Tepania, Audit and Assurance Lead |

|

Authorised by Group Manager/s: |

Bruce Howse, Pou Taumatua – Group Manager Corporate Services, on 06 November 2024 |

Whakarāpopototanga / Executive summary

The Risk management Activity Update report outlines the summary of Council’s progress in risk management related activities including Strategic and Operational.

That the report ‘Risk Management Activity Update’ by Mandy Tepania, Audit and Assurance Lead and dated 5 November 2024, be received.

Background/Tuhinga

Risk can be simply defined as “The effect of uncertainty on objectives”; Risk management is the assessment of this uncertainty, and encompasses both the likelihood of something happening, and the consequences or impacts if it were to happen, which can introduce both opportunity and hazards. Risk needs to be understood in order to make informed decisions.

Council uses tools to manage risk including a risk management framework, policy, and risk register which is maintained in council’s Process Manager (Promapp) risk module. Council maintains Strategic, Operational Groups, health and safety and project risk registers.

Strategic Risks:

Risks become strategic in nature (as opposed to operational) where the risk widely impacts the whole organisation. These risks are significant because they impact the ability of council to deliver against the Long-Term Plan (LTP). The LTP holds council accountable for their activities and long-term focus.

Operational Group Risks:

An operational risk presents a potential impact on council’s individual groups achieving their objectives. Operational group risks are identified and managed by group managers and their teams. Group risk must be regularly reviewed and reported as evidence of management.

Risk Management Matrix Evaluation Tool (to explain the ranking against each risk)

|

Likelihood |

Consequence |

||||||

|

Inconsequential (1) |

Minor (2) |

Moderate (3) |

Major (4) |

Severe (5) |

|||

|

Frequent (5) |

5 Moderate |

10 High |

15 Extreme |

20 Extreme |

25 Extreme |

||

|

Often (4) |

4 Low |

8 High |

12 High |

16 Extreme |

20 Extreme |

||

|

Likely (3) |

3 Low |

6 Moderate |

9 High |

12 High |

15 Extreme |

||

|

Possible (2) |

2 Low |

4 Low |

6 Moderate |

8 High |

10 High |

||

|

Rare (1) |

1 Low |

2 Low |

3 Low |

4 Low |

5 Moderate |

||

Progress on risk management since the last meeting of the Audit, Risk and Finance Subcommittee includes:

1. The Strategic and Operational group risk registers have been refreshed following leadership review.

2. The risks and their treatment/controls (mitigation action/s) have been managed by staff through the Process Manager (Promapp) risk module. The monitoring of the strategic, corporate, operational and fraud, corruption and dishonesty risk registers is performed by the Corporate Strategy team monthly.

This report provides several summaries:

· Table 1 provides a brief overview on risks that have been updated/ added over the past month.

· Table 2 provides a table of high rated risks and above for Corporate/NRC Wide (Strategic) risks.

o Graph showing the strategic/corporate risk trend for 2024.

· Table 3 provides a table of high rated risks and above for Operational services

o Graph showing Operational risk trend for 2024.

· Deep Dive Schedule is summarised in Table 4.

· The Strategic/Corporate and Operational risk register for November 2024, pre-control (inherent) and post control (residual) is Attachment 1.

· Deep Dive Report – Management of data and information assets - Attachment 2.

· Deep Dive Report - Cyber Security Update – Attachment 3.

|

Risk Title |

|

|

R00080 |

Changes in legislation & central government policy impacting council’s resources, budgets and activities |

|

|

Updated Activity: Under review |

|

Strategic Risk |

There is a substantial reform programme in train but there are a lot of unknowns at this stage when it comes to how far the reforms will go and what will be required in terms of implementation. By the next Audit & Risk hui (next year) we will have more certainty around what the reforms are likely to entail, and we would have had the opportunity to better consider this risk and the associated controls we will put in place to manage the risk. |

|

R00230 |

Climate Change Response |

|

|

Update Risk: For your information |

|

Operational Risk |

Risk trend remains steady. Mitigation and controls are in place or work in progress. New LTP resources will help to progress action items. |

|

R00245 |

Failure to prepare for future local government review/reforms and its impacts |

|

|

Risk Update: Archived (include in Risk R00080) |

|

Operational Risk |

There is a risk that if council fails to adequately understand and/or prepare for the impact of the future of local government review and reforms then there will be adverse impacts on the organisation, reputation and potential negative impacts on community wellbeing. |

|

R00094 |

Investment portfolio financial risk |

|

|

Risk Update: Trending â |

|

Corporate Risk |

Reduction in the likelihood of investment performance being impacted by a volatile market. Provisions have been made in preparation should there be a reduction. Residual rating has been decreased from Severe to Moderate (16 to 9) |

|

R00270 |

Tāiki ē Strategic intent Te Tiriti Strategy and Implementation Plan |

|

|

Risk Update: Trending â |

|

|

Reduce risk factor relating to

communication channels due to regular briefings with TTMAC, Co-Chairs and Te

Raki councillors. Focus on Māori capability and capacity within

council. |

|

R00255 |

Economic Downturn |

|

|

Risk Update: Trending â |

|

Corporate Risk |

Economic downturn adversely impacting revenue sources. With a reduction in inflation and interest rates the risk identified here has reduced therefore the residual rating has been decreased from likely to possible (9 to 6) |

|

R00256 |

Leasehold Property Remediation |

|

|

Risk Update: Information Update |

|

Corporate Risk |

Work continues now in Phase 2

– Notices have been extended from July to 27 November 2024 with work

ongoing. |

|

R00271 |

Development and implementation of the Regional Pest Management Plan |

|

|

Risk Update: Trending â |

|

Operational Risk |

Decreased: The risk rating continues to fall with the plan nearly at completion and limited risk. Residual risk decreased from moderate to rare (2 to 1) Not showing on Table 3 as residual risk rating is well below high. |

|

R00094 |

Investment portfolio financial risk |

|

|

Risk update: Trending â |

|

Corporate |

Decreased due to the

provisions made to cover any impact on investment |

|

R00014 |

Cyber Security Attach |

|

|

Risk update: Trending â |

|

Corporate Risk |

Decreased as stated in the Deep Dive report attached due to additional controls as outlined in the security improvements roadmap including an incident response and recovery plan. Further reassessment in March 2025 to compliance with the NZISM standards through the ALGIM SAM for Compliance programme. Previous residual risk likelihood has a further reduction from Often to likely (16 to 12) |

|

R00260 |

Lack of public knowledge – New rules relating to Marine Protected areas (Mimiwhangata and Rakaumangamanga) |

|

|

Risk Update: Trending â |

|

Operational Risk |

Communication continues to engage with the communities in promoting the rules surrounding Rāhui Tāpu marine protected areas - Mimiwhangata and Rakaumangamanga (Cape Brett) marine protected areas. Decreased residual risk likelihood Frequent to Often (15 to 12) |

Table 1. Strategic /Corporate risks listed -rating high and above

|

|

Extreme |

High |

Moderate |

Low |

|

Key –Residual rating |

Extreme |

High |

Moderate |

Low |

|

Key – Trend |

Increasing (I) |

Decreasing (D) |

New (N) |

Static (S) |

|

# |

Risk Statement |

Inherent Rating |

Residual Rating |

Trend |

|

1 R00080 |

Changes in legislation and central government policy impacting council’s resources, budgets, and activities. |

25 |

20 |

S ↔ |

|

Controls |

Track central government proposals, policy and legislation; Council prepares and budgets for implementation of new policy; Process of engagement (budgets and feasibility of operations), Communication/workshop central government policies and plans; Ensure council processes, policies and plans are structured to be adaptable and responsive |

|||

|

2 R00252 |

Marsden Maritime Holdings (MMH) Investment – Capital raising risk |

25 |

20 |

S ↔ |

|

Controls |

Engage with MMH to signal sufficient lead in time for NRC responding to any capital raising; Commission independent financial expertise re undertake scenario modelling for capital raising options assessing impact on NRC’s financial strategy; Ensure NRC exerts control available to it over MMH as majority shareholder; Reserve any surplus funds at year end to compensate for reduction in dividend |

|||

|

3 R00258 |

Unintended marginalization of partners/stakeholders through council activities |

25 |

16 |

S ↔ |

|

Controls |

Te Tai Tokerau Māori and Council (TTMAC) Working party to ensure views of Māori are included in council functions; Ongoing collaboration with community working groups (Awanui River WG, Urban Whangārei WG, Kerikeri River WG etc 8 in total); Collaborative approach through joint committees, with implementation and planning

|

|||

|

4 R00014 |

Cyber security attack |

20 |

12 |

D â |

|

Controls |

Multiple layers of defences (perimeter & endpoint); Education programme; Modern detection applications in place; Network accounts with elevated permissions; Cyber Security Audit procedures; Security Risk Assessment and roadmaps; Current system releases/versions are maintained; Ongoing security roadmap actions/adjustments/reviews |

|||

|

5 R00221 |

Workload |

20 |

15 |

S ↔ |

|

Controls |

Analysis of workload issues; Resolve roadblocks as necessary; Consider impact on resources ($, people etc) work taken on aligns with LTP; Workloads improvement program and frameworks, e.g. streamlining P&C processes, improvement IT systems

|

|||

|

6 R00239 |

Dealing with aggressive people – psychological harm |

15 |

15 |

S ↔ |

|

Controls |

Policy and Process for managing EAP/Staff counselling, Suspicious Activity, InReach Emergency Activation, Work Safely in the field planning, process for aggressive callers; Panic alarm and lockdown procedures; use of the Buddy System; Training available for all staff |

|||

|

7 R00256 |

Leasehold Property Remediation |

16 |

10 |

S ↔ |

|

Controls |

Follow legislative compliance and best practise in managing this risk.

|

|||

|

8 R00012 |

Potential Non-compliance with Health and Safety at Work Act 2015 |

20 |

12 |

S ↔ |

|

Controls |

Health & Safety Strategy project underway; H&S terms of reference established; H&S policy and procedures along with training; H&S hazard register; Monitor and reporting on incidents, trends to ELT, Audit & Risk

|

|||

|

9 R00229 |

Management of data and information assets |

16 |

12 |

S ↔ |

|

Controls |

Project Plan development and monitored to manage data/information assets; Capability and knowledge to mitigate reliance on suppliers; Training programs and continued review/policy/procedure reviews; Work collaboratively testing environment developed programs; database backed up regularly; Robust test plans; Disaster management policy; security controls; Regular audits and reporting to monitor processes and governance |

|||

|

10 R00094 |

Investment Portfolio Financial Risk |

15 |

9 |

D â |

|

Controls |

Mitigate by management-monthly account review, internal audit reporting, established operating cost reserve plan; active investment strategy; investment reviews by CEO and independent advisors, - |

|||

|

11 R00136 |

Capability and operational capacity to manage events and directives |

20 |

12 |

S ↔ |

|

Controls |

Succession plan in place reviewed annually; Processes & policy documented for staff to follow; Induction provided, a civil defence course available; regular exercises of emergency management skills; Learning and development is identified and completed for staff to maintain /increase capacity to perform; Recruitment process covering essential qualifications and competencies; Planning process including Long Term Planning and annual budgets to review structure and capacity of teams |

|||

|

12 R00015 |

Core IT applications/system are not designed and/or implemented to support all organisational processes, or applications will stop working |

20 |

9 |

S ↔ |

|

Controls |

IRIS next Gen Project; Ensure systems running current releases/versions; Alternative interim solutions considered and assessed based on critical needs; ensure participation in sector (SIG) activities and initiatives; Clear business case for new systems as required; additional workshops as required to complement planning processes and sufficient level of knowledge and background information |

|||

|

13 R00255 |

Economic Downturn |

20 |

6 |

D â |

|

Controls |

With increased provision for doubtful debt; continued SIPO review for activities and what we are funding via rates |

|||

|

14 R00265 |

Consent Non-Compliance when completing work on behalf of NRC |

15 |

9 |

S ↔ |

|

Controls |

Legislation requirements (e.g. Consents) for project and contractors added to the templates to ensure staff complete whilst planning the work;

|

|||

|

15 R00228 |

Policies and Protocols not clearly documented or followed

|

16 |

8 |

S ↔ |

|

Controls |

Policy framework schedule: staff trained in finding and understanding policy and procedure requirements; Infrastructure in place (promapp, policy register, audits); Delegations manual; Contract management program, policy, procedures and training; Tendering policy & procedures; Current audit of all policy and procedures to ensure current and compliant |

|||

Graphics below provides Strategic/Corporate Trends reported 2024

R00014, R00255 and R00094 decreased - (Economic Downturn rated moderate no longer in the high category)

Risks rated high and above that did not change are showing as static for November (12)

Table 3. Operational risks listed (High risk ranking and above)

|

Key – Inherent rating |

Extreme |

High |

Moderate |

Low |

|

Key –Residual rating |

Extreme |

High |

Moderate |

Low |

|

Key – Trend |

Increasing (I) |

Decreasing (D) |

New (N) |

Static (S) |

|

# |

|

Risk Statement |

Inherent Rating |

Residual Rating |

Trend |

|

1: R00270 |

Tāiki ē Strategic intent Te Tiriti Strategy and Implementation Plan |

25 |

12 |

D â |

|

|

Controls |

Regular meetings and briefings with the Chair and Te Raki councillors

|

||||

|

2: R00257 |

Caulerpa – Threat to marine life, shellfish and marine diversity along Northlands coastline |

25 |

25 |

S ↔ |

|

|

Controls |

Awaiting advice from crown due to receive mid-August on program of action moving forward |

||||

|

3: R00267 |

Gold Clam Biosecurity Response |

25 |

10 |

S ↔ |

|

|

Controls |

Developed an eDNA surveillance programme for review; continuation of surveillance activities – determined by the direction of the nationally led response with funding availability from council |

||||

|

4: R00269 |

Continuation of PF2050 Funding |

25 |

15 |

S ↔ |

|

|

Controls |

Awaiting National PF2050 confirmation of future funding – discussions underway

|

||||

|

5: R00268 |

Eradication of Deer from Northland |

25 |

6 |

S ↔ |

|

|

Controls |

First have secured a two year of co-funding from DOC to support the operational activities in Russell State Forrest. Further funding will be sort in 2025

|

||||

|

6: R00260 |

Lack of public knowledge – New Rules relating to Marine Protected Areas (Mimiwhangata and Rakaumangamanga) |

15 |

12 |

D â |

|

|

Controls |

Effective communication through signage and media program; monitoring plan is developed, implemented and maintained; Compliance measures are planned and resourced |

||||

|

7: R00131 |

Treaty Settlements |

16 |

12 |

S ↔ |

|

|

Controls |

Proactive council involvement in the Treaty Settlement process; Participation in cross-council initiative to better inform central government about costs of treaty settlement implementation; Resource the work and be ready for opportunities; Meet regularly with Ministers and Te Arawhiti Agency to stay informed.

|

||||

|

8: R00230 |

Climate change response |

20 |

12 |

S ↔ |

|

|

Controls |

Risk trend remains static with all controls in place and being managed. Progress on climate change strategies will improve as new initiatives approved through the recent LTP come online. |

||||

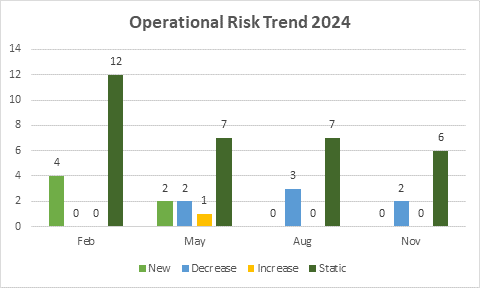

Graphics below visualise Operational Risk Trends for 2024

R00270 and R00260 decreased and there were no new risks identified this quarter.

Risks rated high and above against the risk matrix that did not change are showing as static for November (6)

The Corporate Strategy Team facilitates risk owners to provide deep dives into each risk in accordance with the following schedule (Table 4), initially focussing on the risk with the highest pre-controls risk rating or where specifically requested due to increasing risk ratings.

Table 4. Risk deep dive schedule.

|

Risks |

February 2024 |

May 2024 |

August 2024 |

November 2024 |

February 2025 |

May 2025 |

||

|

7 |

Cyber Security Attack |

√ |

|

|

|

|

|

|

|

12 |

Economic Downturn |

|

√ |

|

|

|

|

|

|

14 |

Dealing with Aggressive People |

|

|

√ |

|

|

|

|

|

9

4 |

Management of data and information assets Cyber Security Update |

|

|

|

√

√ |

|

|

|

|

9 |

Use of Firearms |

|

|

|

|

√ |

|

|

|

3 |

Gold Clam Biosecurity Response |

|

|

|

|

|

√ |

|

Attachments/Ngā tapirihanga

Attachment 1: Strategic and Operational

Risk Register November 2024 ⇩ ![]()

Attachment 2: Deep Dive Report

Management of Data and Information Assets ⇩ ![]()

Attachment 3: Deep Dive Report Cyber

Security Update ⇩ ![]()

Audit Risk and Finance Committee item: 6.3

18 November 2024

|

TITLE: |

Review of Business Continuity Plan |

|

From: |

Chris McColl, Organisational Projects Specialist |

|

Authorised by Group Manager/s: |

Bruce Howse, Pou Taumatua – Group Manager Corporate Services, on 05 November 2024 |

Whakarāpopototanga / Executive summary

A full review of Councils Business Continuity plan has been completed and is attached for your information.

That the report ‘Review of Business Continuity Plan’ by Chris McColl, Organisational Projects Specialist and dated 4 November 2024, be received.

Background/Tuhinga

Northland Regional Council developed an organisation wide Business Continuity Plan (BCP) in 2021.

This plan was reviewed and updated in October 2024 and is attached for your information.

Council maintains 15 supporting Essential Function plans which are reviewed and updated on a rolling basis. All 15 are up to date as of November 2024

Attachments/Ngā tapirihanga

Attachment 1: Business Continuity Plan ⇩ ![]()

Audit Risk and Finance Committee item: 6.4

18 November 2024

|

TITLE: |

Fraud, Corruption and Dishonesty Activity Update |

|

From: |

Mandy Tepania, Audit and Assurance Lead |

|

Authorised by Group Manager/s: |

Bruce Howse, Pou Taumatua – Group Manager Corporate Services, on 06 November 2024 |

Whakarāpopototanga / Executive summary

The Fraud, Corruption and Dishonesty Update report provides the current state and any updates since the last report.

That the report ‘Fraud, Corruption and Dishonesty Activity Update’ by Mandy Tepania, Audit and Assurance Lead and dated 5 November 2024, be received.

Background/Tuhinga

Definition:

Fraud: Is an intentional and dishonest act involving deception or misrepresentation, to obtain or potentially obtain, an advantage for themselves or any other person/organisation.

Dishonesty: An act (or omission) undertaken without the belief that there is consent or authority for doing the act (or omission).

Corruption: Refers to a person in authority exploiting their position for personal gain (e.g., receive gifts or other benefits to perform part of an official function, or omitting to perform an official duty resulting in personal gain for another).

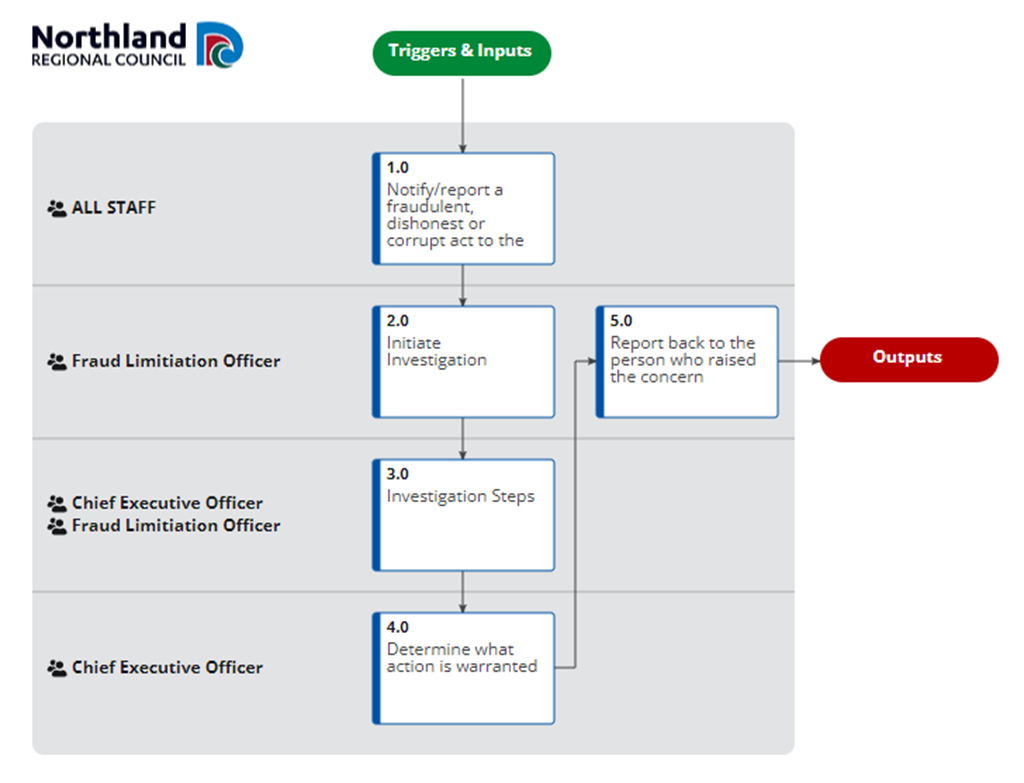

A policy provides guidance to staff for reporting dishonest behaviour to the Fraud Limitations Officer (FLO). The below procedure outlines the steps taken.

This report provides several summaries:

· Chart below provides a quick view of the 12 Fraud, Corruption and Dishonesty Risks Inherent/Residual controls in Table 1.

· Fraud Corruption and Dishonesty Risk Register including treatments/controls in place as identified in Table 2.

· Risk Management Matrix Evaluation Tool (ranking) Inherent/Residual Table 3.

Table 1. Report showing all Fraud Corruption and Dishonesty Risks scores (Inherent/Residual)

![]()

Table 2. Fraud Corruption and Dishonesty Risk Register current rating and controls.

Risks below are identified in the risk register as ongoing risks with controls in place to manage and monitor any breach in behaviours. All risks on this register have been reported including a brief overview of the controls in place for each. Risk ratings are adjusted when a regular review identifies and requires a policy or process change be made to remove or limit chances of fraudulent, corrupt or dishonest behaviours.

|

Inherent Rating |

Extreme |

High |

Moderate |

Low |

|

Residual Rating |

Extreme |

High |

Moderate |

Low |

|

|

Risk Statement |

Inherent Rating |

Residual Rating |

|

|

1: R00085 |

Data Loss through theft, unauthorized access, or distribution |

9 |

6 |

|

|

Controls |

Processes and policies in place, automatic PC screen lock, staff education, laptops for offsite work with security controls |

|||

|

2: R00112 |

Theft and inappropriate use of council assets

|

6 |

4 â |

|

|

Controls |

Vehicle inventory checks (current & sold), regular stock takes, lockable storage, disposal of assets by public auction, restricted and monitored access to building, user reporting (internet, cell phones) Treasury management policy monthly performance reporting, BP fuel reporting |

|||

|

3: R00117 |

Conflict of Interest

|

9 |

6 |

|

|

Controls |

Staff annual declaration of interests, tendering process requires disclosure, segregation of duties, minutes of meetings declaration of any conflict of interest, employment application forms include questions. |

|||

|

4: R00115 |

Supplier Invoice Fraud |

6 |

4

|

|

|

Controls |

Delegation limits and authoristion process in place, dual signatory procedure to release payments, segregation of duties in payment process, monthly actual vs budget reporting and review |

|||

|

5: R00121 |

Bribery and inappropriate receipt of gifts & secondary employment |

6 |

4 |

|

|

Controls |

Gift register reported to independent member of Audit & Risk subcommittee, annual declaration of conflict of interest performed and report to CEO, external audit, employment contract in place for all staff, application form asks if they continue with any other employment and if there is any conflicts of interest before commencing with employment |

|||

|

6: R00106 |

Fraud Corruption and Dishonesty

|

10 |

5 |

|

|

Controls |

Raise awareness through policy, provide fraud dishonesty and corruption training to staff including positions susceptible to such activities eg ELT, DLT, managers, business supports and staff, Misstatement of financial statements, maintain appropriate levels of insurance, investigate and implement any internal/external audit recommendations promptly, Policy and Procedures for reporting and investigating any items reported, Policy and Procedure regular review (e.g. Fraud, Dishonesty and corruption policy, Protected Disclosures Policy, Code of Conduct Policy) |

|||

|

7: R00118 |

Recruitment Fraud

|

6 |

4 |

|

|

Controls |

Police checks for all new employees, checking qualification documents, completed application questionnaires are checked, psychometric testing where requested, credit checks perform on new employees where appropriate (e.g. finance) |

|||

|

8: R00119 |

Theft of Bus Service Revenue

|

6 |

4 |

|

|

Controls |

Monthly reconciliations, restricted access, Internal audits |

|||

|

9: R00114 |

Timesheet and expense claim fraud

|

6 |

4 |

|

|

Controls |

Monthly budget monitoring, authorisation process and workflow, police checks obtained where necessary, timesheets, sickness, other leave signed off by manager, internal audit where appropriate |

|||

|

10: R00120 |

Material misstatement of the financial statements

|

6 |

3 |

|

|

Controls |

Internal/ external audits, segregation of duties and sign off processes |

|||

|

11: R00113 |

Payroll Fraud

|

3 |

2 |

|

|

Controls |

Monthly budget monitoring, payment run audit reports reviewed and verified separately from payroll function, payment run variance report (compare previous to current and verify differences), segregation of duties payroll processing and authorisation process, data matching processes over bank account details, CAAT are performed annually, Review by HR/ELT of staff on payroll |

|||

|

12: R00116 |

Koha Fraud

|

3 |

2 |

|

|

Controls |

Approval, receipting and confirmation process in place and reviewed and updated regularly |

|||

Table 3. Risk Management Matrix Evaluation Tool (to explain the ranking) Inherent/ Residual

|

Likelihood |

Consequence |

||||||

|

Inconsequential (1) |

Minor (2) |

Moderate (3) |

Major (4) |

Severe (5) |

|||

|

Frequent (5) |

5 Moderate |

10 High |

15 Extreme |

20 Extreme |

25 Extreme |

||

|

Often (4) |

4 Low |

8 High |

12 High |

16 Extreme |

20 Extreme |

||

|

Likely (3) |

3 Low |

6 Moderate |

9 High |

12 High |

15 Extreme |

||

|

Possible (2) |

2 Low |

4 Low |

6 Moderate |

8 High |

10 High |

||

|

Rare (1) |

1 Low |

2 Low |

3 Low |

4 Low |

5 Moderate |

||

Fraud Limitations Officer updates:

· An investigation is underway concerning a potential breach of the contract management policy and a related conflict of interest reporting issue. Once the investigation is complete the findings will be reported to the CEO.

· An Internal Process error resulted in confidential information being accessed by a member of staff. The staff member reported the access immediately, and additional system security was applied to prevent any repeat of this occurring.

· #R000112 – Theft and inappropriate use of council assets – residual risk rating was reduced this quarter. NRC provided Fraud Corruption and Dishonesty online training to all staff plus communication relating to missing items was provided on the Aotahi platform. This ensured staff were aware of the current environment and to be more vigilant in the workplace.

Attachments/Ngā tapirihanga

Attachment 1: Fraud Corruption and

Dishonesty Risk Register Nov 2024 ⇩ ![]()

Audit Risk and Finance Committee item: 6.5

18 November 2024

|

TITLE: |

Health and Safety report for first quarter of 2024-25 financial year |

|

From: |

Tamsin Sutherland, Health and Safety Advisor and Beryl Steele, Human Resources Manager |

|

Authorised by Group Manager/s: |

Bruce Howse, Pou Taumatua – Group Manager Corporate Services, on 06 November 2024 |

Whakarāpopototanga / Executive summary

This report is to inform the council of the activity in Health and Safety for the period July - September 2024.

An overview/summary of the report includes:

· A summary of the events, investigations and outcomes that have occurred in this period.

· Overall number of incidents/hazards has declined this quarter, this is common after successful implementation of an improved reporting system as staff revert to under reporting.

· Health and safety training has continued to be a priority in this period.

· A new health and safety management system started a phased implementation on 7 October.

That the report ‘Health and Safety report for first quarter of 2024-25 financial year’ by Tamsin Sutherland, Health and Safety Advisor and Beryl Steele, Human Resources Manager and dated 5 November 2024, be received.

Background/Tuhinga

Background/Tuhinga

1. Health and safety performance

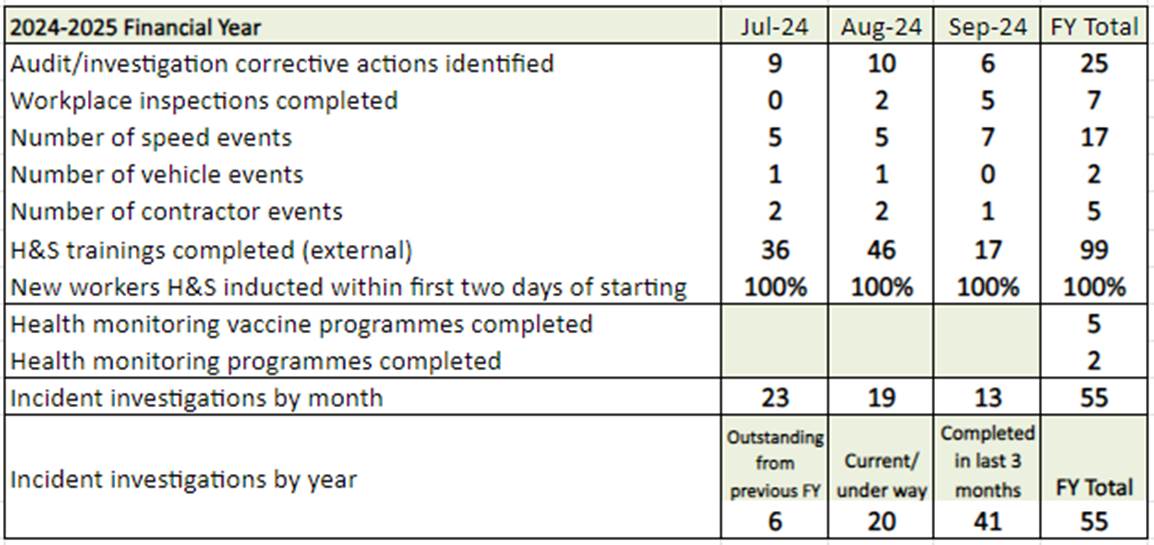

A summary of the health and safety performance for the period July to September 2024 is show in Table 1 below:

· A “pre-application” audit has been carried out for Union East Street, prior to applying for a Location Compliance Certificate. Remedial work was identified by the audit and steps are being undertaken to ensure the site meets requirements, before formal assessment – scheduled for mid-November.

· The programme of policy review and process update is ongoing.

· A “Health and safety implementation plan” has been provided to Ministry for Primary Industries and discussed with them. MPI requested a statement on progress in health and safety, in order to satisfy themselves that good progress is being made in terms of achieving and maintaining compliance. This is part of MPI’s due diligence in funding project work through Councils, and relates to wilding pine, deer eradication, gold clam response and Caulerpa projects at Council.

· Health and safety training undertaken in this period includes first aid, 4WD skills, dog safety and a new Defensive Driver course, which has been very well received by staff.

· Incident reporting has fallen in this quarter, some of this will be due to less field work in the winter season. It is very common following the successful implementation of an improved reporting system that incident report numbers rebound down after a period of improvement.

· A new software system for Health and Safety was launched on 7 October, training has been running to upskill staff in this system.

· Staff engagement in health and safety was strong during the nomination and election process for new Health and Safety Reps. A record number of nominations were received for Reps from diverse work groups. This has resulted in a better spread of Reps across Council teams. The number of nominations for the Health and Safety Committee roles triggered an election, for the first time. We now have a Committee including all Council Groups and 26 Health and Safety Reps, which ensures all offices and groups have representation.

2. Risk Management

The critical risks identified included 12 critical risks staff face. The ‘fatigue’ hazard has been updated to reflect a broader spectrum of risks, referred to as ‘psychosocial risk’. Psychosocial hazards can be defined as:

The design and management of work and its social organisational context that may have the potential for causing mental or physical harm. – WorkSafe NZ

This includes harm from bullying, poorly organised work, or fatigue.

Table 1: Health and safety performance lead and lag indicators July 2024 to September 2024

The programme of deep dive reviews by ELT members of the critical risks continues, and has included a review of helicopters, firearms, and lone & remote working in the past quarter.

Health monitoring was overdue for some staff and is in progress at the time of writing. Where Council exposes staff to situations that may affect their health, such as noise or chemical sprays, there is an obligation to monitor any health impacts from this exposure. Health and safety are working with managers to ensure that the correct health monitoring tests are administered to the right staff at the correct frequency. This has been difficult information for H&S and managers to track in Enterprise/Infor. It is anticipated that this will be managed in Safety Champion by April 2025.

The storage of hazardous substances has not been compliant with requirements in NRC’s Whangārei premises. Each team has held a compliant inventory of hazardous substances for their team. However, these have not been considered holistically, for either total volumes held or compatibility requirements. Reviewing the sum of all the inventories identified that both Water Street and Union East Street required Location Compliance Certificates. The storage of bulk materials has been moved to Union East Street, ensuring that Water Street does not require a Certificate. At Union East Street the addition of a waste container wash facility, two hazardous chemical containers, for flammable and corrosive materials has upgraded the storage. Staff induction to the safe working practices and emergency arrangements are being carried out, before the Location Compliance Certificate assessment is booked.

The Harmful Communications Policy has been adopted, to provide staff with more clarity on terminating visits and conversations where members of the public become abusive. Guidance is now available on the NRC website for the public regarding NRC expectations. Further guidance is in final draft on the use of body cams during site visits. We hope the use of body cameras will deter aggressive behaviour towards Council staff.

Health and safety have been working closely with the Nursery and the Tsunami Siren install project to ensure contractor management is effective.

Safety Champion launched on 7 October. This is bespoke health and safety software. The adoption of Enterprise/Infor created barriers to reporting incidents, and the system is very challenging to report/oversee training and health monitoring information. As a short term improvement, an alternative system was adopted for incident reporting, which was well received. Safety Champion has a staged launch, initially an incident reporting module. Before the end of 2024, the chemicals inventory will be held within Safety Champion. Over the next 6 months, this will also be used to hold the health and safety hazard register and the training and health records for health and safety. This will help managers track competency and health monitoring status for staff.

The NRC GIS team have submitted an application for the ALGIM national awards based on the recommendation from the health and safety Auditor. The Before You Go and Take 5 safety system for field staff, developed by NRC staff, was commended by the auditor as market leading.

3. Injuries, incident and hazards

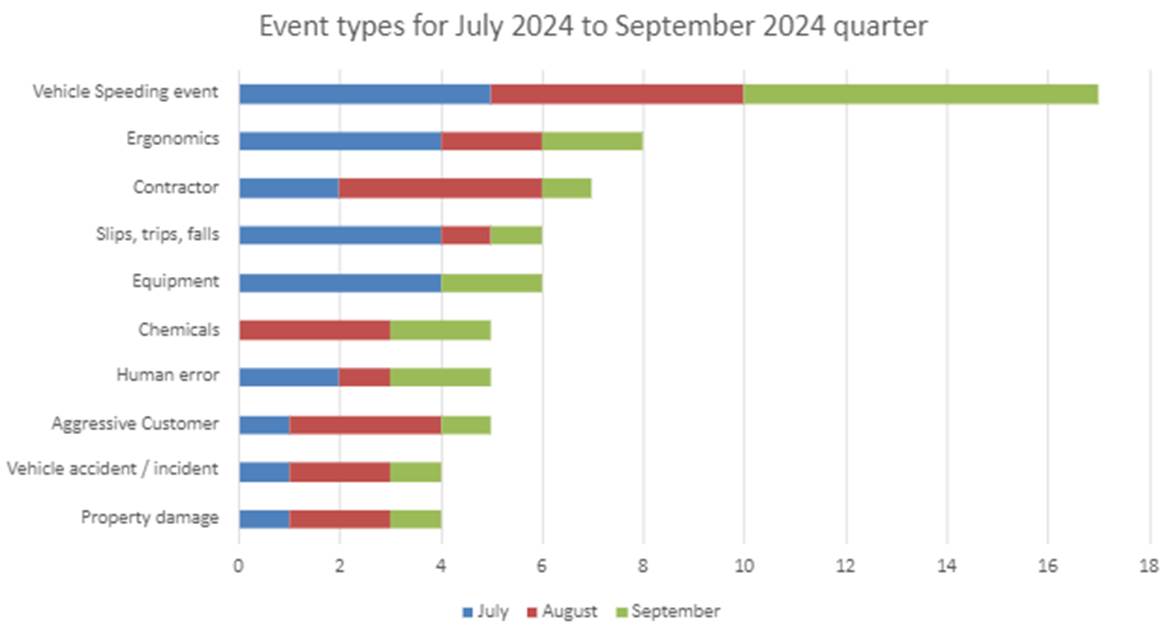

The most frequent incident type for the July-September 2024 quarter was vehicle overspeed reports. Although the most frequent incident for the quarter, the number of these incidents is significantly lower than it was prior to the implementation of speed management reporting in February 2023. The number of contractor incident reports has risen as contract managers stress the importance of reporting incidents to NRC, however, this still represents very significant under reporting.

Figure 1: Health and safety event reports categorised by type for the July to September 2024 quarter – note vehicle incidents include near misses whilst driving

Workstation assessment training for NRC staff has provided an internal resource to carry out workstation assessments. These assessments have identified a number of workstations where staff work in discomfort. As these are identified more appropriate equipment is provided to ensure staff do not developing ergonomic injuries.

4. Events reported

55 incidents were reported in this quarter, this is a significant drop in reporting compared to the previous 12 months.

17 overspeed events were identified in ERoad for this period, plus two speeding tickets. NRC vehicles travel in excess of 100,000kms per month. The number of incidents recorded represents an average of 1 speeding event per 20,666 kms driven this quarter. This compares to an average of 1 event per 29,603 kms driven over the past 12 months, an overall downward trend, but a disappointing quarter.

5. Events of interest

Note: the events of interest only detail high risk events, or events which affect large groups of people.

The following events are events of interest from the quarter July to September 2024:

Contractor incidents:

· A firearms incident was reported by a contractor, a parked, branded vehicle was damaged whilst the contractor was away from the vehicle, carrying out work for NRC. The reporting to the Contract Manager was immediate, and work was halted while the threat was assessed. A new safe system of work has been developed between council and contractor and implemented before the work re-started. Police have been involved in the incident investigation.

· Severe allergic reaction in a field worker to previously unknown trigger.

· Building re-development incidents include the discovery of an unknown site of buried asbestos during digging works, and a property damage incident, both of which were reported promptly.

NRC incidents:

· Member of staff had to take evasive action to avoid collision with aggressive driver, was then chased by the other driver and verbally abused when they stopped the vehicle.

6. H&S Strategy work programme

Due to delays in the customisation build of Safety Champion, the health and safety team are behind the planned progress for implementation in some areas of the H&S Strategy. These delays include:

· Tracking staff training for competency components.

· Reporting health and safety information.

· Short term administrative support for the H&S team during the transition to Safety Champion has been advertised on a fixed term basis. This will minimise the impact of the transition on staff resourcing.

7. Legislation updates

There are no legislative changes to note since the last report.

Case law developments in health and safety provide some clarity regarding the interpretation of the Act. A case regarding liability for named executives under the Health and Safety at Work Act is currently before the courts. This has the potential to impact all employers.

A test case of the application of the Proceeds of Crime Act to health and safety offences has been successfully taken to the High Court by the police. A business owner has forfeited profits from operating in repeated, knowing contravention of health and safety requirements, which resulted in a fatality.

In a recent decision, a Health and Safety Advisor (consultant) was found guilty of offences under the Health and Safety at Work Act. A member of staff suffered life changing injuries in a vehicle incident. The situation had been flagged as a significant concern by the Advisor during a site visit, but he did not take action to remedy the issue. Being aware of an issue, but not resolving it, was the basis of the legal action.

Attachments/Ngā tapirihanga

Nil

Audit Risk and Finance Committee item: 6.6

18 November 2024

|

TITLE: |

Regulatory Services Quarterly Report |

|

From: |

Colin Dall, Pou Whakaritenga - Group Manager Regulatory Services |

|

Authorised by Group Manager/s: |

Colin Dall, Pou Whakaritenga - Group Manager Regulatory Services, on 07 November 2024 |

Whakarāpopototanga / Executive summary

This report covers the council’s consent processing and compliance monitoring functions/activities for the period 1 July to 30 September 2024. A separate report on formal enforcement activities is included in the Confidential section of this committee agenda.

The following is a high-level summary of our consent application processing and compliance monitoring functions/activities during the reporting period:

Consents

|

Metric |

July 2024 |

August 2024 |

September 2024 |

Total |

|

Applications received1 |

35 |

32 |

32 |

99 |

|

Decisions issued2 |

22 |

29 |

20 |

71 |

|

Outside timeframes |

0 |

0 |

0 |

0 |

|

Hearings |

0 |

0 |

0 |

53 |

|

Objections/appeals |

0 |

0 |

0 |

44 |

1 An application may include multiple activities which individually require a resource consent.

2 The number of decisions issued is based on the total number of activities that required a resource consent.

3 Two of the five hearings started in the previous financial year but finished in the current financial year.

4 There is also an appeal that had not been resolved that was lodged prior to 1 July 2023.

Of the applications in progress at the end of September 2024, 34 were received more than 12 months ago (two less than the previous reporting period).

Compliance Monitoring Events

|

Environmental Incidents

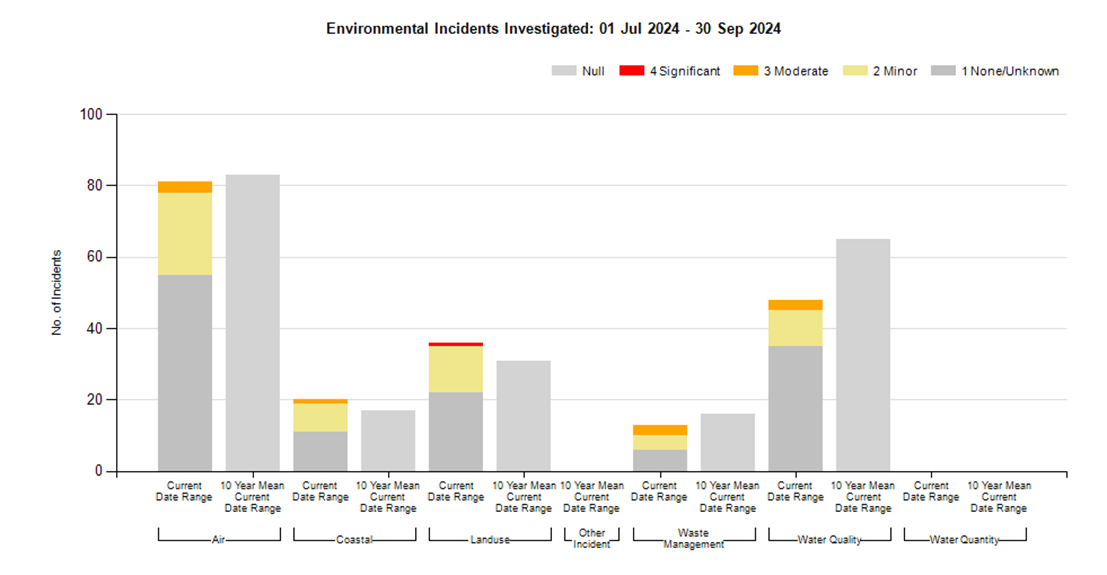

A total of 297 environmental incidents were recorded and investigated in the reporting period (141 in July, 79 in August and 77 in September). The following graph compares the number of environment incidents investigated for each main incident category with the mean (average) number of incidents investigated for the same category and reporting period for the previous 10-year period. The colour coding for the incidents investigated in the current reporting period gives the assessed scale of adverse effects of the incident.

Ngā mahi tūtohutia / Recommendation

That the report ‘Regulatory Services Quarterly Report ’ by Colin Dall, Pou Whakaritenga - Group Manager Regulatory Services and dated 31 October 2024, be received.

Background/Tuhinga

Compliance ratings specified in this report are those recommended by the Ministry for the Environment’s “Best Practice Guidelines for Compliance, Monitoring and Enforcement under the Resource Management Act 1991” (2018):

|

|

Compliance grade |

|

|

FULL COMPLIANCE with all relevant consent conditions, plan rules, regulations, and national environmental standards. |

|

|

LOW RISK NON-COMPLIANCE. Compliance with most of the relevant consent conditions, plan rules, regulations, and national environmental standards. Non-compliance carries a low risk of adverse environmental effects or is technical in nature (e.g. failure to submit a monitoring report). |

|

|

MODERATE NON-COMPLIANCE. Non-compliance with some of the relevant consent conditions, plan rules, regulations, and national environmental standards, where there are some environmental consequences and/or there is a moderate risk of adverse environmental effects. |

|

|

SIGNIFICANT NON-COMPLIANCE. Non-compliance with many of the relevant consent conditions, plan rules, regulations, and national environmental standards, where there are significant environmental consequences and/or a high risk of adverse environmental effects. |

Table 1: Applications Received 1 July to 30 September 2024

|

IRIS ID |

Consents Required |

Received Date |

Applicant |

Description |

|

APP.004111.01 |

3 |

1/07/2024 |

Far North District Council |

To discharge treated wastewater to the Waitangi Wetlands within the Waitangi Forest (near Skyline Road) on Lot 1 DP 137183, at or about location co-ordinates 1690245E 6099451N. |

|

APP.012944.01 |

1 |

1/07/2024 |

Carpenter Investments Limited |

Replacement consents for a marine farm in coastal marine area at Waikare Inlet, Bay of Islands (ex-lease #124). |

|

APP.012995.01 |

1 |

1/07/2024 |

Carpenter Investments Limited |

Replacement consents for a marine farm in Waikare Inlet, Bay of Islands (ex-lease #345). |

|

APP.045921.01 |

1 |

1/07/2024 |

Mr J Dickson |

Unconsented boat ramp in coastal marine area adjacent to Haven Close, Ngunguru. |

|

APP.045940.01 |

1 |

1/07/2024 |

Northland Regional Council |

Two Temporary swing moorings for Caulerpa control in coastal marine area in Omakiwi Cove, Bay of Islands. |

|

APP.045954.01 |

1 |

1/07/2024 |

A R McPherson |

Place a swing mooring in the coastal marine area at location co-ordinates 1720653E 6088004N in Wharf Road Mooring Zone, Whangaruru. |

|

APP.045962.01 |

3 |

4/07/2024 |

Oceans Resort Body Corporate 349622 |

Existing bore for commercial use at Marlin Place, Tutukaka. |

|

APP.034765.01 |

2 |

5/07/2024 |

Te Puna Inlet Oysters (2019) Limited |

Replacement consents for a pile mooring and discharge from oyster washing facility at Opete Creek, Bay of Islands. |

|

APP.037637.02 |

1 |

5/07/2024 |

Marsden Maritime Holdings Limited |

Replace consent for discharges from a boat maintenance facility at Marsden Cove Marina (Marsden Point). |

|

APP.045963.01 |

3 |

5/07/2024 |

Te Hau Ora O Ngapuhi Limited |

Earthworks for site development for 90 residential units at Bisset Road and Rimu Place, Kaikohe. |

|

APP.045964.01 |

3 |

5/07/2024 |

N L Mirtle & D A Leslie |

Earthworks near wetland and domestic on-site wastewater discharge at Tauranga Bay Beach Road, Tauranga Bay. |

|

APP.045965.01 |

3 |

8/07/2024 |

Quixotic Trustee Limited |

Bore construction at Paroa Bay Road, Russell. |

|

APP.045932.01 |

1 |

9/07/2024 |

Far North District Council |

Two temporary bridges in coastal marine area on Hihi Road, Hihi. |

|

APP.045970.01 |

1 |

10/07/2024 |

Kainga Ora - Homes and Communities |

Discharge to land for remediation of contaminated land at 4-6 Wilkinson Avenue, Te Kamo, Whangārei. |

|

APP.045971.01 |

1 |

11/07/2024 |

Jackson Hikurangi Limited |

Earthworks for residential subdivision at 54 and 56A George Street, Hikurangi. |

|

APP.041517.01 |

2 |

12/07/2024 |

Minargo Trust |

Replacement consents for a pontoon and increase in dredge area; new consent for a permanent vessel berth in Opete Creek, Purerua Peninsular (Rangihoua Road). |

|

APP.045972.01 |

3 |

15/07/2024 |

M A Masters |

Bore construction at Unahi Road, Karikari Peninsula, Awanui. |

|

APP.045973.01 |

3 |

15/07/2024 |

J Mortensen |

Bore construction at Puketī Road, Ōkaihau. |

|

APP.045974.01 |

3 |

16/07/2024 |

C & J Wood |

Earthworks in flood zone at Grey Heron Close, Mangawhai Heads, Mangawhai. |

|

APP.045976.01 |

3 |

16/07/2024 |

D L O'Leary & |

Bore construction at Sulenta Loop Road, Waipapakauri. |

|

APP.045977.01 |

3 |

16/07/2024 |

Logan King Trust |

Bore construction at Lot 1,DP 140708 Gill Road, Awanui. |

|

APP.045978.01 |

3 |

17/07/2024 |

E J Turner |

Bore construction at 10 Brooks Road, Braigh. |

|

APP.045979.01 |

2 |

17/07/2024 |

Utakura 7 incorporation |

Wastewater discharges for papakainga development of ten houses at Horeke Road, Horeke |

|

APP.045980.01 |

3 |

18/07/2024 |

The Esplanade Residential Limited |

Earthworks and associated activities for a subdivision at Beacondale Place, Te Kamo, Whangārei. |

|

APP.045981.01 |

2 |

19/07/2024 |

W & T McCarthy Family Trust & McCarthyforde Trustees Limited |

Discharge domestic wastewater at Aucks Road, Okiato, Russell. |

|

APP.045983.01 |

3 |

19/07/2024 |

Ketenikau Developments Limited |

Subdivision works at 29 Ketenikau Road, Whangārei. |

|

APP.031351.01 |

4 |

22/07/2024 |

Waipapa Pine Limited |

Replace existing air discharge consent and new activities for a timber processing plant at State Highway 10, Waipapa. |

|

APP.045987.01 |

1 |

22/07/2024 |

Kingheim Limited |

Earthworks for rock revetment wall outside coastal marine area at Gillies Avenue, Karikari Peninsula. |

|

APP.045989.01 |

1 |

23/07/2024 |

Projects HB Limited |

Discharge to land from a lifestyle village at Peter Snell Road, Ruakākā. |

|

APP.041986.01 s125 |

1 |

25/07/2024 |

Agrotrust Limited |

Take water from an unnamed tributary of the Waikopiro Stream for the purpose of filling a dam reservoir associated with the development of an orchard at State Highway 1, Pākaraka. |

|

APP.045990.01 |

2 |

25/07/2024 |

Upson Downs Limited |

Sediment discharge at Te Maire Road, Te Kopuru. |

|

APP.045991.01 |

1 |

26/07/2024 |

Top Energy Limited |

To place an underground cable in the coastal marine area at Ōmanaia River. |

|

APP.040907.01 |

1 |

29/07/2024 |

Oranga Kai Limited Partnership |

Replacement consent for a short term groundwater take for the purposes of frost protection and horticultural irrigation of fifteen hectares of avocado trees at Mangakāhia Road, Kaikohe. |

|

APP.045996.01 |

3 |

29/07/2024 |

Sands Road (Whangarei) LP |

Reconsent for Stages 3, 4, and 5 subdivision earthworks at Sands Road, Glenbervie. |

|

APP.043217.01 |

1 |

30/07/2024 |

Fonterra Limited |

Emergency take water from a reservoir for milk processing purposes at the Kauri Dairy Factory and Maungaturoto Dairy Factory. |

|

APP.045999.01 |

3 |

1/08/2024 |

Institute of Geological & Nuclear Sciences Limited |

Four exploratory bores at Ahipara for Aqua Intel Aotearoa, Te Hiku Water Study. |

|

APP.046000.01 |

3 |

1/08/2024 |

A F Abercrombie |

Site development works to construct a modular house factory at State Highway 10, Puketona. |

|

APP.046001.01 |

3 |

1/08/2024 |

P L Lulich Limited |

Bore construction at Island Road, Turiwiri, Dargaville. |

|

APP.031467.01 |

3 |

2/08/2024 |

Southern Skies Trust & M V & L J Evans |

Construct a replacement seawall and renew consent for jetty at Far North Road, Pukenui. |

|

APP.037645.01 |

1 |

2/08/2024 |

J C & E de Wolf Trustee Company Limited |

Replacement consent to discharge treated wastewater to land at Waipapa Road, Kerikeri. |

|

APP.044420.04 |

3 |

5/08/2024 |

Allim Limited |

Section 127 change to earthworks for site development at Pīpīwai Road, Ngāraratunua. |

|

APP.046009.01 |

1 |

5/08/2024 |

Te Aupouri Commercial Development Limited |

Earthworks and wastewater system for a papakāinga development at Lamb Road, Pukenui. |

|

APP.013001.01 |

1 |

6/08/2024 |

S H R & T M Murray |

Replacement consents for a marine farm in Pārengarenga Harbour (ex-lease #357). |

|

APP.046013.01 |

1 |

6/08/2024 |

Main Road Properties Limited |

Discharges associated with a wastewater system for a manufacturing facility at State Highway 12, Maungaturoto. |

|

APP.046016.01 |

1 |

6/08/2024 |

Gemscott Falls Limited |

Remediation of contaminated land at Ngunguru Road, Tikipunga. |

|

APP.045969.01 |

1 |

7/08/2024 |

Coastguard Whangaroa Inc |

Pontoon and associated activities in the coastal marine area adjacent to Whangaroa Marina in Whangaroa Harbour. |

|

APP.046017.01 |

1 |

7/08/2024 |

Z Energy Limited |

Discharge stormwater to land from a petrol station (from potentially contaminated land) at State Highway 10, Taipā. |

|

APP.046018.01 |

2 |

8/08/2024 |

A L R & T D Lugtigheid |

Discharges associated with a sileage storage area at Mititai Road, Ōkahu. |

|

APP.039332.01 s125 |

1 |

9/08/2024 |

LJ King Limited |

Extension to lapse date for a groundwater take for horticultural use at Far North Road, Kaitāia. |

|

APP.046030.01 |

2 |

9/08/2024 |

G & D-M Trask |

Domestic discharge to land at Motel Road, Tutukaka. |

|

APP.046031.01 |

3 |

13/08/2024 |

Matatina Marae Trust |

Earthworks and associated activities for a proposed papakāinga at Nathans Road (private) Waipoua Settlement. |

|

APP.038513.01 s125 |

1 |

16/08/2024 |

Te Runanga o Ngai Takoto |

Take groundwater for irrigation at Kaimaumau. |

|

APP.046032.01 |

1 |

16/08/2024 |

ForestryCo Limited |

Installation of a debris trap in Waipahihi Creek, in Pumanawa Forest at Tauranga Bay Road, Kaeo. |

|

APP.046034.01 |

1 |

20/08/2024 |

Ritchies Transport Holdings Limited |

Remediation of potentially contaminated land at State Highway 1, Kaiwaka. |

|

APP.012886.01 |

1 |

21/08/2024 |

M J & J M Fleming |

Oyster farm lease No. 14 at Waitapu Bay Whangaroa Harbour. |

|

APP.012921.01 |

1 |

21/08/2024 |

M J & J M Fleming |

Replacement consents for marine farm in Waipatu Bay, Whangaroa Harbour (ex-lease #57). |

|

APP.008857.01 |

1 |

22/08/2024 |

M I Armstrong & |

Take groundwater for irrigation at Mangonui. |

|

APP.046046.01 |

1 |

23/08/2024 |

Far North District Council |

Earthworks and associated activities within 10 metres of a wetland to install and operate stormwater network infrastructure at Marreine Place, Tokerau Beach. |

|

APP.013576.01 |

1 |

26/08/2024 |

Mt Farms Pahi Limited |

Replacement consent inclusive of a change in species and methodology for a marine farm in the Kirikiri Inlet, Kaipara Harbour (ex-lease #277). |

|

APP.046047.01 |

1 |

26/08/2024 |

J Dunn |

Effluent discharge from two industrial and two residential units to land at Wiroa Road, Kerikeri. |

|

APP.045568.01 |

1 |

28/08/2024 |

KDC |

Place, use and occupy space in the coastal marine area with a tidal gate structures in Awarua River, Rūāwai. |

|

APP.006148.02 s125 |

1 |

29/08/2024 |

C D Tompkins |

Alter a boat shed in the coastal marine area adjacent to Riverside Drive, Whangārei. |

|

APP.046053.01 |

3 |

29/08/2024 |

D P Holy |

Bore construction at Purerua Road, Te Tii. |

|

APP.042456.01 |

3 |

30/08/2024 |

Tararua Wind Power Limited |

Section 127 change to project envelope in two locations – Earthworks for the construction of a wind farm and site access at Maitahi Road, Mamaranui. |

|

APP.043510.01 |

3 |

30/08/2024 |

Neil Construction Limited |

Earthworks for the development of a residential subdivision at Kāpiro Road, Kerikeri. |

|

APP.046058.01 |

4 |

30/08/2024 |

P.A.G. Trustees KMR Limited |

Discharge from two existing silage pads and one new standoff area at State Highway 12, Rūāwai. |

|

APP.046061.01 |

1 |

30/08/2024 |

Mangawhai Hills Limited |

Earthworks for subdivision development at Cove Road, Mangawhai. |

|

APP.046063.01 |

1 |

3/09/2024 |

Heron Point Limited |

Site development works for a 17 lot subdivision at Hihitahi Rise, Paihia. |

|

APP.041130.01 s125 |

1 |

4/09/2024 |

Hira Estates Limited |

Discharge secondary treated wastewater to land for a commercial building at Freyburg Road, Rūāwai. |

|

APP.046069.01 |

3 |

4/09/2024 |

Institute of Geological & Nuclear Sciences Limited |

Construction of two monitoring bores at Ari Ari Road, Poutō Peninsula. |

|

APP.046075.01 |

3 |

6/09/2024 |

Greenstar Properties (NZ) Limited |

Site development works at Reservoir Rise, Whangārei. |

|

APP.046083.01 |

1 |

10/09/2024 |

Summit Forests New Zealand Limited |

Earthworks for forest roads and skids for harvest operations at Dutton Road, Peria. |

|

APP.005055.02 |

1 |

11/09/2024 |

Northport Limited |

Replacement consents for dredging of the Turning Basin and associated activities at Marsden Point, Whangārei Harbour. |

|

APP.046049.01 |

1 |

11/09/2024 |

A Misecue |

Swing mooring in Wharf Road Mooring Zone, Whangaruru Harbour. |

|

APP.046086.01 |

3 |

11/09/2024 |

D P Holy |

Bore for domestic and stock use at Purerua Road, Te Tii. |

|

APP.046087.01 |

1 |

11/09/2024 |

R & J Hilton-Jones |

Domestic discharge to land at Landowners Lane, Tutukaka |

|

APP.046092.01 |

1 |

11/09/2024 |

A Trevelyan |

Site development works at Kauri Grove, Mangawhai. |

|

APP.046103.01 |

3 |

12/09/2024 |

G Henwood |

Bore construction for domestic use at State Highway 10, Mangonui. |

|

APP.037936.01 |

2 |

13/09/2024 |

P J & K A Thornton |

Discharge secondary treated wastewater to land Manawaora Road, Russell. |

|

APP.046104.01 |

2 |

13/09/2024 |

A B Allen & E Hunt |

Domestic discharge at Waiotoi Road, Ngunguru (replacement of expired consent AUT.029105.01.01). |

|

APP.046105.01 |

1 |

16/09/2024 |

J A Roberts |

MM4 swing mooring at Te Uenga Bay, Bay of Islands. |

|

APP.046106.01 |

1 |

16/09/2024 |

Carrington Farms Jade LP |

Bore construction for domestic, stock and community water supply at Matai Bay Road, Kaitāia. |

|

APP.046107.01 |

3 |

16/09/2024 |

Firth Industries Limited |

Bore construction at Moir Point Road, Mangawhai Heads. |

|

APP.046108.01 |

1 |

16/09/2024 |

Tararua Wind Power Limited |

New transmission lines between the wind farm and sub-station at Kaiwaikawe Wind Farm – Grey Street, Awakino Road, and Parore West Road, Dargaville. |

|

APP.045525.01 |

1 |

17/09/2024 |

P J Thornton |

Swing mooring 4248 – Waipohutukawa Bay, Bay of Islands. |

|

APP.045540.01 |

1 |

17/09/2024 |

P Dingley |

Bay of Islands - Parorenui Bay. |

|

APP.045548.01 |

1 |

17/09/2024 |

B Dee |

Bay of Islands - Pareanui Bay. |

|

APP.045549.01 |

1 |

17/09/2024 |

J Dee |

Bay of Islands - Pareanui Bay, Russell. Temporary consented swing mooring due to CAN (no anchoring) in place for Caulerpa in Te Uenga Bay. |

|

APP.046112.01 |

1 |

17/09/2024 |

J W & M J Dadson |

Section 125 extension to lapse date to install a bore to access water for domestic and stock use on that property at Mataraua Road, Kaikohe. |

|

APP.046113.01 |

1 |

17/09/2024 |

Northland Regional Council |

Take water from Lake Taharoa for biosecurity purposes at Kai Iwi Lakes. |

|

APP.046114.01 |

4 |

17/09/2024 |

Paparoa Gospel Hall Trust |

Earthworks for site development for the construction of a church within a flood hazard area at 70 and 136 Franklin Road, Paparoa. |

|

APP.046115.01 |

3 |

17/09/2024 |

Meridian Energy Limited |

Install five bores (Piezometer Installation) at Site 1: 626 Port Marsden Highway, Ruakākā and Site 3: 445 Marsden Point Road, Ruakākā. |

|

APP.046120.01 |

1 |

19/09/2024 |

Ngati Manawa Marae Trustees |

Discharge wastewater to land from a wharekai at West Coast Road, Panguru. |

|

APP.046033.01 |

1 |

20/09/2024 |

Robinia Investments Limited |

Jetty and floating pontoon in the coastal marine area at Russell Whakapara Road, Russell. |

|

APP.046122.01 |

1 |

20/09/2024 |

G & L Howell |

Domestic discharge at Christie Close, Pātaua North. |

|

APP.046126.01 |

1 |

23/09/2024 |

Parihaka Marae Trustees |

Discharge wastewater at Parihaka Marae, Te Iringa Road, Kaikohe. |

|

APP.046128.01 |

1 |

24/09/2024 |

Shepherd Property Development Limited |

Earthworks and stormwater conversion for a subdivision at 19 Cemetery Road, Maunu, Whangārei. |

|

APP.046129.01 |

2 |

24/09/2024 |

Bidfood Limited - Auckland Food Service North |

Discharge of wastewater for a distribution centre at 15-19 Kahikatearoa Lane, Waipapa. |

|

APP.046130.01 |

1 |

25/09/2024 |

WSP New Zealand Limited |

Earthworks within a flood hazard area for carpark upgrade at corner of Alamar Crescent and Olsen Avenue, Mangawhai Heads. |

Table 2: Consents Decisions Issued 1 July to 30 September 2024

|

IRIS ID |

Consents Required |

Description |

Issue Date |

|

AUT.003953.01.03 |

2 |

Kaipara Kumara Ltd - Discharge wash water and take water from a bore for kumara washing purposes at Reeves Street, Rūāwai. |

1/07/2024 |

|

AUT.004732.01.05 |

1 |

Sayang Limited - Take water for irrigation at Waimatenui Road, Kaikohe. |

2/07/2024 |

|

AUT.007046.05.01 |

5 |

Golden Bay Cement - Earthworks for quarry expansion at Boundary Road, Hikurangi. |

2/07/2024 |

|

AUT.042489.01.02 |

1 |

BP Oil NZ Ltd - Discharge vehicle wash water to land at State Highway 10, Waipapa. |

2/07/2024 |

|

AUT.015967.01.04 |

2 |

Cavalli Properties Ltd - Discharge for communal wastewater system at Matauri Bay. |

3/07/2024 |

|

AUT.041876.01.02 |

1 |

Rosyth Farm Ltd - Surface water take for a dairy shed at Rosyth Road, Waipū. |

3/07/2024 |

|

AUT.045270.01.01 |

7 |

EB Developments Ltd - Divert stormwater for within stormwater network at Tāmure Place, Ruakākā. |

5/07/2024 |

|

AUT.009495.01.03 |

1 |

Taipa Water Supply Ltd - Take for irrigation and public water supply, Ōruru River. |

9/07/2024 |

|

AUT.045926.01.01 |

5 |

Far North District Council - Reconstruct bridge in the coastal marine area in Whangae River, Ōpua. |

15/07/2024 |

|

AUT.045938.01.01 |

3 |

Condon - Bore construction at Babylon Coast Road, Ōmāmari, Dargaville. |

15/07/2024 |

|

AUT.045639.01.01 |

6 |

North Views, Harris & Armstrong - Concrete channel in the tributary of Kanekane Stream Wrathall Road, Mangonui. |

18/07/2024 |

|

AUT.045900.01.01 |

1 |